Andrey Fursenko: ''To be honest, Elon Musk has long become bankrupt''

Laments for bad PR of Tatarstan in China and search how to apply blockchain for cows at Russian Venture Forum in Kazan

The annual Russian Venture Forum finished on April 19 in Kazan. The correspondent of Realnoe Vremya, who attended the event, found out how the tense geopolitical situation has affected IT business, how optimistic the situation can be called in the venture market of Russia and why the world lacks new Elon Musks.

''Unfortunately, very few people in China know about Tatarstan''

This year, the Russian Venture Forum as usual gathered a huge number of speakers of the highest level — representatives of leading venture funds, large investors, entrepreneurs and business angels from Russia, the USA, China, Singapore and other countries. The event started with a press conference, the leitmotif of which was the influence of current geopolitical background on IT business and the organization of the forum itself.

People like to say that entrepreneurship knows no boundaries and real technologies are always global in nature, says Alexandra Johnson, the managing director at Global Technology Capital. But she is sure that there are still changes. Nothing can be done in a vacuum, and no matter how brilliant you are, if there is no exchange of existing technologies, it will be difficult to invent a bicycle every time. Mrs Johnson believes that political storms will pass, but businessmen — they can work at any time.

Peter Braun, a board member of The European Trade Association for Business Angels, also expressed his view on how the geopolitical situation affect business. In the first place, the speaker stated that the West wants to keep the dialogue going and does not want a new cold war. They want to build bridges and trust-based relations. Business needs trust, and what we are doing – taking talents and putting them in the process of selection by the best companies having a potential for survival on the world market – it is an excellent strategy, Mr Braun considers. Nationality, state you live, gender, race do not matter, the main thing is to find the best entrepreneur, a talented person, and to support him or her, Mr Braun urged.

Then the conversation gradually shifted to the investment attractiveness of the Republic of Tatarstan, about which foreign colleagues very positively spoke. However, in the course of the conversation it turned out that we are well known in Europe and Silicon Valley but in China almost no one heard about the existence of such republic.

Xiu Xiaoping, Secretary-General of the Commission for Venture Investment of the All-China Association for Financial Aid for Science and Technology, said that very few people know about Tatarstan in China. She has visited Russian for many years, but it has been her first visit to Kazan. Mrs Xiaoping shared that she found the city very attractive and expressed hope that this visit would help to better study the local potential. However, she says, there are some problems from the point of view of promoting the product and business.

Aynur Aydeldinov, CEO of the Investment and Venture Fund of the Republic of Tatarstan, the moderator of the press conference, hastened to add: ''Imagine 10% [of China citizens who know about Tatarstan] – is it little or many? 10% of the Chinese population — it is like the entire Russia. That is, the whole Russia knows about Tatarstan.''

Alexandra Johnson sweetened the pill by saying that Kazan today is one of the main investment platforms. The companies they see today here, in fact, are very different by the level from those they see in Silicon Valley. They have not seen here a SpaceX, Mrs Johnson said, but local companies are similar by the enthusiasm of their entrepreneurs, who at the same time understand their market. Mrs Johnson said that she has seen many presidents in her life, but the president of Tatarstan is an enthusiast with human face.

''This system will allow the farmer to enter the electronic trading platform''

It is worth explaining that the forum consists of two parts: the first is plenary, where market trends are discussed, forecasts for the future, and entrepreneurs build communication with potential investors. The second part is a fair, where the subject of sale is a special product — shares of high-tech companies.

In parallel with this, it is carried out acceleration. According to Aynur Aydeldinov, this year 542 projects from 24 countries were announced to participate in it: ''Out of the total amount, 50 projects were selected. The main developments are in the field of ICT, chemistry, new materials, as well as medicine. The panel of judges will work during the day, they will select from this number from 5 to 10 projects for the acceleration programme. These companies will be trained in Russia, Ireland, Silicon Valley.''

The selected projects, about which Aynur Aydeldinov described above, were presented at the forum. Tatarstan President accompanied by local and federal government officials carefully examined the stands, talked with the developers and chose several interesting projects. It should be noted that among the developments in the field of additive and cognitive technologies, payment systems based on blockchain technology and high-tech composite materials for the industry, he particularly focused on the Kazan project Agrarium (the platform for blockchainization of business of real sector of economy).

''We have created a platform for digital agriculture, where we have released meat-token, dairy token, grain token. That is, we tokenize the assets of the farmer, present them to the pool of investors, and the investor, buying a meat token, invests directly in a calf,'' the head of the company Dinar Alvertovich explained the essence of his project.

''Dinar, we need to teach our people to work in the e-commerce system. People think it's very difficult. They should be involved in this process. This system will allow the farmer to enter the electronic platform. Yes, the buyer will not believe him, but he will believe the ministry of agriculture,'' said Rustam Minnikahnov. ''Besides, the most important thing is that you should understand why blockchain — this system gives decentralization, transparency. So that's how people get trust.''

''The picture of Russian venture market inspires moderate optimism''

After visiting the fair, the central event of the forum began — the plenary session, at which experts considered the development of innovations in the economy, where one of the key tools is the venture investment mechanism. According to Aynur Aydeldinov, just 10 years ago the entire venture capital market was about $55 billion, and today this figure has grown to $150 billion. At the same time, the number of transactions in America previously amounted to about 3,000 a year, but today — 8,000. In Russia, the market is estimated at an average of $200 million, and the number of transactions a year reaches 150. Albina Nikkonen, CEO of Russian Venture Capital Association (RVCA), gave a detailed analysis of venture capital markets in Russia and abroad.

''The statistics of the Russian venture market is very much inferior in terms of investments in foreign markets. However, it should be emphasized that the evaluation of our market is given only for investments of institutional segment, and only in Russian companies, which are understood as companies for which the Russian market is targeted,'' Nikkonen said. ''In turn, the investment statistics of funds with Russian founders in foreign markets shows that the volume of their investments is very significant. Companies and funds actively investing in foreign markets can invest tens of millions of dollars in one round alone.''

According to the expert, despite the difficult economic background, new players continued to appear quite actively in the Russian venture market last year, and the amount of capital attracted by venture funds in 2017 significantly exceeds the figures of recent years. Three quarters of the total new venture capital funds were private equity, which reflects a positive attitude of investors in terms of market prospects. Former technology entrepreneurs take the second place, and Russian private companies — the third.

''A positive signal is that almost all new private venture funds, which entered the Russian market in 2017, were launched by entrepreneurs with Russian roots. At the same time, about a fifth of the number of new venture funds were funds with state participation. Their number will grow in the coming years according to the forecast. In general, the role of the state in the Russian market is very noticeable not only in attracting funds to the market, but also in the implementation of investments,'' says the expert. ''Summing up, I can say that the picture of Russian venture market, recorded by the results of 2017, inspires moderate optimism.''

The speaker also went through the world trends. One of them is the increased attention of investors to more mature, established companies on the market. According to the expert, this shifts the emphasis towards later rounds, and against this background, primary financing of start-ups has been declining in recent years, which is not very good. However, Nikkonen points out that one of the most attractive segments for investors around the world is ICT. Also, among the promising areas there are AI, medicine and biotechnology.

''Exactly such people — dreamers, adventurers — are creating our future today''

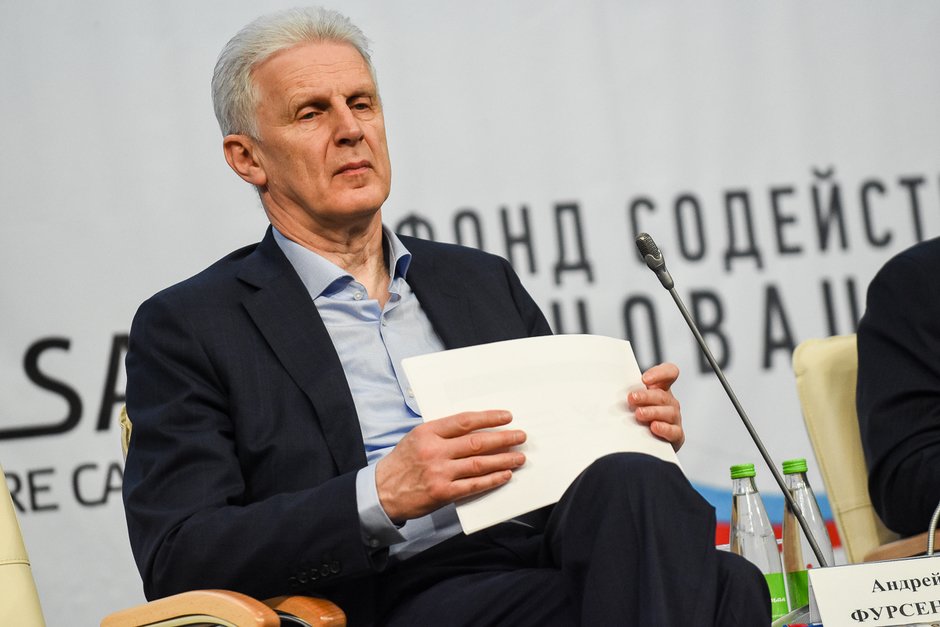

A serious question was raised at the plenary session: why does business in Russia provide insufficient funding of applied science? Aide to the President of the Russian Federation Andrey Fursenko, who inadvertently stated in one of his early interviews that ''huge funds are allocated in Russia to finance applied science, what is more — two-thirds of this money are state funds'' had to give the answer.

''First of all, about money — it is an exaggeration. I've always said that money is not enough, and in education and science — especially. The structure of financing of applied research in Russia, to put it mildly, differs from what is accepted in the world. There, the state indicates its interest and regulates, but does not take on all the costs. The business prefers to moan and somehow to pull the money out of the state than to invest their own. Perhaps, the reason is that there is no real interest in innovation, in reducing costs at their expense. There is no complete trust in those innovations that appear in Russia — it is simpler to buy something abroad,'' the speaker said.

Also, within the discussion, experts were asked to explain why, despite the fact that Russian universities have excellent scientists, patents and a number of other conditions, we do not get innovative companies. Alexander Kuleshov, a Russian mathematician and expert in the field of information technologies and mathematical modeling, was the first to announce his position.

''In my opinion, we lack risk-takers. The dream of young people — to go to work in a large company. The same thing happens on the side of those who invest. For the whole world, Elon Musk is the example of a risk-taker. Everyone who has read his biography understands that he is not a great scientist, not a brilliant engineer, but a person who is able to take on new risks. Such people — dreamers, adventurers — are creating our future today. And such people we lack today. Maybe 100 years of negative genetic selection or something else has affected, but there are very few such people today,'' the expert believes.

Andrey Fursenko agreed with the position of Kuleshov. According to him, there is no readiness to take risks throughout the whole world.

''People prefer to take risks in computer games. But there is also the other side: when you take a risk, you should understand that it is not a computer game, you do not have nine lives. A risk-taker should understand the level of responsibility to himself to investors. You have mentioned Elon Musk – to be honest, he has long become bankrupt. He is not accountable to investors – it is his own money. Therefore, it is necessary to strike a balance between risks and responsibility,'' Fursenko expressed his view.

The presidential aide had to leave the meeting shortly before its end due to busy schedule. At parting, he decided to quote one of the founders of the Russian venture market: ''In fact, everything is simple. Two feelings fight in a venture investor — cowardice and greed. The right balance of these feelings makes it possible to make good investments.''