Great Chinese advent: how Celestial Kingdom brands conquer Tatarstan’s car market

Five Chinese brands at once — Chery, Haval, Exeed, Geely and Omoda — are in the top 10 most sold cars during the first months of 2023

Chinese producers are driving out South Korea in the Tatarstan passenger car market. Europeans and Japanese continue losing positions. Lada still holds the lead in new car sales in Tatarstan and in the Volga region but the dynamics of the Russian car giant loses to Chinese rivals. Read in Realnoe Vremya’s analytic staff’s report about what brands are at the heels of KIA and Hyundai, what Tatarstan drivers choose, what Volga regions are in the top in car sales and what’s happening to parallel imports.

Market repartition underway

The landscape of Tatarstan’s car market is rapidly changing, while American and European brands are disappearing, Chinese producers are seizing vacant niches. The top most sold cars changes almost every month, once invincible Koreans — KIA and Hyundai — are going to fall out of the list of sales leaders.

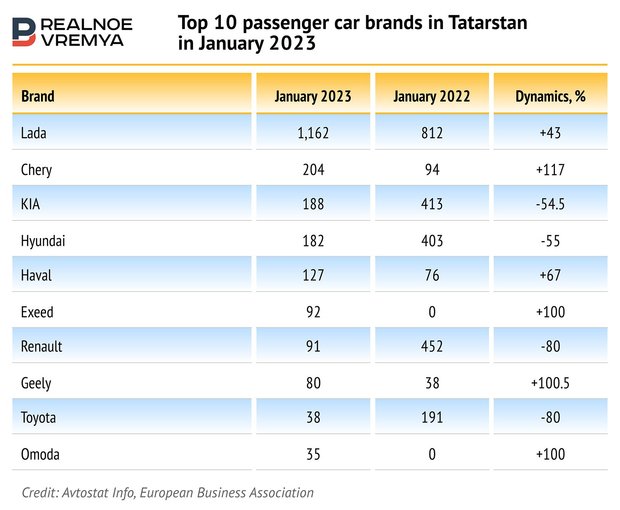

Car sales that collapsed last haven’t yet recovered: 2,382 passenger cars were sold in Tatarstan in January, which is 26% less than during the same period in 2022 (3,233). Lada (+43%), Chery (+117%), KIA (-54.5%), Hyundai (-55%) and Haval (+67%) were in the top 5 new car sales in the republic during the first month of 2023.

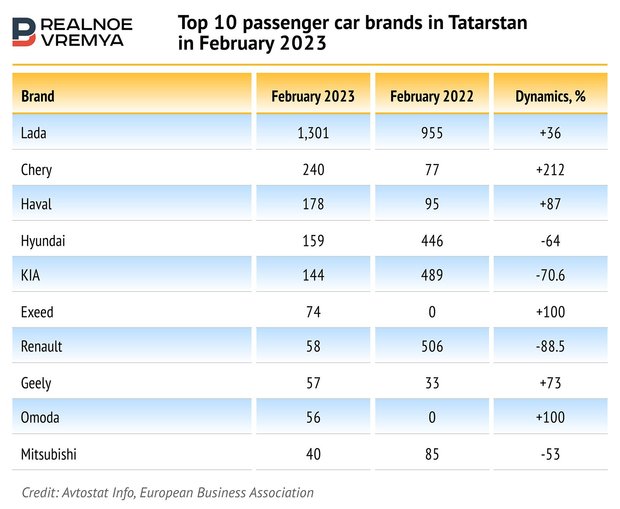

But Chinese brands started to drive Koreans rapidly losing sales from the first positions in the top in February — Chery (+212%) and Haval (+87%). Given the dynamics of sales fall, once popular Korean brands Hyundai (-64%) and Kia (-70.6%) will be replaced by new Chinese brands Exeed and Omoda.

2,549 new passenger cars were sold in Tatarstan in February, 31% less than during the same period last year (3,707). The trend for a general fall in sales is here.

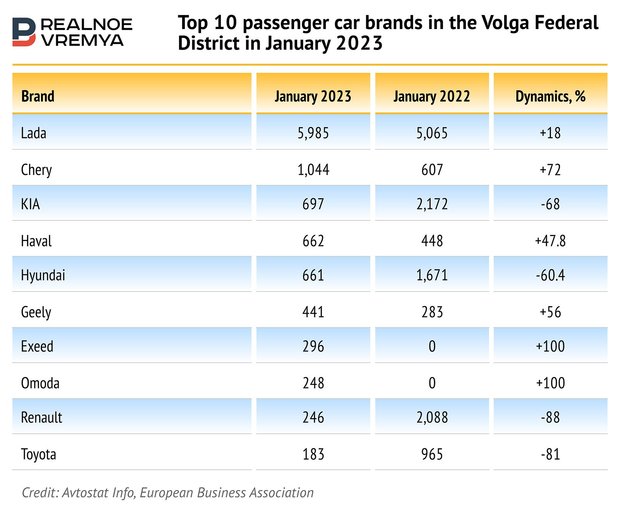

Despite a decline in the market, Tatarstan holds the leadership in the Volga Federal District in new passenger car sales. It is followed by Bashkortostan and Samara Oblast. 11,289 passenger cars were sold in the Volga District during the first month of 2023, which is 33% less than in January 2022 (16,818).

The top most sold new cars in the Volga Federal District in January included (+18% against last year), Chery (+72%) , KIA (-68%), Haval (+47,8%) and Hyundai (-60,4%).

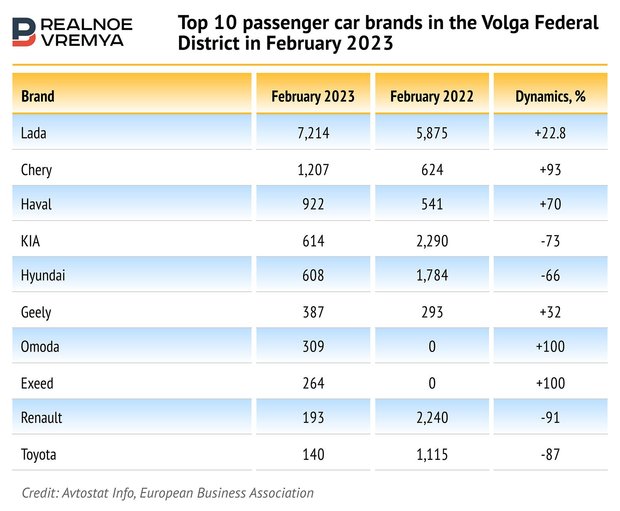

12,791 passenger cars were sold in the Volga Federal District in February 2023, which is 32.6% less than last February (18.990). The top 5 brands include Lada (+22.8%), Chery (+93%), Haval (+70%), KIA (-73%) and Hyundai (-66%). Moreover, Chinese Geely, Omoda and Exeed rapidly increasing their sales in the Volga region are from the 6th to the 8th position.

Over 2 million for Chinese car

The share of Chinese car sales in Russia can reach 60% this year, the National Automobile Union doesn’t rule out. This can happen because of the exit of European and American brands. Russian buyers have almost no choice left.

The starting price for most Chinese cars topped 2 million rubles. Haval Jolion whose basic model is 1.9 million rubles is an exception. The second cheapest Chinese car in Russia Chery Tiggo 4 — costs from 2 million rubles. The average price for Omoda C5 is 2,57 million, Geely Coolray is 2,58 million, Chery Tiggo 7 Pro — 2,72 million, Haval F7 and Haval F7x are 2,8 million. Geely Altas Pro is 3,07 million rubles on average, while Chery Tiggo 8 Pro Max and Exeed TXL million are 4,04 and 4,42 million rubles respectively.

Clients mostly buy Lada (61.6%), Haval (5.5%), Renaut (4.8%), KIA (4.6%) и Chery (4.3%) at KAN AVTO.

The press service of TTS said that Lada, Omoda, Chery, Haval and Exeed were the most popular brands in Tatarstan, whereas Lada, Omoda, Chery, Renault and Exeed are in all cities they are present in.

AvtoVAZ to hold leadership in sales

“In 2023, several factors will influence the car market. Firstly, it is the state of the economy and consumers’ incomes. If they are low, this will influence the unwillingness to make big purchases, including cars. Secondly, the state of the car market will depend on the state of the automotive industry, what models it will offer, moreover, I mean both Russian producers and car concerns from other countries,” enumerates Dmitry Baranov, leading expert of Finam Management. “Thirdly, it will matter how it will be possible to set up parallel import of cars of those brands that suspended operations in the country.”

Also, according to him, state support measures for the car market and loan terms will be significant. The spread of environmental moods in society and the appearance of a wide line of cars with non-traditional engine (electric, gas, hybrid) can influence the market too.

In general, car sales in Russia in 2023 can be bigger than last year, but it can take the Russian car markets several years to recover.

New players from Iran and India to enter the market

“720-780,000 cars can be sold in Russia in 2023. The market can grow by from 15 to 25% against 2022 (626,000),” forecasts Azat Timerkhanov. “But other scenarios cannot be excluded — an optimistic (over 30% growth) and pessimistic (up to 5% fall). High prices for cars now play against the market, but the fact that the automotive industry in the country is starting to revive plays into its hands — we see the launch of new factories and hear announcements of future launches.”

“People need to drive something and somebody simple needs to buy a new car. The likelihood of that the corporate segment — taxi and car sharing — will make a solid contribution to the market this year is high,” he notes.

The expert also expects the arrival of new players — from the PRC, Iran and India. “Imports are growing. At the same time, we shouldn’t forget about the possible growth of currency rates that market responds to negatively and the ongoing deficit of cars,” comments Timerkhanov. “The parallel import, which we call alternative, cannot compensate for the amount of brands that are gone. There are risks too here: other models are imported, they are unfamiliar for buyers, they are more expensive too. But the share of such imports is growing a bit — it had 11% of total new passenger car sales in February. Moreover, official imports (almost all Chinese) held 29%.”

Foreign cars, of course, will also stay in the Russian market in general, the so-called “Russian foreign cars” that used to be made on the territory of Russia will go (almost gone), he adds. Of course, foreign cars are going to be resold in the second-hand market for many years.