''Crisis instead of boom''. Experts forecast new problems for banks

Expert RA analysts warned about the growth of bad debts in the next two years

Expert RA analysts warned about risks of a new crisis of bad debts. Banks started to aggressively lend the population despite stagnation of its incomes with a fall in corporate enterprises' marginality. According to the agency's forecasts, this will lead to growth in the level of troubled debt in the next two years. Now it's been at the lowest level since early 2015. Realnoe Vremya tells the details.

Crisis on the horizon

Expert RA predicts problems with overdue debt for banks. In the agency's opinion, the share of non-refundable loans will grow in the next two years while a retail boom will change by a crisis. Prerequisites for it are created today when banks faced a stall in the corporate segment are intensively lending the population amid stagnation of its incomes.

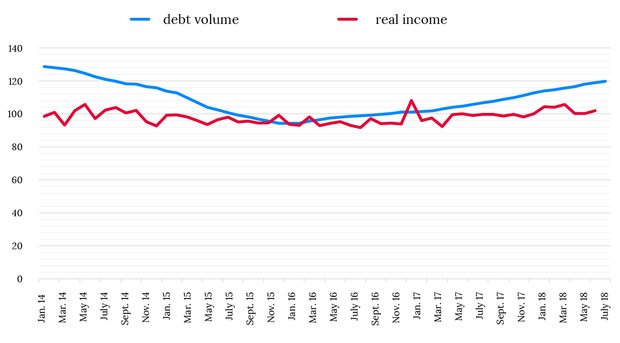

During the year, the Russians' debts to banks have increased by 19,7% to 13,56 trillion rubles from last year's August to August 2018. It's the fastest growth since 2014 (the volume of debt reduced from August 2015 to September 2016). The real income of the citizens has stopped falling only early this year, and now their growth is slightly seen – +2,6% a year in January-July.

We can't hope for a fast recovery of incomes: on the contrary, the population will become less solvent as a result of a rise in VAT, higher prices for fuel and the weak ruble. This, the analysts write, will bring to greater default in retailing in 2019-2020.

Real income and debt of Russians to banks compared to the same month last year, %

Bankers have their own reasons to focus on retailing. ''Top corporate borrowers have just a symbolic margin. This is why the sector boosted retailing to the max,'' said Banking Rating Director at Expert RA Vladimir Teterin to Realnoe Vremya previously. ''The danger is that banks often underestimate long-term risks in retailing. Moreover, at the moment there is no feeling that citizens will look at their pockets optimistically.''

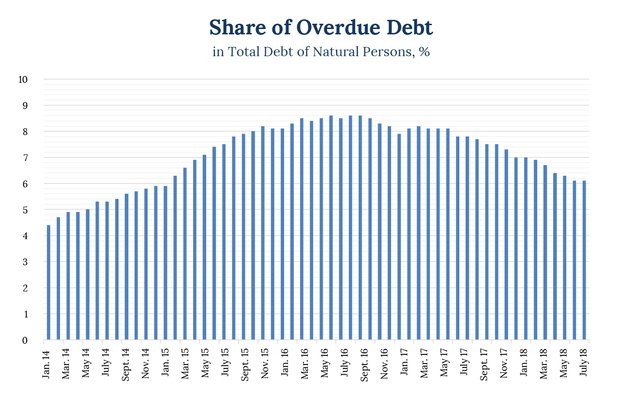

The share of overdue debt in the retailing has been reducing since approximately the autumn of 2016; now it's considerably low – a bit more than 6% of the total debt of physical persons to banks. The peak of problems was in June-September 2016 when the level of overdue debt exceeded 8,5%.

The Central Bank has recently warned about a bubble in consumer lending many times. To cool the market down, it raised loan coefficient risks. But a worse quality of portfolios, which has been at the lowest level of reserves in retailing in the last several years and the shift to the IFRS 9 will soon require banks a great final estimation of risks. Retail lending will stop being a full-fledged driver in the next years, and the majority of banks won't be able to compensate payments to the reserves of new loans. As a result, they won't be able to maintain the current level of profitability, the agency assumes.

The last hope of profitability

At Realnoe Vremya's request, authors of popular Telegram channels commented on Expert RA's forecast.

''In my opinion, retailing (with all its risks) is almost the only area of the banking business that can remain profitable for medium-sized banks. Meanwhile, the risks are manageable, while the return of troubled of debt is higher than in corporate lending or the bond market. The current growth is also caused by reduced rates down to 11,5% a year in the biggest banks, which allowed good clients to refinance having increased the sum with conserved monthly payments. The retail lending sector will grow, the paces will maybe go down given the stabilisation of rates.''

''The boom in consumer lending in the last 1,5 years is partly linked with the postponed demand of the population and once strict risk management of lending institutions during the active phase of the fall of the Russian economy several years ago when banks almost didn't lend, while homesteads expressed their interest in borrowed products. It's interesting to pay attention that the portfolio of retail loans has been financed by short-term deposits of natural persons since 2017, that's to say, a more self-sufficient population lent the poorer. So new loans were granted with a very high net interest margin. This is why in this respect banks have a good reserve of buffer for absorption. At the same time, the retail business isn't a factor of problems of lending institutions if it's not the key area, of course. The main risks remain in corporate portfolios, which have been restructured and prolonged many times. We shouldn't forget the loans granted to several juridical persons often exceeded a bank's capital, while there aren't such problems with retail lending. In general, worse solvency is quite possible against a background of higher VAT and a debt burden of the whole population because the population's real available income continues demonstrating not promising results.''

''As it's said in the research, the volume of debt of natural persons to banks has risen by 19% and reached the indicators like in 2014 in the last year. I don't doubt the dull forecast about a new crisis will come true. And not the regulator's actions but that of the banks, which will have to tighten conditions to grant a loan, correct scoring mechanisms are the reason.''

''Of course, the risk of overdue payments increases because of a general boom of retail lending. Corporate lending, unfortunately, is reducing. This is why banks are looking for a solution by increasing consumer lending. However, there is a problem of delayed payments here too. Moreover, the population that has taken out several loans just doesn't have another option but to increase the number of consumer loans by a general reduction of incomes. If they take out loans, they close old loans. There are new loans, and they have to take out loans again. The level of overdue debt grows, banks have to increase reserves for default loans, tighten conditions to grant loans, correct scoring mechanisms and so on. It's an endless circle, in general. However, they're unlikely able to reduce retail lending now.''

Zero-sum game

Even if big players take a bigger part of the business, even small banks have a chance to keep their clients, writes Expert RA. Softer requirements for the rating level, which is needed to have the right to issue guarantees for state contracts – the competition is going to shift to this segment – became the emergency exit for many small market players. But without diversification of incomes, about 30 banks won't be able to meet even tolerable requirements and won't be allowed to enter the market of guarantees.

Weak players will be driven out of the market in the absence of growth points. ''Stable meddling banks and highly specialised banks will more often become candidates to be absorbed by federal banks. Moreover, <…>, a noticeable trend for the consolidation of banks making up bank groups will clearly go on,'' the analysts predict. According to their forecasts, 20 biggest banks will have 82-83% of general assets of the sector by early 2020 (now they hold 80,4% of assets).

Expert RA expects several deals on merger and absorption in the next two years. We're talking about the union of Sovkombank with Rosevrobank and SKIB; Vozrozhdenie bank and VTB; Svyaz-Bank with Globeksbankl; the union of Tatneft's Zenit, Devon-credit, Zenit-Sochi, Spiritbank and Lipetskkombank; as well as the union of ''healthy'' assets of Otkritie FC, Binbank, RGS Bank and Trast.

Telegram channels made their forecast about the candidates for absorption. In Riskovik's authors' opinion, it's Vostochny, Russky Standard and Absolut Bank (or its mortgage portfolio). ''It will also probably affect universal regional banks – UBRiR and Ak Bars,'' the channel replied.

''Small and medium-sized banks are the main candidates for absorption. Moreover, their owners often would be glad to be sold to some of the federal banks, but they can't agree on price,'' say Banki channel's authors. ''It's obvious that small banks can't compete with the top 50 in either quality of service or technologies or conditions. Their road is to be sold, obey slowly or change suddenly.''

Nebrekhnya predicts a further rise in the state's share: now it reaches 80% in assets of the 10 biggest banks, and the situation will worsen. ''Asian-Pacific Bank (it's been almost already announced), Vostochny are the most probable candidates for absorption; we expect the results of the deal on Vozrozhdenie. Smaller banks will leave the market calmly and almost unnoticeably. Big shocks and merges of even big banks are possible, there are rumours about Alfa-Bank. And, as we already see, VTB managers started to partly move there. In any case, the banking sector will be rough and the number of banks will be threefold less in the next two years.''