Analytics of Realnoe Vremya: what proposal of TAIF on Nizhnekamskneftekhim OJSC means in fact

How the execution of a law turned out to be a falsehood about the ‘deal of year’ in the leading business media of Russia

Last week on Saturday the press service of the Svyazinvestneftekhim published an official statement that the state corporation doesn't consider a possibility of the sale of Tatarstan's block of shares, which Nizhnekamskneftekhim OJSC, the largest petrochemical enterprise of Europe, holds. It should be noted that during a week a number of the large mass media, including the federal one, was declaring a possible 'deal of the year' on the purchase of petrochemical giant's shares by TAIF. Meanwhile, the analytical service of Realnoe Vremya looked into the documents and came to a paradoxical for their colleagues-journalists conclusion that stands out a mile: there was no mega deal on sale of Tatarstan's blocking shares between majority shareholders of Nizhnekamskneftekhim OJSC (NKNKH) like TAIF PJSC (TAIF) in person of the Telecom-Management PLC (Telecom-Management) and the Svyazinvestneftekhim PJSC (SINKH).

Deal of the year'

These days sensational news has exploded the business information space: TAIF PJSC intends to buy Nizhnekamskneftekhim OJSC out for 22 billion rubles. It was caused by a message that appeared on the website of TAIF on 27 February. It was said that Telecom-Management, an subsidiary of the holding, sent NKNKH a voluntary offer (a proposal), which was spread among all shareholders of the enterprise, on intention to buy over 50% out of the total amount of common and preferred stocks of NKNKH, including those that they already hold.

We understand our colleagues that the advertisement for the intention of the majority shareholder to buy a large block of shares of the petrochemical giant, especially within the scope of the proposal, is a remarkable event that doesn't happen every day nor every year. Nizhnekamskneftekhim' is one of the leading petrochemical manufacturers of the world that produces the full range of synthetic rubber, plastic and other products, which are indispensable for production in many strategic sectors. The products of NKNKH are sold worldwide: the export potential of the enterprise is 46% or, more precisely, almost a half of produced goods is in a stable demand from abroad. In general, all events related to NKNKH cause quite a stir without any exaggeration in the world.

The leading business media quickly 'made' conclusions of the message declared by the holding that TAIF decided to buy out all shares of NKNKH that were still in circulation, including 25,2% of shares that belong to the state corporation Svyazinvestneftekhim and become a personal owner of NKNKH. What is more, the holding allegedly made a decision to save money when it bought shares at 20% below the market value, which was concluded from security quotations of the enterprise formed after and only after the first publication of the message on the proposal of Telecom-Management to the Central Bank at the end of January. Then there was a negative wave on that the 'experts' put pressure, which affected not only NKNKH but also tangentially the authority of Tatarstan…

Sensation or fake?

The analysts of Realnoe Vremyathoroughly studied the documents: Federal Joint-Stock Companies Act, information placed on the websites Interfax, TAIF PJSC, the Central Bank and Federal Antimonopoly Service (FAS). They made a conclusion that in the advertisement of the proposal there was nothing about the intention to purchase shares of Nizhnekamskneftekhim OJSC except a strict sticking to the letter of the law by the companies of the TAIF Group (Chapter XI.1. Purchase of over 30 per cent of Share of Public Companies).

We analyzed the chronology of these events. So, the message about sending the proposal to the shareholders of NKNKH on the purchase of these securities by Telecom-Management was published on the site of TAIF, while the very text of the proposal was in 'Interfax' on 27 February. It means that on the eve of that day, the term, which had been given by the law for the preview of the proposal in the Central Bank that was invested with the power of regulator of the stock market after the 'absorption' of the Federal Financial Markets Service, expired. This term is 15 days, i.e. the documents were received in the Bank on 11 February (Clause 1 of Article 84.9 of Federal Joint-Stock Companies Act).

Meanwhile, initially, it became known about the proposal after the message of Telecom-Management published on the Interfax informative website on 26 January that the proposal was referred to the Bank on 23 January. Consequently, the Central Bank of Russia published a message saying that the injunction was referred to Telecom-Management on 6 February, that is to say, on Friday. It states that, 'the Bank of Russia reports about the referral of the injunction on organizing a voluntary offer to the Telecom-Management PLC, according to the requirements of Clauses 2-5 of Article 84.2 of Federal Law from 26.12.1995 No. 208- Federal Joint-Stock Companies Act, on purchase of securities of Nizhnekamskneftekhim OJSC in accordance with the requirements of the Russian Federation. On 12 February on the site of Interfax there was Telecom-Management's message about the second referral of the proposal to the Central Bank on 11 February.

In other words, for 'organization of the voluntary offer… according to the requirements of the legislation' Telecom-Management needed… only 5 days, including two days off. Perhaps, there was not an outrageous breach of the legislation; the mega regulator probably made some formal comments that were quickly resolved. It almost refutes versions in some mass press that there was a 'terrible breach' of rules and provisions of the law in the applicants' documents (for instance, the omission of the purchase price or its inconsistency with the 'market' financial quotations, though we should note that the purchase price for shares is a sine qua non to submit a proposal and there must be documents from the Exchange proving its correspondence to the market) to the missing compulsory condition of the proposal – a bank guarantee on all sum of the offer.

Firm guarantee

The matter of the bank guarantee (Clause 5 of Article 84.1, clause 3 of Article 84.2 of Federal Joint-Stock Companies Act) of 22bn rubles needs to be analysed separately. So let's turn the clock back. It is unlikely that the mega regulator spent less than 15 days, according to the law, to consider the proposal of Telecom-Management for the first time. It is a well-known fact that the Bank of Russia is too full, and, what is more, it includes the Federal Financial Markets Service and the Federal Service for Insurance Supervision. As it was stated above, the applicant's documents were received by the Central Bank on 23 January. Taking into account the fact that the company had only 9 days after the New Year break, it is obvious that the preparation for obtaining the guarantee began before New Year.

What is more, in Tatarstan only largest banks like Sberbank, VTB and Gazprombank can grant it. And the local authority of the credit organization probably must be a consummate professional that needed a certain courage and serious authority to engage the administrative resource in Moscow, in the head office of the bank. Was it a joke to grant a 22bn guarantee, though to one of the reliable recipients, between a 'Black Tuesday' and long holidays?

Proposal as it is

Here we go back to the share buyout with the purpose of studying marginally the mechanism of the act of the proposal to understand it. According to the Federal Joint-Stock Companies Act, a proposal on securities purchase from a public joint-stock company may be submitted by its shareholder if as a result of the purchase his share is over 30% of the authorized capital of that company (Clause 1 of Article 84.1 of Federal Joint-Stock Companies Act). In addition, the proposal precedes the applicant's intention to buy any amount of shares. However, if one of the threshold values of participation interests (30, 50, and 75 per cent respectively) is exceeded, a buyer is charged with duty to make an obligatory offer of securities purchase, which is made to other shareholders (Clause 1,7 of Article 84.2 of Federal Joint-Stock Companies Act).

It is known that Telecom-Management has been holding over 50% of common stocks of NKNKH since 2005 (not since 2015, according to some press, for instance, 'Vedomosti'). In fact, its share in the authorized capital of the enterprise was less than 50%. Meanwhile, during these 10 years, Telecom-Management and its affiliated members have been making deals using petrochemical giant's shares in spite of failures, crises and fluctuations of their price. It is obvious that the controlling shareholder, who is interested in the development of its asset, has an either-on situation – you believe that your business is prospective and successfully run it or leave the capital and sell your block of shares. Published on the website of NKNKH, the message about changes on the list of affiliated members states that the participation interest in the capital of the Telecom-Management PLC increased from 45,6 to 50 per cent, i.e. reached the threshold value.

If the value exceeds 50 per cent, it is obligatory to make a proposal. It means that if Telecom-Management itself or its affiliated members purchased, at least, one share of the petrochemical giant (they can do it at any time without any hindrance), Telecom-Management or its affiliated person would direct an obligatory offer to other shareholders within 35 days (Clause 1 of Article 84.2 of Federal Law on Joint-Stock Companies). In other words, the company or its affiliated person had to get the bank guarantee equal to 22bn rubles practically one month beforehand. It is apparent that it is better not to bring the situation to this stage.

Now the shareholders of NKNKH, who were on the list of shareholders when the proposal was received by the enterprise, have 70 days as from 27 February (Clause 2 of Article 84.1 of Federal Joint-Stock Companies Act), to make a decision whether to sell their shares to the majority shareholder or not. According to the law, they will have 15 days more to prepare and send to his address a statement offering to purchase the shares (Clause 2 of Article 84.1 of Federal Joint-Stock Companies Act), that is to say, the results of the realization of the proposal of Telecom-Management will be known at the beginning of June.

Price tag

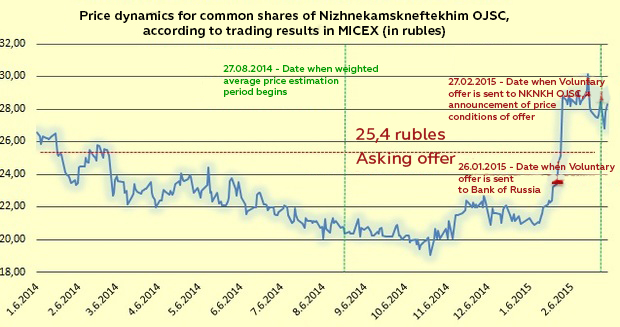

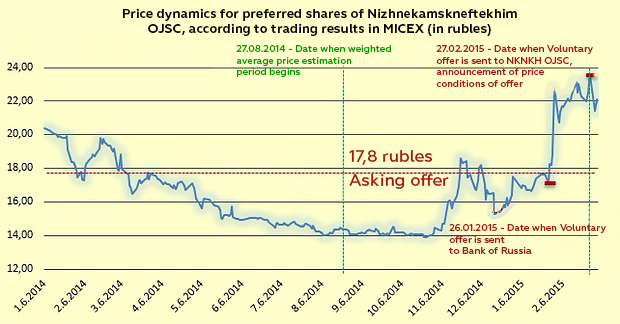

Now we switch to the price tag that Telecom-Management mentioned in its offer on securities buyout: 25,4 rubles for a common and 17,8 rubles for a preferred stock. The irony of the figures published by the mass media covering the proposal is that law again fixes the price of the offer. What is more, the algorithm of the evaluation is quite simple. The shares of NKNKH are rated in the Moscow Interbank Currency Exchange (MICEX), so, firstly, a weighted average cost of the capital in the Exchange for the last 6 months is chosen (Clause 4 of Article 84.1 of Federal Joint-Stock Companies Act). Secondly, the highest share price, at which the majority shareholder have been buying them out during the last 6 months. Then these two figures are compared, and the highest price is chosen again.

Historically, the Federal Joint-Stock Companies Act is a copy of a western act, but it was modified, according to the Russian realias. It is possible that the existing mechanism of the evaluation formed on a background of corporate raids and unfriendly absorption of enterprises in defence of minority shareholders. Even though they don't have alternatives except share sale, they can realize them at the highest price of the offer.

However, the very conclusion that having offered other shareholders the above-mentioned prices, TAIF decided to save money is paradoxical; just look at the rate table on MICEX. It is visible with the naked eye that during 2014 share price for a common stock of the enterprise was about 22 rubles and for a preferred one – 16. So no intention to save money exists.

What about the Federal Antimonopoly Service?

There is one detail that escaped the 'analysts' and journalists' 'watchful' eyes, who declared in the press that TAIF intends to buy out a large block of Nizhnekamskneftekhim OJSC – a modest role of the antimonopoly establishment in this matter. For some reason, our respected colleagues forgot that the Federal Antimonopoly Service attentively monitors all deals on the large block of securities of enterprises, especially when it relates to the federal-scale enterprises like NKNKH (Clause 28 of Federal Competition Act).

The Federal Competition Act (Clause 6, part 1 of Article 28) requires to make deals with such large enterprises like NKNKH with prior consent of the Antimonopoly Service if in the end the majority shareholder that holds more than 50 and less than 75 per cent of voting shares is authorized to use over 75% of voting shares.

If Telecom-Management had no serious foundation not only to make an offer but also consider a possibility that SINKH accepted the offer and purchased the controlled by Tatarstan block of shares of NKNKH, it would address to the Federal Antimonopoly Service to obtain a permission for such a deal. There is no sense to start any serious talk without this condition because the antimonopolists are able to ban the deal. This is why, as a rule, the permission of FAS must be obtained before addressing to the Central Bank (Clause 1,3 of Article 33 of Federal Competition Act), otherwise, breach of the requirement of the antimonopoly law threatens to declare the deal invalid by request of the antimonopoly unit and imposition of a heavy fine from 300,000 to 500,000 rubles (Clause 19.9 of the Code of the Russian Federation on Administrative Offences).

However, on the website of FAS there was no information about such addresses from 'Telecom-Management' and other related companies of the TAIF Group and no permissions of FAS on the purchase of shares from NKNKH…

And a full stop

Finally, the end in massaging the rumours generated by 'journalists' and 'experts' about the possible deal between Telecom-Management PLC and Svyazinvestneftekhim was put by SINKH itself. Last week on Wednesday SINKH published on its site an official statement that the state corporation doesn't consider the sale of the block of shares that belong to Nizhnekamskneftekhim OJSC and is not going to do it regardless of the offers from any shareholder of NKNKH.

Here an obvious and unpleasant for the journalists conclusion as regards all above-mentioned explanations offers itself. It is about our colleagues' crying reluctance to put minimal efforts and grasp, as it seems, an easy topic. Unfortunately, we may conclude that it is today's distinctive mark: reliable information is cheaper than a canard and any, even unchecked and sensational fake. This story of the buyout of Nizhnekamskneftekhim is the perfect example and the fruit of this big unprofessional problem.

Photo: photoiskusstvo.info, www.rupec.ru, officenext.ru