Oil companies catch the wave

Russia’s Fuel and Energy Complex turned out to be in an anomalous situation

Tatarstan’s biggest oil company Tatneft turned out to be resistant to Western sanctions but can suffer from Russian regulation of the sector. The oil company’s common share price has increased by more than 80% since February 2023 — amid the unexpectedly favourable market situation and weakening ruble rate. But the further rise in Tatneft’s rates will be complicated because of a twofold decrease in damper payments from this September. Read about how sanctions affected Tatneft’s capitalisation and who else can suffer from the damper correction in Realnoe Vremya’s analytic service.

Pessimistic forecasts didn’t live up to the expectations

By experts’ forecasts, 2023 was to be much tougher for Russia’s Fuel and Energy Complex than 2022. Sanctions were imposed last year gradually, while the price cap on oil products came into force in February 2023. The price for shares of Tatarstan’s biggest oil company Tatneft rapidly went down because of these fears.

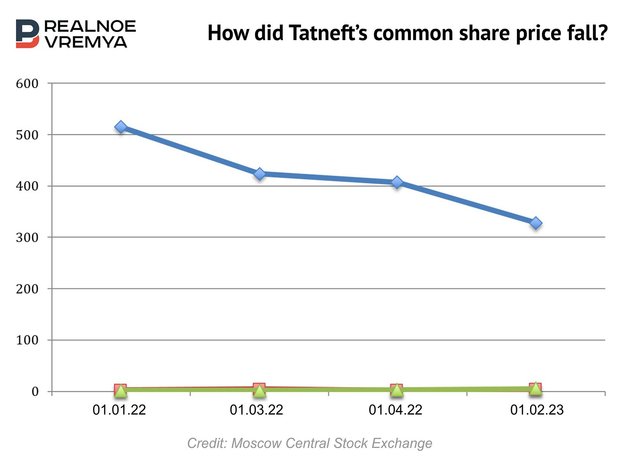

According to the Moscow Central Stock Exchange, Tatneft’s common share as of January 2022 cost 515 rubles. On 1 March, its price reduced to 424 rubles and fell to 407 rubles by 1 April 2022. Due to the imposition of the price cap on petrochemicals in February 2023, the cost of the Tatarstan companies’ shares decreased to 328.5 rubles.

However, in summer 2023, Russian oil companies tuned out to be in an unexpectedly favourable market situation. The oil market switched to a deficit after actions of OPEC+, a voluntary oil production cut by Saudi Arabia and the USA’s transition to strategic reserve replenishment. This allowed oil rates to top the bar of $80 per barrel for the first time since April.

As of 14 August 2023, Tatneft’s common share appreciated to 593.7 rubles (+80.7%, to February 2023 lows).

Tatneft demonstrated resistance to sanctions

“Locally, the Russian oil sector turned out to be in an anomalous situation. In the recent months, we have seen a one-time rise in world oil prices, a fall in the discount for Urals and a rapid depreciation of the ruble,” says analyst of Finam Sergey Kaufman. “This led to a situation in which a barrel of Urals now is traded at some 6,800 rubles — extremely high even compared to historical digits.”

The expert warns that amid the currency control, it will be hard for the ruble to remain so weak with such a weak export rise, this is why such a favourable market situation isn’t stable.

“February lows were conditioned by fears that it will be hard for Tatneft to redirect exports of oil and oil products from the EU to other markets,” explains Kaufman. “However, the reality showed that there weren’t almost any difficulties with re-orientation of exports, which logically led to a rebound in shares.”

Rosneft that is receiving surplus sales income from more expensive ESPO brand and Lukoil that is weakly suffering from the correction of the damper mechanism are at the moment in a more favourable situation among Russian oil companies.

“The correction of the damper mechanism envisaging a double fall in payments from the budget from September is an important theme for oil companies. Tatneft, Gazprom neft and Bashneft will suffer from this measure the most. Their losses can total 10-15% of forecasted EBITDA,” Kaufman warns.

Today the damper mechanism compensates for a part of the different between export and domestic prices for oil products. Oil companies are paid money from the budget when fuel is supplied to the domestic market if its export price is higher than the one fixed by the state.

The law on this mechanism correction was signed by President Vladimir Putin in late July. The novelty will cut the payouts to oil companies twice until 2026 both in petrol and diesel fuel. This can reduce budget expenditures with its deficit, since oil companies were transferred damper payouts from 48 to 109 billion rubles a month from January to June. Amid the significant damage from the damper correction and instability of current higher oil prices in rubles, Sergey Kaufman considers the current assessment of Tatneft’s share is close to be fair.

New sanctions not expected

“With high oil prices, representatives of the oil sector can feel quite good. Key sanctions have already been digested, while new ones aren’t expected, so oil companies’ shares now look very interesting,” stock market expert of BCS World of Investments Igor Galaktionov agrees.

Tatneft shares were back by the general market growth, a rise in oil prices as well as the fact that the company is susceptible to sanction risks to a lesser degree and keeps quite a high level of transparency. “The company’s papers still look one of the best opportunities in the sector,” he considers.

Tatneft, according to Galaktionov, published quite good results in the first quarter by the Russian Accounting Standards. In the second quarter, the company showed the second biggest quarterly result in income since 2017. “The favourable prices in the market support the company’s results, and in the second half of the year we can see a faster growth,” he considers.

Discounts for Russian energy resources to reduce with time

Russian oil companies had enough time to adapt to the new conditions. Relatively low specific operational costs on mineral production in Russia allow them to flexibly manage costs, reduce product prices offering discounts to world benchmarks and staying profitable at the same time, notes an analyst of the National Credit Ratings agency.

In 2022, key sanctions of a series of foreign countries were designed, first of all, for the Russian Fuel and Energy Complex as one of the crucial sectors of the country’s economy, accounting for a significant part of budget income (36% of taxes in 2021). However, the expected significant cut in production of main fuel and energy resources didn’t happen in Russia: oil production rose by 2.1%, coal did by 0.4%, natural and associated petroleum gas reduced by 12% whereas liquefied natural gas production ramped up by 8%.

Amid grown world prices for energy resources, this allows increasing incomes of the sector’s Russian companies and their contribution to the country’s tax replenishment; according to the Ministry of Finance, the share of oil and gas incomes in 2022 increased from 36% to 42%; the Russian Statistics Service assesses the share of the oil and gas sector in GDP augmented to 18.1% and the total income of companies production oil, gas and coal totalled 3.7 trillion rubles, reads the National Credit Ratings’ research.

The imposition of the embargo on energy imports from Russia by a number of countries forced Russian companies to redirect a flow of cargo to the regions where such restrictions don’t exist. Now main routes are in Near East, Africa, China and India. Part of the products (including processed from Russian feedstock) from these countries then goes to the states that restricted their direct import from Russia. This situation is profitable for intermediary countries, but sellers and buyers of the product are carrying losses because of higher transaction expenses — a rise in logistic costs and more complicated financial settlement.

The National Credit Ratings thinks the discounts for Russian energy resources will shrink with time but won’t disappear completely before the sanctions are lifted. The presence of export-oriented companies’ revenue in a foreign currency with primarily ruble expenses and ruble devaluation gives them an additional advantage. The agency thinks that Russian companies will produce resources until this becomes unprofitable for them because the conservation and a sudden production cut will demand huge capital costs on the resumption of field use in the future.