Behavioral economics in fashion: how real people differ from rational machines?

A review of the book by recent winner of the Nobel Prize, former economic adviser to Barack Obama and David Cameron, Richard Thaler

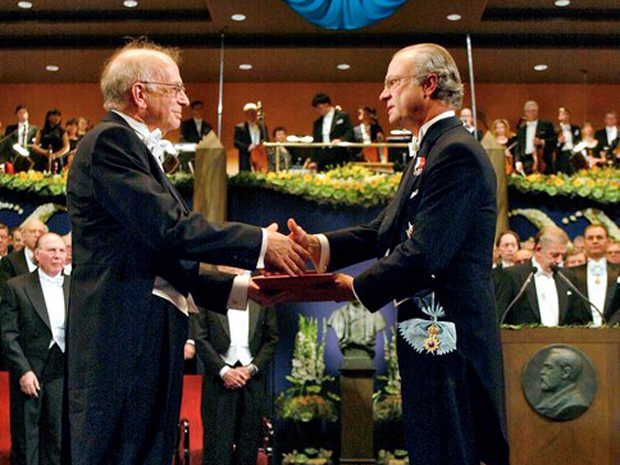

The scientist from the United States of America Richard Thaler has recently won the Nobel Prize in Economics. The former adviser to Barack Obama and David Cameron proved the so-called ''endowment effect'' and founded the theory of behavioral finance. Six months before to the award, Thaler had expressed his views in the book Misbehaving: The Making of Behavioral Economics. Realnoe Vremya publishes a popular description of the new trendy economic theory.

Behavioral economics, what is it?

What does today's main trend in economic science, the so-called mainstream, constitute itself? It is primarily the synthesis of the most proven and practical currents of economic thought. Now the mainstream covers the theory of general equilibrium, new classical macroeconomics, the Chicago macroeconomic theory, some ''remnants'' of Keynesianism and neo-Keynesian theories and mainly neo-institutionalism and behavioural economics.

Behavioral economics is rightfully one of the pillars of the mainstream. It studies the influence of social, cognitive and emotional factors on economic decision-making by individuals and institutions and the consequences of this impact on market variables (prices, income, allocation of resources). In fact, scholars since ancient times tried to understand the influence of human psychology on the economy. But the most profound breakthrough in this direction was made in 1979, when it was published the work by Daniel Kahneman and Amos Tversky Prospect theory: An analysis of decision under risk. This work made revolution in economics and until 2000 it was the second by citation economic publication in the world. Before it, Daniel Kahneman in 2002 won the Nobel Prize in Economics (Amos Tversky died 6 years before the award). The scientists proved in it the existence of systematic errors in estimation of risk and probability of revenues and losses. They described 11 ''cognitive illusions'' that distort the capacity for rational evaluation. Among them — anchoring, fear of loss, herd behavior and risk avoidance.

By the way, Daniel Kahneman is one of the most renowned experts in behavioral economics, his book Thinking, Fast and Slow was published in Russian in 2014 and was sold out with the circulation of 3000 copies. But because of high demand the book is constantly reprinted and you can see it on the shelves of bookstores today. By the way, I recommend to buy and read — it is a very well stated theory of the division of human thinking into two systems, fast and slow. The first system is usually called intuition. It works automatically, instantly making decisions based on subjective experience and common stereotypes. The second system is conscious mind, which slowly and carefully analyzes the options. Daniel Kahneman tells that intuition is suitable for everyday tasks, but when the stakes are high and your well-being depends on your decision, we should wait and turn on the second system.

But it is difficult to call this very book by Kahneman a fully elaborating on the theory of behavioral finance. It focuses on just one piece of this theory, at the conceptual paradigm of heuristics and biases. There are also another popular books on behavioral economics revealing only certain aspects of behavioral economics. It is, first and foremost, the books by Dan Ariely, Professor at Massachusetts Institute of Technology (Predictably Irrational: The Hidden Forces That Shape Our Decisions and The Upside of Irrationality: The Unexpected Benefits of Defying Logic at Work and at Home), and, of course, by Nobel laureates Robert J. Shiller and George Akerlof (Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism, Irrational Exuberance and Phishing for Phools. The Economics of Manipulation and Deception).

Richard Thaler, Obama adviser and aspiring actor

A luxury gift for Russian economists in 2017 was the release of the book by Richard H. Thaler Misbehaving: The Making of Behavioral Economics in Russian.

The author of the book, Richard Thaler, is a Professor at Chicago University, legendary personality for behavioral finance. Great Daniel Kahneman presented the author and the book itself the following way, ''The creative genius who invented the field of behavioral economics is also a master storyteller and a very funny man. All these talents are on display in this wonderful book.''

Richard Thaler is the author of the so-called Nudge theory (''controlled choice''). This concept has recently been adopted by practically all major world leaders. Its essence — a new form of manipulation of human behavior without prohibitions and orders. The basic idea of this theory is simple. People make a choice using either rational thinking or automatically, without much thinking (by the way, hello to Kahneman with his System 1 and System 2). Therefore, it is often possible to direct people in the right direction by making their choice automatic. Thaler in his interviews often refers to the whole field as the choice architecture, and the specialists — choice architects. The innovation here is that Thaler attempted to build on the basis of behavioral economics a full-fledged political program. The ideas of Thaler turned into instruments of state policy in all major countries.

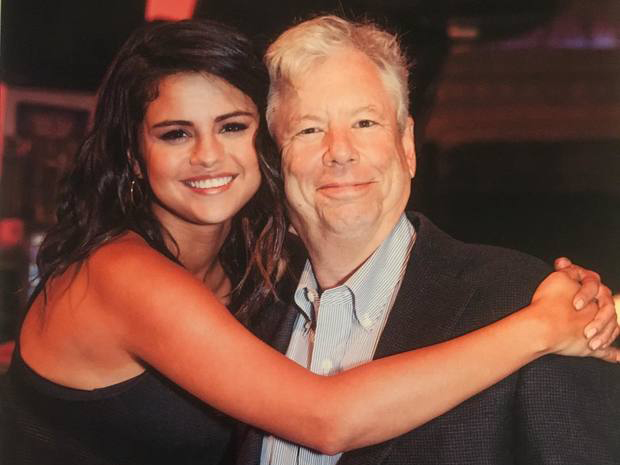

Coolness and recognition of the practicality of the ideas of Richard Thaler are illustrated by the fact that he was an adviser to President Barack Obama and Prime Minister David Cameron. Besides, he even had a cameo role in the much-talked Hollywood movie The Big Short. He in the company with Selena Gomez explains how a market panic is formed.

What is the book about?

If to outline its content very briefly, it is following: conventional economics is based on the axiom of rationality of the human being, but in fact, people often behave irrationally. And this irrationality can be utilized. Richard Thaler builds a book as a mixture of his own scientific autobiography and statement of the basic tenets of behavioral economics.

Here are some quotes from the book:

''For four decades, since my time as a graduate student, I have been preoccupied by these kinds of stories about the myriad ways in which people depart from the fictional creatures that populate economic models. It has never been my point to say that there is something wrong with people; we are all just human beings—Homo sapiens. Rather, the problem is with the model being used by economists, a model that replaces Homo sapiens with a fictional creature called Homo economicus, which I like to call an Econ for short. Compared to this fictional world of Econs, humans do a lot of misbehaving, and that means that economic models make a lot of bad predictions, predictions that can have much more serious consequences.

It is difficult to change people's minds about what they eat for breakfast, let alone problems that they have worked on all their lives. For years, many economists strongly resisted the call to base their models on more accurate characterizations of human behavior. But thanks to an influx of creative young economists who have been willing take some risks and break with the traditional ways of doing economics, the dream of an enriched version of economic theory is being realized. The field has become known as ''behavioral economics''. It is not a different discipline: it is still economics, but it is economics done with strong injections of good psychology and other social sciences.

Eventually I settled on a formulation that involves two kinds of utility: acquisition utility and transaction utility. Acquisition utility is based on standard economic theory and is equivalent to what economists call ''consumer surplus.'' As the name suggests, it is the surplus remaining after we measure the utility of the object gained and then subtract the opportunity cost of what has to be given up. For an Econ, acquisition utility is the end of the story. A purchase will produce an abundance of acquisition utility only if a consumer values something much more than the marketplace does. If you are very thirsty, then a one-dollar bottle of water is a utility windfall.

Humans, on the other hand, also weigh another aspect of the purchase: the perceived quality of the deal. That is what transaction utility captures. It is defined as the difference between the price actually paid for the object and the price one would normally expect to pay, the reference price. Suppose you are at a sporting event and you buy a sandwich identical to the one you usually have at lunch, but it costs triple the price. The sandwich is fine but the deal stinks. It produces negative transaction utility, a ''rip-off''. In contrast, if the price is below the reference price, then transaction utility is positive, a ''bargain''.

For those who are at least living comfortably, negative transaction utility can prevent our consuming special experiences that will provide a lifetime of happy memories, and the amount by which the item was overpriced will long be forgotten. Good deals, on the other hand, can lure all of us into making purchases of objects of little value. Everyone has items in their closets that are rarely worn but were ''must buys'' simply because of the deal was too good, and of course somewhere in the garage or attic is our version of Maya's guilt.''

From myself I would add that it is impossible to include all important examples and ideas from the book in the small size of reviews, but believe me, there are many. The book will be useful not only to economists but also for marketers and entrepreneurs. The book will be useful primarily for practitioners. After all, there is reason why the author was involved in conducting political and economic reforms in the US and the UK at the highest level. I heartily advise you to read the interesting and useful book by Richard Thaler.