Bloggers, miners and conscripts to be added to registers — November novelties in laws

What novelties in federal legislation are changing the lives of Russian businesses and citizens

New rules will come into force in Russia in November that will change the calculation of rent for citizens, the inspection of goods at checkouts, fire safety standards and other requirements. In addition, from this month, the country's government will begin collecting data on miners, bloggers and conscripts in special registers and create a list of mineral fertilisers permitted for circulation on the EAEU market. Read more about these and other changes in legislation in a report of Realnoe Vremya.

Bloggers will be included in the register

Since 1 November, Russia’s communication watchdog has begun to keep a special register of accounts of social media users and instant messengers whose audience is 10,000 followers. Therefore, popular bloggers must provide their data to the watchdog, the rules apply to individuals, sole traders and companies.

Information can be submitted through the State Services or the watchdog’s website with mandatory registration in the Unified Identification and Authentication System. After completing all the procedures, the government agency will send the account owner a corresponding link, which must be posted on your blog An “A+” sign and the “Included by Roskomnadzor in the list of political pages” inscription will appear next to the name of the platform and information about the blogger.

If the owner of popular channels in instant messengers and on social media does not add their data to the electronic list, their content will not be available for reposts. In addition, they cannot place advertisements and receive monetisation from views.

Employers are obliged to provide information on military registration online

Also, since November, all organisations that have at least one conscript or person liable for military service have been obliged send information on military registration in the form of a press release. We are talking about employees of two categories: these are men aged 18 to 30 years old who are required to be on special military registration and are not in the reserve, as well as men in the reserve, graduates of federal universities with a military department, women with military positions. The employers' report will be uploaded to a special registry, which was to start functioning on the same date.

Previously, the information was transmitted on paper. It is assumed that the data from organisations will be sent to the same electronic registry where data on military registration of the Ministry of Internal Affairs, tax service and other departments is accumulated

The EAEU countries are introducing a common registry of approved mineral fertilisers

On 2 November, the decision of the Council of the Eurasian Economic Commission on what data will be included in the unified registry of mineral fertilizers approved for circulation on the EAEU market came into force. First, judicial parts of the registry are created, then they are combined into a single registry for all countries of the Eurasian Economic Union. The website of the association contains information on approval (type, composition, purpose, restrictions on use, etc.), as well as data on its registration, application and manufacturer, safety data sheet. In order to register fertilisers on this platform, manufacturers and importers will have to provide the necessary documents and information. The electronic registry will be fully operational in 2026.

The number of evacuation exits in buildings to increased

Emergency regulations adjusted by the Ministry of Emergencies came into force in November, which boils down to fire safety rules for evacuation routes and exits. Changes, in particular, were made the parameters and number of evacuation exits. According to the new rules, premises for the simultaneous stay of 501 to 1,000 people must have at least three exits. In calculations calculated for more than 1,000 people –g at least four.

At least two evacuation exits must be available on the floors of buildings with a number of people from 50 or more people on the floors. The conditions under which exits with turnstiles are evacuation exits are also specified here. Their width must be at least 70 cm, for people with limited mobility — at least 90 cm. It must be possible to manually, automatically or remotely open and lock the turnstile in the open state.

New requirements are mandatory when designing an object or changing its functional purpose as well as during reconstruction and major repairs.

Citizens are allowed to review customs inspection materials From 14 November, the law on customs regulation comes into force in Moldova, according to which the agency is obliged to provide the opportunity for the inspected person or his representative, with a notarised power of attorney, to review the customs inspection materials. Access will be opened no later than five working days after the submission of applications. This only applies to documents that do not relate to state or commercial secrets.

The inspected person or their representative will have the right to take photographs, extracts from the inspection materials and not just limit themselves to a visual inspection. Currently, there is no such option in the law. The results of the review will be recorded in the act of review of the customs inspection materials.

Foreign sellers of goods will fill out applications to the Federal Tax Service in a new way

The Federal Tax Service has updated the forms of applications for registration, change of information and deregistration for certain categories of entrepreneurs. Fields for filling in data by foreign sellers who trade through the electronic platforms of the EAEU have been added to the document. The changes came into force on 1 November 2024.

Earlier, on 1 July, amendments to the Tax Code of the Russian Federation came into force establishing a mechanism for paying VAT by companies from the EAEU that sell goods through electronic trading platforms. Such transactions were previously not subject to VAT. To implement the mechanism for collecting VAT, rules for registering foreign sellers and intermediaries with the tax authority have been introduced. In this regard, the Federal Tax Service has approved special forms and formats of applications as well as the procedure for filling out these forms.

Miners' activities to be regulated

Regulations will come into force according to which Russians will be able to mine digital currency without being included in a special register, subject to the limits on energy consumption. Legal entities and individual entrepreneurs will also be able to mine, but only if they are included in a special register that will be formed by the Ministry of Digital Development.

All miners will be required to transfer information about the addresses of cryptocurrency wallets and the amount of cryptocurrency received to the body determined by the government. Individual entrepreneurs and legal entities will be prohibited from combining digital currency mining with electricity transmission activities, operational dispatch control activities in the electric power industry, and activities related to the production or purchase and sale of electrical energy. Since mining equipment consumes a lot of electricity, the authorities are going to control its consumption.

Control over the register of miners is transferred from the Ministry of Digital Development to the Federal Tax Service. The agency will be able to exclude companies from the miner registry for violations within one year.

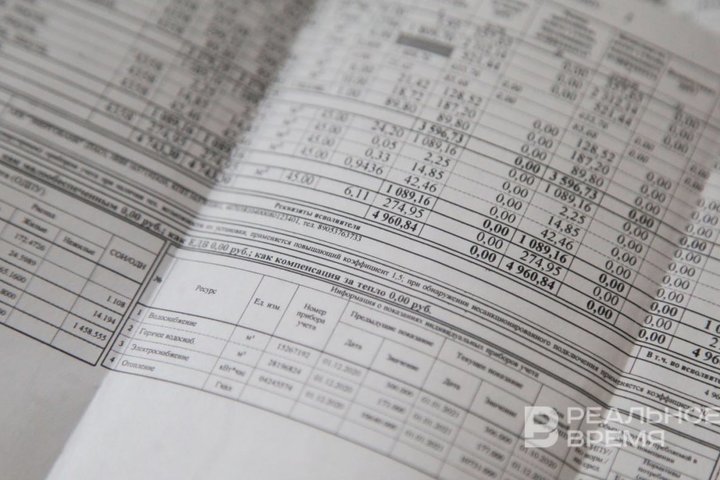

Changes in payment for housing and communal services

Changes in payment for housing and communal services related to amendments to the Civil Code will come into force on 1 November. If additional expenses for common property arise due to the fault of one of the owners of an apartment in an apartment building, the owner will be obliged to pay them. Previously, such losses were covered by the management company. It will be necessary to prove the involvement of the owner of the housing in causing damage in court. It is assumed that the evidence will be recordings from surveillance cameras if any.

Owners will have to pay out of pocket, for example, for blocking or breaking the garbage chute, damage to common property (buttons in the elevator, walls in the entrance, mailboxes, etc.) In addition, homeowners will be required to pay fines for failure to comply with fire safety rules if they allowed them with their actions, for example, arbitrarily installed door structures or arranged storage rooms in the entrance of the building

In November, each owner will be required to participate in covering the costs of maintaining common property in an apartment building in proportion to their share in the property right. In particular, a new column will appear in utility bills, which will indicate the amount of recalculation for last year's utilities. Rural centres will determine how much resources were spent by an individual apartment building on heat and electricity. This will also include the costs of common property. We are talking about houses where meters are installed. If residents exceed the norm, they will have to pay extra.

No commission will be charged for payments through SPB in favour of the state

Since 1 November, C2G payments, payments in favour of the state, through the Fast Payment System (SBP) can be made without a commission. We are talking about paying taxes and fines, as well as kindergartens, clubs, sections if they are state-owned.

Another novelty is being introduced: since November, the limit on free transfers of up to 100,000 rubles per month will also apply to transactions with electronic wallets. It will be possible not only to transfer money to another person for free within this amount, through the SBP but also to top up your own electronic wallets. This is relevant, for example, for purchases at marketplaces.