Russian businesses need angels

Realnoe Vremya’s analytic staff found out how sanctions changed Russia’s venture market

The 17th Russian Venture Forum postponed last late March indefinitely “due to the reasons beyond the organising committee’s control” opened in Kazan on 16 March. The event that suffered from sanctions and the tense geopolitical situation has always been considered as one of the key events for the venture industry and start-ups. Realnoe Vremya’s analytic staff found out what results Russia’s venture industry started 2023 with, what investors remained in the market and where start-ups should look for money in 2023.

Russia left without Western funds

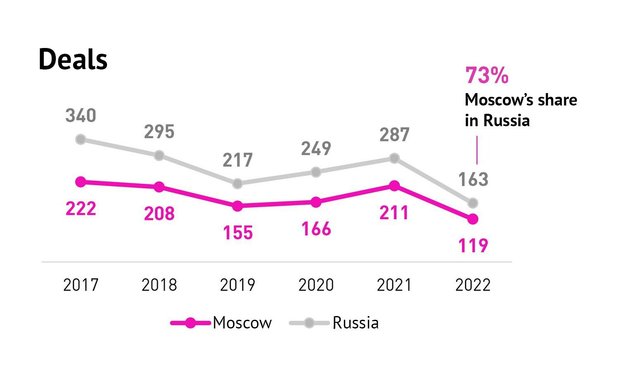

Last year the venture market decreased around the world, however, the scale of the squeeze in Russia significantly exceeds general global indicators because of economic conditions caused by sanctions. The number of venture deals reached a record low since 2017, reported Moscow’s Agency of Innovations: 163 deals were signed in Russia, of which 119 were Moscow start-ups.

Data of Moscow’s Agency of Innovations

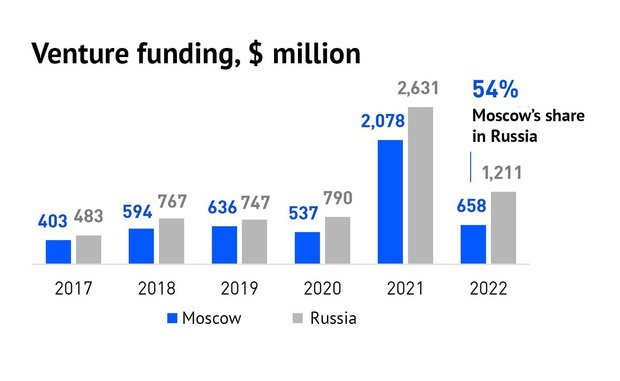

Despite the unprecedented decline, 2022 became the second in number of venture funding in Russia after 2021. The amount reduced to $1.2 billion, but this is why more than in 2020. Russia’s venture market blossomed in 2021, start-ups were literally showered with Western funds’ money, then the amount of venture investing in the country more than tripled — to $2.6 billion, of which 2.08 was Moscow.

Data of Moscow’s Agency of Innovations

Excluding January deals with Miro and Acronics, which announced their exit from Russia in February, Russia’s venture market in 2022 was just $561 million, that of Moscow was $408 million.

Data of Moscow’s Agency of Innovations

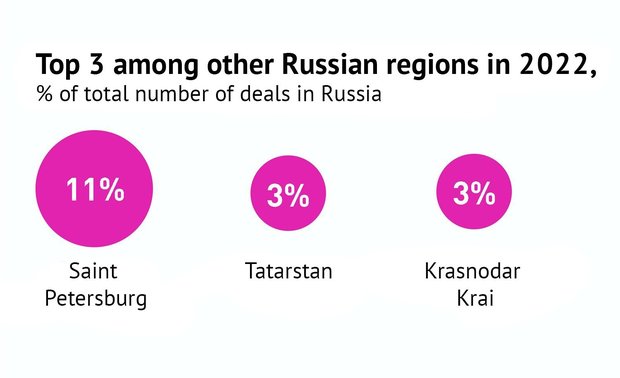

Moscow today is the centre of investment activity in the country. It stably accounts for over half of the venture market — both in volume and number of deals. Moscow is traditionally followed by Saint Petersburg and Tatarstan, mainly thanks to investments in companies registered in Innopolis Special Economic Zone.

Data of Moscow’s Agency of Innovations

Deflating global venture bubble

It is noteworthy that after the record 2021, the global venture market started to deflate too. Raising rate of the US Federal Reserve System became the main problem. The rate hadn’t surpassed 2.5% in the last decade, but in 2020 the FRS lowered to almost zero to support the economy. Due to this, traditional assets, bonds and deposits became uninteresting for investors and they started to invest in start-ups en masse.

However, trying to restrain inflation in the USA last March, the FRS started to raise the rate that reached 4.25-2.5% a year — the highest since 2017. Private investors’ appetite for start-ups suddenly decreased but still top numbers of 2020.

Data of Moscow’s Agency of Innovations

Focus on public funds and business angels

Absolutely all investors reduced their activity last year, but this was especially notable in private funds that reduced their investments fourfold compared to 2021.

Foreign investments in Russian start-ups shrank three times. At the same time, all deals were sealed during the first months of 2022. There was signed no deal with foreign investors in the second half of the year.

Public funds are the only among all investors that formally increased funding by 7%, but this growth was provided by one deal for $190 million with Ixcellerate — a Russian data centre operator.

Business angels were involved in 44% of the deals, they were more than half of the total number and amount of investments during pre-seed and seed rounds. Experts think that private capital owners will continue increasing their activity and investing in Russian high-tech companies because of the impossibility of investments abroad.

The average venture deal size in Russia in 2022 reduced by 43% and amounted to $5.58 million. Late-stage start-ups suffered from the fall in investments the most because during the previous years more than half of the amount of late rounds were provided by precisely foreign investors. Other investors’ attention switched to less experienced start-ups: 70% of them attracted their first investments. The median age of companies attracting investments dropped from five years in 2021 to 3.5 years in 2022. Mostly IT companies with B2B products attracted investments. Men were founders of 80% of the start-ups.

The venture market experienced one of the most serious turmoil

“The Russian economy turned out to be much more steady and stronger than it was predicted and expected. But the venture market experienced one of the most serious turmoil in its history. And by the way, if the deals of Miro and Acronis are removed from the statistics of the study of Moscow’s Agency of Innovations, the fall will turn out much more significant than the numbers provided there, therefore it is not so simple,” says Alexey Taranov, head of the Start-Up Hub at the Bashir Rameyev IT Park.

An outflow of Western investors and relocation of many tech companies as well as some Russian funds and business angels are key factors of the market collapse. “Those who stayed shifted their focus on strategic investments related to the replacement of foreign software, which is forecasted to actively grow for as few as three years,” he explained.

Some IT companies have divided their businesses by opening new companies outside Russia but saving research and development offices in Russia. This means that some assets will stay and develop. “In addition, by losing the European and North American market, we actively entered underestimated markets of South America, Asia, Arab countries and other so-called friendly countries of ours,” the expert says.

According to Taranov, start-ups of IT Park and the Business Incubator attracted 400 million rubles of investments from funds and angels last year. Another 44 Tatarstan companies received over 750 million rubles of grants from the Fund for Innovations, including 7 residents of IT Park — over 89 million rubles.

The head of IT Park’s Start-Up Hub stresses that venture funding suddenly dropped around the world: the Russian market in particular decreased by some 40-60%, the US did by 30-40%, the global market fell by 30-35%.

He forecasts that the investment market in 2023 can grow thanks to the appearance of new internal funds, deals that started last year and corporate deals and investments compared to 2022. “I can’t make forecasts in numbers,” he warns. “I am waiting for a new fund in Tatarstan, fingers crossed. The work on them already started.”

Russian venture market doesn’t go by American textbooks

“Everything got complicated in 2022, miracles do not exist,” says founder of United Investors and author of Start-Up of the Day Telegram channel Alexander Gorny. “A founder had to decided as soon as possible last year too what market he or she worked in and do not mix Russia with, let’s say, the States, and now this, in fact, became a juridical requirements. The new additional condition is to immediately leave Russia physically if you create a Western project.”

According to Gorny, an additional fork on the road appears for future founders that will choose Russia — to try to take the real start-up road like in American textbooks or deal with “Russian venture.” “The goal of the ‘real’ one is to sell for billions of dollars. The goal of the Russian venture is to sell for billions of rubles,” Gorny demonstrates the difference. “The plan B for the real is to sell for tens of millions of dollars. The plan B for a Russian venture is to reach dividends. The real one doesn’t make income, perhaps, never. The Russian venture tries to break even during the first year.”

How to know whose start-up is it?

Sputnik company from Tatarstan attracted 60 million rubles last year, Vasil Zakiyev, co-founder of Sputnik, ex-project director of the business incubator of IT Parks in Kazana and Chelyabinsk told Realnoe Vremya. He also remembered KazanExpress among Tatarstan companies that attracted investments in 2022.

“Any successful start-up enters the whole Russian market as soon as possible if it operates in Russia. It is harmful to lock oneself in your region. This is why one shouldn’t keep an eye on regions — the one who succeeds in something doesn’t work only at home,” thinks Alexander Gorny.

More than 30 unicorns in the world were created by Russian immigrants, the Moscow Agency of Innovations noted. Start-ups of Russian origin often start a business in the US. Companies working in HR & WorkTech, FinTech and Business Software have attracted the biggest investments for the second year in a row.”

“Help to safely pull money out of the mattress”

Co-founder of Technokratos Bulat Ganiyev thinks that today it is time in Russia to simplify the procedure of private investments in start-ups.

It is necessary to protect such private investors legally: “IT Park has a business incubator, all start-ups are normal, none is scam. They work in very understandable segments, and 10-20 million rubles of investments would help many of them to grow,” Ganiyev offers. “But now this money is under the mattress.”