Halal finance: how Islamic banking change since its recognition in Russia

Portfolio of Islamic finance has reached 1.8 billion rubles, new federal players are entering the market

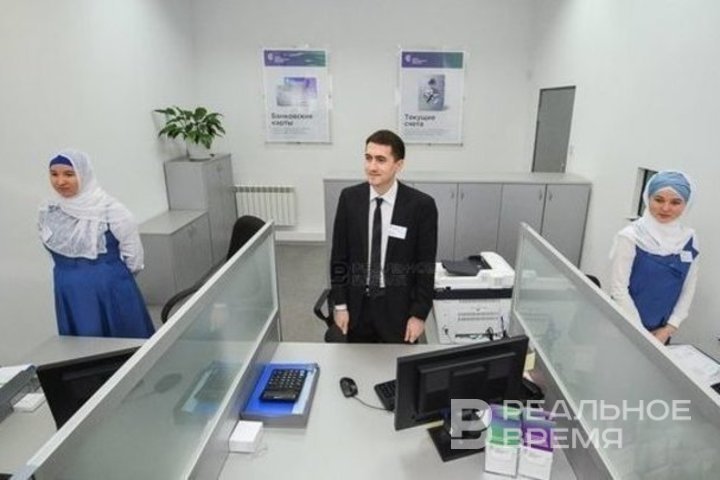

An experiment on the introduction of Islamic banking is taking place in Russia under the strict supervision of the Central Bank. Since last autumn, the pilot has been tested in Tatarstan and three other regions of the country — Bashkortostan, Dagestan, and Chechnya. Nine months later, 23 organisations entered the Register of participants of partner financing in the Central Bank of Russia, the lion's share of which is registered in Tatarstan. How the Islamic finance market operates today and which of the federal players are ready to implement a new financial model — in the review of the analytical service of Realnoe Vremya.

Islamic banking is catching on

The experiment on testing Islamic banking is under the supervision of the Bank of Russia from September 1, 2023 to September 1, 2025. It is necessary to enter the Register of the Central Bank of Russia to officially provide services to the population and businesses according to the principles of Sharia. Today, not only organisations from the regions participating in the pilot project, but also companies registered in Moscow have joined the new financial direction for the country.

Today, there are 23 participants in the Register of the Central Bank of Russia, most of them are from Tatarstan -Ak Bars Bank, Ak Bars Capital, United Stock Broker, Avtogradbank, Amal, Amal Business, Ijara Leasing PLC, Nurfinance PLC, Miras FC PLC, AS Salyam Consumer Society, Entrepreneurship Support Fund of the Republic of Tatarstan, Guarantee Fund of the Republic of Tatarstan, and Regional Leasing Company of the Republic of Tatarstan.

Federal players joined the experiment — Sberbank (Moscow), Domclick (Moscow), Tinkoff Bank (Moscow), Metallinvestbank (Moscow), and Status JSC (Moscow). Representatives of other regions participating in the experiment are still few in the Register of the Central Bank: Promsvyazinvest, a settlement non-bank credit institution from Dagestan, Regional Leasing Company of the Republic of Bashkortostan and the regional charity fund Podderzhka, Flagman Group PLC from Chechnya.

The most popular transactions in Islamic finance are contributions to the authorised capital and purchase and sale agreements. The total portfolio of transactions, brought at KazanForum, is 1.8 billion rubles, according to the estimates of the Central Bank of the Russian Federation.

Introduction of Islamic finance has been discussed for 30 years

The main achievement of the new law, according to Linar Yakupov, the president of the Fund for the Development of Islamic Business and Finance (IBFD Fund), is that the subject of Islamic banking has entered the coordinate system of Russia and four regions. Now the task of both the regulator and market players is to form a practice on which the new law will rely. With a successful development of events, it will be extended to the whole of Russia.

In 2016-2017, the working group at the Central Bank, when discussing the introduction of Islamic banking in Russia, proposed choosing Tatarstan as a special zone for the experiment. “But then, unfortunately, the authorities were not ready for such a turn of events," Yakupov says.

Despite the lack of a legislative framework, a number of Tatarstan companies have introduced services based on the principles of Sharia. Therefore, Tatarstan turned out to be one of the few regions of Russia ready to participate in the experiment approved in 2023.

Tatarstan-based Ak Bars Bank has been introducing Islamic products since 2011. The first transactions to attract Islamic financing for the implementation of infrastructure projects in Tatarstan were carried out in 2011 and 2013, and Islamic mortgages appeared in 2019. In September 2023, the bank joined the partnership financing experiment and soon offered a number of Islamic business products.

As the experiment began, the procedure for introducing Islamic products accelerated and costs for the bank decreased, the press service noted. Clients also had the opportunity to use maternity capital and subsidies to repay the mortgage after the birth of their third child.

The number of clients have grown since the experiment was launched. Corporate Islamic products launched in early 2024 are also starting to be in demand. Interest in Islamic products is growing not only in Tatarstan, but also in other regions participating in the partnership financing experiment — Bashkortostan, Chechnya, and Dagestan, as well as in Moscow and St. Petersburg.

The experiment with Islamic finance, according to Ishmuratov, is just beginning to gain momentum, new market participants join regularly: “Companies that offered Islamic products before the experiment began, after joining it, received an additional opportunity to declare themselves in a new status," he believes.

Neobank, sadaqah machines, and artificial intelligence

At the end of May, the first halal fintech startup HalalCard was introduced in Russia. The mobile application provides financial services — the issuance of a new Islamic card, the display of balance and transactions on the card, the showcase of partners and the accrual of halal cashback, products in the direction of Islamic investments, as well as the opportunity to apply for an Islamic mortgage.

The fintech startup was launched by a resident of the Kazan IT park. Its founder, Islam Akhmedshin, told Realnoe Vremya that his company continues to work in this direction:

“The team began to think about how else it is possible to participate in the development of Islamic banking in Russia. After studying the market, we came up with the idea of creating our own platform, which we now plan to turn into a full-fledged ecosystem," he said.

Within the framework of the project, more than 5,000 Islamic cards have been issued in several regions of Russia. The plans are to increase this number to 100,000 active cards by the end of 2024.

It is also planned to launch deposits, installments, car loans, investments, business loans and other banking products.

To attract migrants from Uzbekistan, Tajikistan and Kyrgyzstan, the application has been adapted to the languages of the citizens of these countries. The work is underway to deploy a sadaqah machine system for religious institutions, shopping malls and other public spaces. These are special designs for collecting donations digitally — by bank cards or phone, using MIR pay, SBP pay or Sber pay. “We want to take charity to a new level: to personalise assistance as much as possible and introduce good deeds into the daily practice of our users," the creators explain.

Akhmedshin believes that today in Russia society is insufficiently informed about the principles of halal finance and there is a certain distrust of such products. Therefore, in Russia they decided to create an ecosystem that will help promote local companies and will represent a kind of educational platform. In particular, they also promise to introduce artificial intelligence Madiina.

“We sincerely believe that Islamic banking is not only finance for Muslims, it is a story for everyone, because the principles of a just society, mutually beneficial cooperation and development lie in the foundations of Islamic law," Akhmedshin is convinced.

Islamic finance market is expanding

Tinkoff plans to launch federal Islamic banking this year. Not only residents of several regions participating in the experiment on Islamic finance will be able to use Islamic products, but also all Muslims of Russia in all regions of the country at once, announced Askhat Giniyatov, the head of the Islamic finance department of the bank.

It is noteworthy that holders of an Islamic card will not be able to use it to pay for products, goods or services from the haram areas, such as gambling, tobacco products, takeaway alcoholic beverages, pawnshop services, etc. There are plans to launch Islamic installments, insurance (takaful) and investment products (halal investments). Leasing (ijara) is planned to be launched for legal entities.

So far, the changes are only positive

Artem Arzamassev, the director general of the United Stock Broker company, says that in general, nothing has changed in their work since the arrival of the Central Bank of Russia: “Those who provided partner financing services continue to work in this direction, as before.” But now these organisations have regulation from the Central Bank and the opportunity to advertise their services on the Internet.

“Since the start of the experiment in Russia, there have been several significant changes in the partner finance industry, and all of them are positive," said Rustam Sagdeev, CEO of Amal Financial House. “The Bank of Russia now oversees and verifies companies. Those who have successfully passed it are included in the register of the Central Bank. This confirms the official status of a market participant. And when the structure such as the Central Bank becomes the guarantor of a company's financial activity, then this is a completely different level.”

For example, companies have the opportunity to place advertising materials, previously, according to Sagdeev, companies were refused with reference to a banking license: “This issue was resolved thanks to the Registry of the Central Bank of Russia. By the way, not all companies and organisations have received official recognition from the Bank of Russia," he notes.

A unified republican portal has been created in Tatarstan with a list of Islamic organisations that represent these products, so you can check the company and make sure that it is not a pyramid scheme or scammers.

Since the entry into force of the draft law on partnership finance, the company's investment portfolio has grown by 68%, and the financing portfolio by 47%. “All this indicates a high demand for partner financing services and the need to scale the industry," Sagdeev believes.