Retail flywheel not allows Tatarstan banks to accelerate

Overview of the dynamics of banking sector credit portfolio as of 1 July 2018

Realnoe Vremya has studied credit portfolios of Russian banks in their annual dynamics. In general, the market is growing, but the locomotive here is mainly the retail segment, which is growing about four times faster than the corporate one. Experts believe that sooner or later the potential of retail will come to naught — this is evidenced by the growing pessimism of Russians regarding their future financial situation, as well as attempts by the Central Bank of Russia to neutralize the risks of inflating the credit bubble. At the same time, the boom of retail lending did not help Tatarstan banks.

Citizens accelerated the market

By July 1, the total volume of bank loans to the economy reached 44,7 trillion rubles. Over the year, it increased by 3,5 trillion, or by 8,5%. However, as Realnoe Vremya has already published, the growth is very uneven: the dynamics in the retail segment is much higher than the dynamics in the corporate segment, which causes great concern for the Central Bank of Russia. The total loan portfolio of organizations (except financial ones) from July 1 last year added 4,7%, while in retail the growth amounted to 18,6%. In total, the companies owe banks 31,4 trillion rubles, the debt of the population is 13,3 trillion.

The vast majority of loans, as usual, is concentrated in the hands of the five largest players — Sberbank, VTB, Gazprombank, Rosselkhozbank and Alfa-Bank: they account for about 75% of the total loan portfolio of the banking sector. In annual terms, VTB had the largest increase — 62,6%. The portfolio of Alfa-Bank increased by 18,2%, Sberbank — by more than 15%, the dynamics of Rosselkhozbank and Gazprombank —11,2% and 10,9%, respectively.

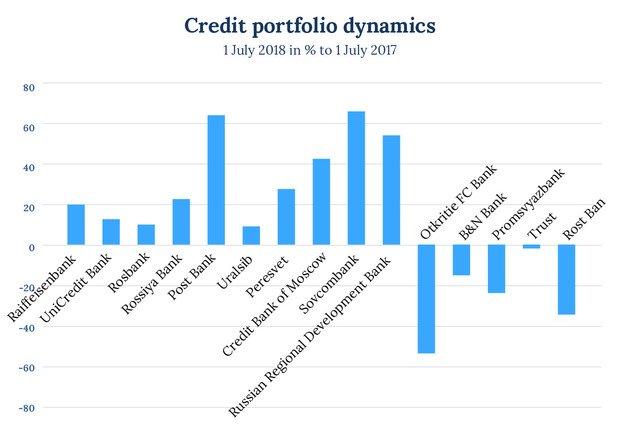

Banks grew differently outside the top five, however, the majority of market participants showed growth. For example, the portfolio of Raiffeisenbank in annual terms increased by 18,3%, UniCredit Bank — by 11,3%, Rosbank — by 9%, Uralsib — by 7,6%. The greater growth was observed in Post Bank (a subsidiary of VTB Bank and Post of Russia, +63,1%), controlled by Rosneft – Peresvet Bank (+26,5%) and Rossiya Bank, among the owners of which are businessmen Yury Kovalchuk, Gennady Timchenko and cellist Sergey Roldugin (portfolio of Russia Bank gained 21,1%).

However, there were also those who lost part of their loan portfolio. In general, these are banks that became the property of the Central Bank of Russia after rehabilitation. For example, FC Otkritie's portfolio has shrunk by more than half, Promsvyazbank's — by almost a quarter, B&N Bank's — by 14,4%. Rost Bank, once controlled by B&N Bank, reduced the portfolio by a third; almost unchanged was the volume of loans of Trust Bank, previously part of Otkritie Group.

The total level of overdue indebtedness at the beginning of July was 5,36%. Now in the corporate segment it is higher than in the retail (6,1% against 6,7%), although a year ago it was the opposite. The average share of overdue payments for the five largest banks is about 5%, but for specific banks it varies. Sberbank and VTB have an overdue indebtedness in the range 2,2-2,5% of the portfolio, Rosselkhozbank — more than 11%.

Tatneft banks losing volumes

In Tatarstan, the situation is more difficult than in the whole sector: about half of local credit institutions reduced their portfolios in a year. Since 1 July last year, the bank controlled by Tatneft, Devon-Credit, lost almost a third of its loan portfolio (like Zenit, another bank of the oil group, minus 11%), Akibank reduced its portfolio by more than 16,5%, Kama Commercial Bank — by 13,6%, and Altynbank of the Abdullin brothers — by more than 34%. Ak Bars Bank also suffered minor losses — -3,4%; the portfolio of the smallest bank of the republic — IK Bank — decreased by almost the same amount (-3,7%).

Among those who showed a positive trend, Tatsotsbank owned by the Kolesovs family was the fastest growing — it added 41,5% in annual terms. The portfolio of Bank of Kazan during the same period increased by 22,4%, Avtogradbank — by 1,7%, AutoCreditBank of Pavel Sigal — by 10%, Energobank — by 2,7%.

Vladimir Teterin, director for banking ratings at Expert RA Agency, believes that the acceleration of retail lending, which has concerned the regulator's representatives, will sooner or later come to naught. ''Indeed, we can say that in recent years, retail lending has been experiencing a real boom despite the fact that a pronounced tendency of the population's solvency increase is not observed. The motives of bankers are clear: first-class corporate borrowers bring only a symbolic margin, therefore the sector has accelerated the retail 'flywheel' to the full,'' says Teterin.

Vladimir Teterin, director for banking ratings at Expert RA Agency, believes that the acceleration of retail lending, which has concerned the regulator's representatives, will sooner or later come to naught. ''Indeed, we can say that in recent years, retail lending has been experiencing a real boom despite the fact that a pronounced tendency of the population's solvency increase is not observed. The motives of bankers are clear: first-class corporate borrowers bring only a symbolic margin, therefore the sector has accelerated the retail 'flywheel' to the full,'' says Teterin.

Against the background of rapid growth, banks often underestimate long-term risks in the retail sector: for example, the reserve ratio in this segment fell to 8% — the minimum since 2014. ''At the same time, at the moment there is no feeling that citizens in the future will be optimistic about looking into their pockets in the light of the factors that are accelerating the inflation, such as an increase in fuel prices and VAT rates,'' Teterin continues. This, together with the restrictive measures by the Central Bank, will lead to the fact that in 2020 the retail segment will cease to be the locomotive of the market. The profitability of retail will also gradually decrease, which may be quite sensitive for mono-liner banks or simply those who are actively increasing lending to the population.