Minus 6% of Russia's GDP: Bloomberg evaluates the strength of economic sanctions

'Punitive measures' against Russia are working, analysts say

Sanctions have cut 6% off Russia's GDP since 2014, Bloomberg reports. According to analysts, the restrictions by the US and EU are achieving its objectives and calling into question the plans of the Russian government to reach higher growth rates. Other experts agree that sanctions will only increase Russia's gap in a long period. Read more in the material of Realnoe Vremya.

Where there is oil, there is sanctions

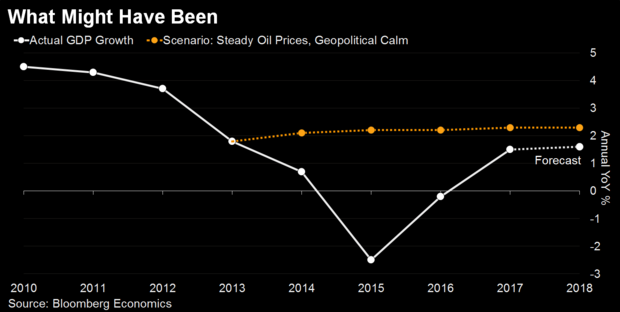

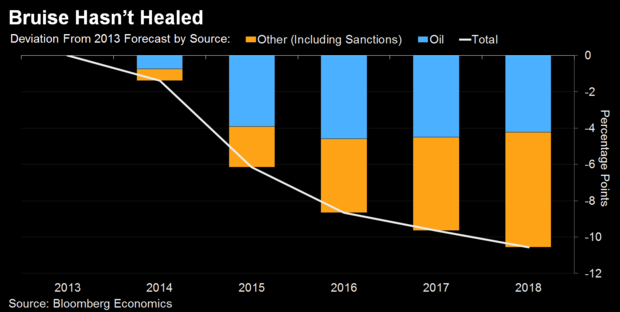

''Sanctions on Russia are working,'' — Bloomberg titled a study on how much the Russian economy has lost due to restrictions by the US and EU. According to analysts, the GDP of the 'world's biggest energy exporter' is now 10% smaller than might have been expected at the end of 2013, before the Crimea crisis, which triggered a series of sanctions.

This can be partly attributed to the collapse of oil prices, but the sanctions have made a greater impact. The underperformance is bigger than can be explained by oil alone, said Scott Johnson, a Bloomberg Economics analyst from London. Part of the gap between potential and actual growth is likely to reflect the impact of sanctions that have been imposed or threatened on Russia over the last 5 years.

These data suggest that 'punitive measures' justify themselves — they are putting pressure on Russia, while not affecting other markets. The policy of protecting the nation from possible sanctions by creating reserves has made the Russian economy more stable; nevertheless, sanctions are still constraining economic growth. The Kremlin, meanwhile, still claims that the pressure does not affect its foreign policy, Bloomberg reports.

Analysts recognize that to some extent the 6% gap is due to other factors, such as the Central Bank's policy of targeting inflation and pessimism in emerging markets. But the fact that the gap in potential versus actual growth continues to grow suggests that sanctions are having a long-term effect that calls into question the Russian government's plans to reach a 3% growth rate. According to Johnson, the persistence of sanctions increases the likelihood of the economy to shrink.

From Crimea to Skripals

Sanctions on Russia began after the Crimea's accession. In the spring of 2014, the US froze the assets of a number of Russian officials and representatives of state companies. Restrictions were also imposed on the supply of dual-use products to Russia (optical sights for weapons, lasers, cartridges for pump guns, etc.).

In July 2014, large companies, such as Rosneft, Vnesheconombank, Gazprombank, Uralvagonzavod and Kalashnikov Concern, also fell under attack. Later, the list was expanded — it included Sberbank, VTB, Rosselkhozbank, Gazprom Neft. All of these companies were denied access to long-term loans by the American financial system.

Later, the EU joined the sanctions, freezing the supply of arms to Russia, as well as suspending the export of technologies for oil production. In September 2014, the EU also extended sanctions to Russian defence and oil companies and large banks.

Russia resorted to retaliatory measures in the form of an embargo on the import of certain products from the countries that had imposed sanctions. It included food products — meat of cattle and poultry, pork, fish, shellfish, nuts, cheeses, etc.

Over time, the list of arguments for the introduction of sanctions expanded: the US began to accuse Russia of interfering in the presidential elections of 2016, then added the Skripal case to this.

The content of sanctions has also changed: the ban on the purchase of a new Russian national debt by American investors, as well as restrictions on the dollar operations of Russian banks, have been considered as the main measures in recent times.

''The estimate of 6% looks realistic''

Before that, other experts had written about the negative impact of sanctions. In April, experts from the Higher School of Economics said that the US and EU restrictions led to the isolation of Russia, its technological backwardness and limited the opportunities for economic growth. According to the HSE estimates, in 2018 the sanctions will cut about 0,2% off Rusisa's GDP as a result of the outflow of private capital.

''In a short term, the impact of oil prices is much more important for Russia than any sanctions,'' says economist, Associate Professor at RANEPA Sergey Khestanov. ''On the other hand, Bloomberg, apparently, estimates losses due to the reduction in the volume of investments — both foreign and domestic. The figures are the subject of endless discussion; at the same time, the estimate of 6% looks quite realistic. This is not critical, but the trouble is that the effect of sanctions is accumulating, and over time it will lead to an increase in Russia's lag in economic growth.''