Natalia Pyryeva: ‘Putin’s offer will keep the buyer, but demand for housing will not be active’

Analyst of FG Finam — about the pre-sanction records of primary housing market and the subsequent decline in the conditions of overheated prices and unaffordable mortgages

The Russian real estate market broke a twenty-year record for the volume of investment transactions — 105 billion rubles — in the first quarter of the year. But despite the successful indicators at the beginning of the year, there is now a tendency for the industry to decline in the face of sanctions pressure, accelerating inflation, high rates, and low incomes of the population. A preferential mortgage with a reduced rate of up to 9% will keep the buyer and bring more objects to the market, but there will no longer be such an active demand for new buildings, says Natalia Pyryeva, an analyst at Finam. In the author's column for Realnoe Vremya, the expert characterises the current state of affairs in the construction industry and predicts how the situation may change by the summer.

Maximum volume of transactions in 20 years

The impressive results of the first quarter in the Russian real estate market do not really reflect the current state of affairs in the conditions of sanctions pressure, accelerating inflation, high rates and low incomes of the population.

At the end of 2021, the growth of loan rates accelerated noticeably, so in January-February, more and more buyers were in a hurry to buy apartments in new buildings, and in March, after the well-known events and a record rate increase to 20%, customers with approved mortgages also tried to close deals as quickly as possible. It is also worth noting that in a number of projects all mortgage transactions were under state programmes. Besides, the share of buyers with full payment has increased significantly, and there was a strong influx of investors who sought to invest in real estate to save their savings in conditions of economic turbulence. Moreover, in the first quarter of this year, the volume of investment transactions in the real estate market reached the maximum value in the 20-year history of observations and amounted to 105 billion rubles, which is 2,4 times higher than in the first quarter of 2021.

During 2020-2021, there was a record demand for new buildings and a record commissioning of new housing, which indicates that a significant proportion of Russians realised previously postponed and current needs for improving housing conditions. Market activity in the first quarter of 2022 is explained by the increased degree of uncertainty in the country's economy, which traditionally stimulates the demand for buying real estate as a reliable asset for saving money.

We do not see any prerequisites for lowering prices for “square metres”

But since the end of February, the number of new projects on the market has sharply decreased in anticipation of a decrease in consumer activity against the background of high prices and virtually unaffordable mortgages, which happened — in March demand subsided.

Taking into account the above factors, it became clear that the updated programme on preferential mortgages at 12% will not be able to have a sufficient stimulating effect to generate demand. Putin's proposal to reduce the rate to 9% will keep the buyer and will also encourage the construction sector to bring more supply to the market, which minimises the likelihood of a real estate market “freeze”. However, there is no reason to believe that demand will be too active, since prices are now “overheated”, inflation is accelerating, household incomes are declining, while the cost of construction continues to rise, which will not allow developers to make discounts to their detriment. But developers continue to provide subsidised mortgage programmes to buyers and also introduce various types of installments, which are beginning to gain popularity again.

However, depending on the region, the nature of supply and demand in the real estate market may differ. In Tatarstan, the demand for the purchase of housing in new buildings significantly accelerated in March compared to February — about 3 thousand DDU contracts were concluded, which is by 50% more than in February. The share of mortgage transactions also increased by 14,6% in March compared to February. At the same time, the number of mortgage loans issued in February-March decreased and amounted to 5 thousand against 7,3 thousand in January, which clearly illustrates the situation with the increase in rates.

Thus, in the region, Putin's initiative to reduce the preferential mortgage rate from 12% to 9% and extend the programme until the end of the year may further support demand. We expect that sales figures in April-May will be modest, but by the summer the situation in the real estate market may revive.

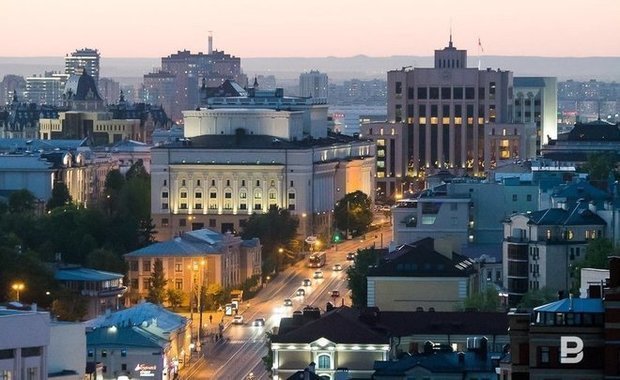

As for price dynamics, the average cost per square metre in new buildings in Kazan in the first quarter of this year increased by 13% from the beginning of the year and by 36% in annual terms, and in Russia as a whole, the cost of housing increased by 7% from the beginning of the year and by 34% yoy. At this stage, we do not see any prerequisites for a significant reduction in prices per square metre.

Developer quotes are reacting violently to news background

Among public developers, so far only LSR and Etalon have presented operating results for the first quarter. According to LSR data, the company's sales volume in January-March of this year increased 2,2 times yoy in monetary terms and 1,5 times yoy in metres, while the share of mortgage transactions increased to 75% from 63% a year earlier, despite a significant increase in the key rate. At Etalon, new real estate sales increased by 21% yoy in monetary terms in the first quarter of 2022, but decreased by 9,1% yoy in metres. The share of mortgage sales in the reporting period remained virtually unchanged year-on-year, at the level of 61%. In general, the optimistic results of both developers confirm the above points about the situation on the real estate market in January-March 2022. We believe that the performance of Pik and Samolet will also be strong.

In conditions of increased volatility in the stock market, the quotes of developers are reacting violently to the news background. At the end of March, LSR presented financial results for the previous year and announced the refusal to pay dividends for 2021 to create large reserves of liquidity, after which the shares of all public developers fell sharply in price. The developers' shares reacted positively to the news about the start of construction of the first project of Samolet in the Far East. The publication of LSR's impressive operating results for the first quarter last week also caused a surge in the growth of developer's shares.

Taking into account the turbulence in the stock market, as well as the high degree of uncertainty in the Russian economy and in the real estate market, in particular, we have placed our recommendations and target prices for shares of Russian developers for revision.

Nevertheless, fundamentally, the largest developers are less exposed to the risks of a sharp decline in sales or freezing of new facilities due to the high level of public confidence, sufficient liquidity reserves and business diversification. We expect that in the long term they will continue to expand their land banks, their own capacities, and IT capacities.

Reference

The author's opinion may not coincide with the position of the editorial board of Realnoe Vremya.