‘Tatarstan paradox’: the republic is in the black thanks to petrochemistry and oil extraction

Results in January-February 2016 demonstrate that the economy of Tatarstan looks good

The economy of the regional development is like a growing living organism. This is why it takes some time to see any stable tendencies in it. Two passed months of observations in 2016 are not enough – there are many one-time statistical uncanny upsurges, but the positive is obvious. Undoubtedly, a rosy picture of our review is indebted to two factors for the optimism: low base in January 2015, when everything suddenly and rapidly dropped, and a 28-day February 2016 (one additional working day). It all resulted in positive figures compared to last year, which were analyzed by the economic reviewer of Realnoe Vremya Albert Bikbov.

Very low oil prices

On 1 March, the press service of the Ministry of Finance of Russia informed that an average Urals crude oil, a reference oil brand used as a basis for pricing of the Russian export oil, decreased by 42,7% in January-February 2016 compared with the analogous period in 2015 and made up $29,69 per barrel. In January-February 2015, Urals crude oil on average was $51,81 per barrel.

Such extremely low prices were detected moons ago, and though today's situation is a bit better (Urals is sold for about $38 per barrel now), all situation is quite shaky. There is no confidence in stabilization, not to mention further development.

Twofold drop in oil prices significantly affected tax payments too, which depend on oil prices. For instance, tax payments for mineral extraction (Mineral Extraction Tax) (petroleum) in January in Tatarstan was equal to 16,9bn rubles in January-February 2016 and reduced by 23,6% (minus 5,2bn rubles) compared with last year's January-February. It all happened in spite of the raise in the taxation rate (from 766 rubles per tonne in 2015 to 857 rubles in 2016)! Although these tax payments go to the federal budget, it is a sort of unclear indicator of ill-being.

Devaluation, unfortunately, could not even partially compensate the twofold slump in oil prices: the dollar grew in January-February 2016 by 21,5% in comparison with January-February 2015, and its average ruble value made up 76,73 per one dollar. The growth of the euro was lower – only 15,6%.

'Tatarstan paradox' is continuing

The action of 'Tatarstan paradox' is maintained in January-February 2016 in Tatarstan. The results for January-February 2016 demonstrate that Industrial Production Index dropped by 0,7% in Russia in general and rose by 2,2% in Tatarstan!

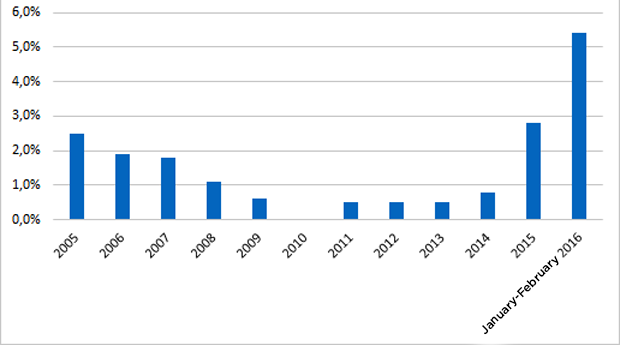

We had written that this paradox is explained by a powerful increase of oil extraction and export volumes respectively. If dollar prices decrease, and devaluation doesn't compensate properly, how do exporters react if it's necessary to close the slump in revenue? The answer is simple: they try to augment physical volumes of extraction to the maximum. The paradoxical industrial growth of Tatarstan took place thanks to an unreally sharp augmentation of oil extraction rate for the last decade in the history of Tatarstan.

Due to the growth in mineral extraction in January-February 2016 by 5,4% (+2,8% in Russia) and the sectors connected with oil extraction. In Tatarstan, growth in petrochemistry has been 4,2% (reduction by 2,6% in Russia) and +0,2% in chemical production. We don't cross the negative zone as the whole country does, where Industrial Production Index is worse than in Tatarstan (-0,7%).

Our oil extraction has just Stakhanovite rates. For example, Tatneft Group of companies extracted 2,327,285 tonnes of oil in January 2016 (+4,2% compared to January 2015).

Annual growth rate of mineral extraction in Tatarstan

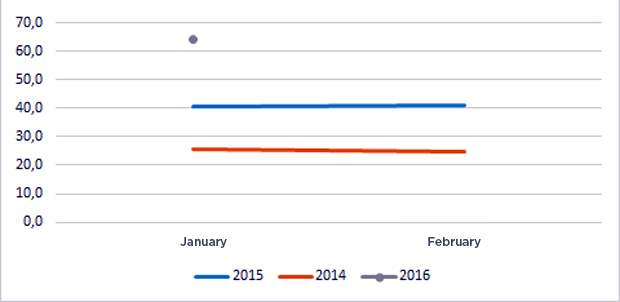

Penetration for a new drilling significantly increased too: it was 64,000 metres in January 2016. Truly Stakhanovite rates: boring rates has been 2,5 times higher than in 2014!

Monthly penetration for a new drilling, thousand metres

Why this intensification of the extraction is bad? In general, its motives are clear: a person who reduced or just doesn't augment oil extraction loses not only his or her profits but also the market. A rational behaviour means to increase the extraction if costs allow it. Marginal costs in oil extraction in developed fields in Tatneft are very low: spending on oil extraction in the third quarter 2015 was 279,0 rubles per barrel on average, that is to say, $4,5 per barrel (by the way, in Rosneft, it was $3,0 per barrel).

Another thing is bad: this intensification is fraught with premature depletions of fields with all ensuing consequences. In other words, our children and grandchildren may not have oil.

There is a concept: optimal reservoir exploitation. Not only wells with petroleum are bored but also the borehole array of a field. Some people are granted good loans: petroleum is extracted quickly, well and under high pressure, while in other parts – scarcely. But these wells give an opportunity to devastate the fields evenly, i.e. to extract the oil to the maximum. This barbarian method was used by Soviet oil workers in unique and gigantic fields like Romashkino Field: to select the oil, which is easily and quickly extracted, and pipe the water underground to maintain the pressure a bit. As a result of such uneven extraction, the most part of petroleum remains underground, and it is impossible to extract it. So, now after a barbarian exploitation in the Soviet era in Romashkino Field, borehole fluids consist of 86% of water and only 14% of petroleum. So, Tatneft is more a water company. For this reason, this forced turn towards the barbarian exploitation of our fields is a very sad occurrence. But there is no way out: the economy of the sector will be at a deep loss without augmentation of extraction and its export.

The rest of the economy has not woken up yet

If we estimate the state of affairs in other sectors of the economy of the republic, which were not lucky to be linked with the petroleum economy, the picture is not good but not terrible. Sectors oriented to import substitution are growing (and then some!): food industry, textiles, woodworking, and agriculture, of course.

Production indexes (January-February 2016 compared to January-February 2015)

Tatarstan | Russia | |

Manufacturing industry in general | -2,1% | -1,0% |

Production of food, including beverages and tobacco | 9,6% | 3,5% |

Textiles and clothing industry | 21,7% | -0,5% |

Production of leather, leather goods and shoemaking | -7,3% | 6,0% |

Woodworking and production of goods made of wood | 10,8% | -2,2% |

Production of rubber and plastic goods | 3,3% | 1,3% |

Machinery and equipment industry | -24,4% | 1,6% |

Production of transport vehicles and equipment | -1,9% | -5,5% |

Manufacturing industry of the republic dropped lower (-2,1%) than manufacturing in Russia in general (-1,0%). But the results of two untypical months filled with festive days show that it is difficult to project a picture for the whole year. The key tendencies will be clearer in March.

Tatarstan | Russia | |

Production and distribution of electricity, gas and water | 14,2% | 1,3% |

Housing construction | 9,9% | -1,7% |

Agriculture | 11,1% | 2,8% |

Freight turnover | 14,0% | -2,8% |

Retail turnover | -3,0% | -6,6% |

Confirmation of the thesis on the continuing crisis of consumer demand is seen in a fall in retail turnover in Tatarstan (-3,0%). The population reduces its consumer spending because people's real incomes in January 2016 in Tatarstan compared to the same period last year reduced by 9,9% and real salary decreased by 0,6%.

We are looking forward to the March results for a more objective picture.