Albert Shigabutdinov: “I really want to participate in the formation of a new TAIF team”

The unchallenged leader of TAIF Albert Shigabutdinov explains why he has decided to resign as CEO and how the company's development programme is going to be implemented until 2030 worth 2 trillion rubles. Read the details in an interview published in Vedomosti newspaper.

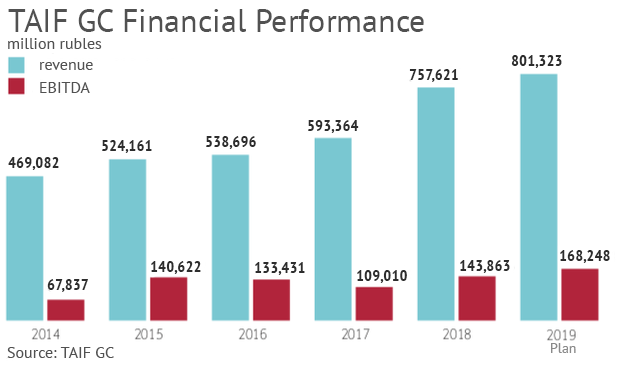

Established in the mid-1990s as an investment fund, TAIF gradually gained control over several large industrial enterprises of Tatarstan, and now its main field of activity is oil refining and petrochemicals. In 2013, when Forbes the last time published the rating of the largest non-public companies in Russia, the group of companies (GC) TAIF by a large margin took the first position in it. By 2018, TAIF's revenue and EBITDA had almost doubled. Albert Shigabutdinov has been the head of TAIF since the company was founded and over this time entered the top hundred richest businessmen of Russia according to Forbes ($1,2 billion, 88th). In the interview with Vedomosti, Albert Shigabutdinov admitted that he has decided to resign as CEO of TAIF but would participate in the creation of a new management team of the company.

What are the indicators you finished the year 2018?

They are slightly below my personal expectations, but better than the results of 2017. The revenues from sales of commercial products and services amounted to about 880 billion rubles, including the company's revenue — about 760 billion rubles, EBITDA — about 150 billion rubles. These are balanced results.

What about the revenue structure by divisions?

I wouldn't call it divisions. These are the four main areas of work. The first, why the company was created, is investment and work in the stock market, the revenue of which amounted to about 170 billion rubles. The construction and production of construction materials — about 3 billion rubles. The service sector, including the filling station chain, entertainment centres, customs and consignment warehouses, providing services to the population — 29 billion rubles. The rest, of course, is concentrated in the field of oil refining, petrochemistry and power engineering — this is the main direction where the company's work is focused on, the revenue from them reached 552 billion rubles.

Against the backdrop of rising oil prices, the year 2018 was very successful for oil companies in general. But you, not having your own production, are engaged only in processing. What were the results of your refinery and petrochemical segment last year? How did the freezing of prices in the domestic fuel market affect them?

Of course, this redistributed our revenues between oil refining, petrochemistry and power engineering. Total sales in the field of oil and gas processing became larger than before, but there is a small loss. Petrochemistry — Kazanorgsintez and Nizhnekamskneftekhim — and power engineering worked much better than the level of both 2017 and previous years. But this is due to the commissioning of new facilities.

What's the downside in refining? How much is TAIF-NK, as a separate company within the group, unprofitable in the current realities?

Somewhere around 9 billion rubles in 2018, which were blocked by the gratuitous financial support of the parent company — TAIF PSC. Now the unprofitability has slightly decreased but still has remained.

Are you trying to explain to the federal government that you are not a vertically integrated oil company, you do not have your own production and there is nothing to compensate for the losses from processing?

Yes, we cannot cover our expenses or, let have it straight, unprofitability at the expense of oil production as we do not have it. Of course, we are in constant dialogue with all structures of our government, the Republic of Tatarstan, as well as with Russian ministries. But so far there is no much progress: [the tax maneuver in the industry] continues. Therefore, the only option is to make oil refining profitable by all means. We are in the final stage of commissioning the world's first large-capacity plant for the processing of heavy oil residues (HRCC at TAIF-NK — Vedomosti). It should solve the problem of the cost of oil and oil products for the company once and for all, at least for the next 20-30 years. The cost of light oil products will always be higher than the cost of a barrel of oil from which they are derived.

Unique complex worth $2bn

You have finished the construction of the HRCC in 2016 and since then you have tested the production processes. It is clear that technologically it is a unique complex, but when will you finally launch it and bring it to full capacity?

The nearest time it can happen is July. The deadline is the end of this year. The delay in launching is due to that such technology is being implemented on such a scale for the first time in the world. The project consists of nine units. The plant integrated into the complex for the production of hydrogen at 160,000 tonnes a year, for example, is the largest in Europe and the CIS. Combined cracking plants — such do not exist in the world yet. The composition of the slurry, which is obtained at the first stage of processing, turned out to be more complex and even more aggressive compared with theoretical calculations. Besides, the processing itself is carried out at temperatures up to 500 degrees Celsius and at variable pressure from 0 to 220 atmospheres. This led to a lot of questions related to the design of plants, equipment and composition of the metals from which they are made. We had to delve very deep into hydrodynamics, thermodynamics, design activities, materials science, metal science. But with the launch of this unit, we will get the output of light oil products up to 98-98,5% of the processed oil.

Taking into account all these improvements, what is your assessment of the actual cost of the project?

With all the direct costs, this project will cost us about $2 billion.

What is the expected payback period?

As soon as we launch, the complex will pay off within 3-3,5 years.

The remaining 1,5-2% after processing is...

First, pure granulated sulphur. Besides, the oil consist of almost entire periodic table — metal compounds that cannot be turned into oil products. All this we will withdraw from the oil.

Our specialists believe that in the near future this can become a subject of serious interest for metallurgical plants, for example, Nornickel. It is almost sulphur-free coke — a mixture of precious metals with coal. When processing 7,3 million tonnes of oil, from it will be possible to extract expensive metals, including nickel and vanadium, up to 1,200 tonnes. We already have the technology of these processes. We'll do it later, before the negotiations begin.

Now all your colleagues-oilmen are trying to establish the maximum depth of processing. They are turning to you with requests for visits — to see, to evaluate the experience, maybe to learn something?

A lot of calls from top officials of the largest companies, and not only of Russia. But I can not name specific names. All have the same request: to come to see, but so that no one knew anything about it. So the two of us were almost wearing masks. Indeed, everyone is interested, but no one wants to show that they want to do it.

The cost of this technology will rise very sharply otherwise?

Most probably. I can think of dozens, if not hundreds, of reasons why this is happening. First of all, we are probably one of the few companies, if not the only company in Russia, which operates in the most competitive conditions. Not that I'm complaining, it's the way the world works. We have no oil and gas production. In general, TAIF was established as an investment company. The fact that we are engaged in oil refining, Nizhnekamskneftekhim, Kazanorgsintez — it was a request of the leaders of the republic, the instruction of the shareholders. This is what they say today: yes, the future belongs to petrochemistry! In 1995, when we started to be engaged in it, everything was unprofitable in oil refining and petrochemistry and no one believed that this industry in Tatarstan had a future.

Investments vs charity

You have recently adopted a programme of petrochemical industry development until 2030. How much do you plan to invest in it?

Until 2030, we have drawn up the plans, plus or minus 5-10%. At the same time, we take into account forecasts of market volatility and plans of other companies. According to the programme of strategic development of TAIF for the period from 2012 to 2030, the investments in oil refining and petrochemistry — about 2 trillion rubles. About 400 billion of them for 2018 have already been invested. If you take a drive around the plants, there are many facilities under construction, two or three are launched a year. In Western countries, it is called “plants”, but for our complexes, it is “units”.

Last year, Tatneft adopted its programme for the development of oil refining and petrochemistry, and this year it has adjusted it. We have agreed that this year together with Tatneft we will consider our programmes in more detail so that there are no intersections and hasty waste costs.

It is called a market sharing…

Whatever you want to call it, but any person, and you including, wants to buy good things at more optimum price. Here is the same. If Tatneft is good, then we are good. And vice versa. Our programme until 2030 is very complex and expensive. Two trillion does not come every day, we need to agree, somewhere to attract — it's not our own money. We don't have such money yet. Although the assets and financial flows of the company, taking into account the pace of development, are reliable and allow to attract such funds. When we build, these productions will bring up to 1,7 trillion rubles of income from sales of finished products and services a year.

It's a good programme, but it requires a lot of effort from people. Today, a huge amount of money goes to social spending, which is not associated with production. You have seen Kazan, it has become so beautiful for a reason. That takes money. TAIF Group is actively involved in socially significant projects, such as the revival of Bolgar museum-reserve, Sviyazhsk reserve, the restoration of the Kremlin... We support museums, educational institutions, publishing houses, sports. The total amount allocated by TAIF Group to social expenses not related to production activities since 1995 amounted to 253,7 billion rubles, including 173,5 billion on a non-repayable basis.

When we discussed the production development programme with the leadership of the republic, it provided for a temporary reduction of gratuitous financial support for charitable projects, but with subsequent restoration and even increase. Because the investment cycle in petrochemistry cannot be halted halfway. The programme must be executed. In order to provide guarantees of financing, it is necessary to remain within the limits of bank requirements in relation to debt/EBITDA. At the same time, if in 2018 the contribution of taxes and payments to the regional budget amounted to 17 billion rubles, then in the future, starting from 2021, this figure will increase annually by at least 5 billion and by 2030 will be about 76 billion rubles. Accordingly, the amount that TAIF Group plans to direct to the implementation of charitable projects in Tatarstan will increase.

But the republican leadership says: look, maybe it is impossible somehow not to reduce, and if reduce — just a little bit. What is also a cast-iron logic and justice: I live today, he lives today. Tomorrow we may not be alive, and why should we deprive people of some opportunities today? So now we are working together on this programme — how to optimize costs.

What areas of petrochemistry do you plan to invest in?

We produce almost all types of polymers that are required in Russia. Only some brands are missing or, let's say, there are no polyurethanes yet. There are a number of plastics, which Russia doesn’t have yet. All this is provided in the programme. The nomenclature of new products is determined based on that they have been in demand for at least 30-40 years and remain highly liquid on the market. The development of completely new products requires research, R&D, we do not have enough capacities for this yet — it is very expensive.

Your plans to increase the polyethylene production are already known. Are there any other projects, the parameters of which will allow you to say: we will increase the capacity for rubbers by this amount, for this type of product — by that...

I wouldn't like to announce these figures. But to give a sense of scale... In 1995, when we were created, the enterprises that are now part of TAIF Group used to produce about 400,000 tonnes of polymers a year. Last year — about 2,3 million tonnes. By 2030, this figure for TAIF Group is going to be 6 million tonnes.

Obligations for majority shareholders

You are going to invest 2 trillion rubles in petrochemistry by 2030. What share of debt and project financing do you see optimal? Maybe you are ready to attract partners to the share capital of individual projects?

I gave the total figure. It is not only own, not only borrowed — there are different types of financing. When we were unknown in 1995-2000, the situation with the attraction of funds was more difficult. Well, we're not trusted. If did, then under the pledge of everything, and the rate of 12%. The situation today, of course, has changed. Without any applications, TAIF Group is now offered credit lines of about $6 billion. Even given that we already have $3 billion... Since 2015, within TAIF Group, the rule has been introduced: 85% of the project cost is borrowed funds. We have internal financial resources that allow us to get loans without such guarantees as it was before. The shareholders help — they also lend us. Though a low interest, but it's their capital increases.

We are not interested in selling very small stakes. The appearance of the majority shareholders — can be. The issue of their involvement is open. We do have such a desire, and proposals are received, but so far rejected by shareholders. Large partners are attracted in two cases: either there is not enough money, or when a person wants to get out of business. Today, TAIF has neither one nor the other.

Are you talking about attracting, in theory, shareholders to TAIF Group in general or about the sale of stakes of individual companies?

There are different options. Maybe TAIF, and Nizhnekamskneftekhim, and Kazanorgsintez, and TAIF-NK, and TGC-16. It will be chosen the option that will be the most financially-economically advantageous. If I were a potential investor, I would better buy the shares of TAIF.

There is another way to raise funds — IPO.

I say — majority shareholders, you say — IPO. In principle, it is the same with some exceptions.

What do you mean by majority stake? Selling 50% plus 1 share?

In my understanding, this is control over at least 25-30% of shares, which gives the right to impose certain restrictions on the decisions of the shareholders' meeting, including changes in the authorized capital, the issue of additional shares and the liquidation of the company.

That is, you admit the possibility of IPO, in principle, but no time horizons have not yet been determined?

We have certain conditions, whether it is IPO or the appearance of a majority shareholder. Let's say you have money, conditionally $20 billion. “Albert, give it.” No problem, take it. But I have a request: a 2 trillion worth programme has been adopted, such products are to be obtained. This development programme must be implemented. If the funds are not enough — please: what you pay us for the shares, we are ready to give you as a loan. But if you do not do in time — you return [the assets]. In a period of 10 years we return you the money quietly and we finish this case ourselves. Who exactly will be engaged in the programme of development of TAIF Group — TAIF, Ivanov, Petrov, Exxon, Lukoil or Sibur — it is not important. The programme that has been developed can only be adjusted together with us, but in any case it must be implemented. Here on such conditions (if there are) the attraction of majority shareholders will take place.

At the beginning of 2019, TAIF allocated to a separate management company the assets that do not belong to the petrochemical industry. This is preparation for their sale or to attracting partners in the petrochemical industry?

After the Soviet Union collapsed, the mechanism of the centralized planned economy ceased to work, and there were no mechanisms of the market economy yet, so we had to be engaged in everything: construction, telecommunications, banking, insurance, depository business, oil refining, petrochemicals, energy. Huge forces were invested in telecommunications, because without them it was impossible even to dream about further development. Today, I believe, the sphere of telecommunication services in Tatarstan is developed at the level of the most advanced countries of the world.

But you sold your telecommunications business...

Yes. We made good money then. But now the construction industry has seriously recovered: houses are being built, factories. It is difficult for one and the same person to delve into the advanced technologies of petrochemistry, oil refining and energy and in parallel to engage in construction or communications. Therefore, the decision was made: other individual people will be engaged in the assets related to oil refining, petrochemicals and energy.

What about other directions?

The shareholders have already separated banking from TAIF. But there are still many assets: production of building materials, highly professional building, transportation, entertainment centres. It is possible to negotiate in some way: either to share, or just...

... to sell. Do you see an opportunity to make money on the construction segment?

One hardly can make much money in the construction segment.

But you are ready to sell this business?

We are going to get out. Yes, we will try from the management company TAIF, which is, to realize the dream of my partners, who dream that TAIF should be exclusively an investment company. To make this possible, a separate management company has appeared. It is expected to lead to more effective work in investment activities and with the stock market.

Unequal opportunities

Another option to find resources for investments is to pay less to the budget. Novatek, for example, receives significant benefits at a comparable cost of the programme for the development of LNG production in the Arctic. You with petrochemistry potentially also work to address the problem of increasing non-oil exports. Are you discussing a special regime for your facilities with the federal and republican authorities?

As for Leonid Viktorovich [Mikhelson] and Novatek... I've been there, long ago, under Rem Ivanovich [Vyakhirev]. In the conditions in which they build, few people are able to work. And if they are allocated some benefits, it's right. This is for the benefit of the country, there are no questions.

And our projects... It is not only we who are working. There are smaller plants, bigger than us that work in the centre of Russia. The main thing is that everyone should have equal opportunities, they generate real competition. If there is competition — new products will appear faster. The country will grow economically much faster than expected. Now there are changes constantly taking place in the tax legislation in the field of oil refining, oil production, petrochemistry. I believe that if some benefits are given, they should apply to all.

Due to technological peculiarities can be introduced, for instance, a reverse excise on naphtha or liquefied natural gas. It is imposed on everyone, while every manufacturer has one’s own effect.

The state makes and defines concessions. And something is needed somewhere in the country, while it will take much time to wait, there won’t be competition, a concession appears, some of the businesspeople grabs it and does it, it is fine. The country tries to put all the sectors in equal economic conditions with the help of reverse excises. This is why I am for both straight-run gasoline and liquefied gas.

But if a producer stopped working with the imposition of some new law, while another one began to work better, it means nothing has changed. For instance, the imposition of reverse excise on ethane is discussed now. And it is written that it affects only those who are going to launch production from 2022 or 2023. What about those who had been working with ethane? If a law is introduced, it must affect everyone.

Back to the question about equal conditions. Now you are buying about 7,4 million tonnes of oil a year with a 1,82-1,84 sulphur content.

And density is over 0,870. While we are purchasing for the price of the Urals. By our estimates, the difference from the fair price per barrel is about $4-5, while it is already about $30-35 per tonne. At the same time, some oil refineries get oil with the sulphur content of 1,5 as maximum and the density of 0,850-0,854. I think the price must hinge on quality. But everyone operates in different conditions: heavy oil is produced in one place, light oil is produced in another one — it is a matter of luck. If the state imposes a tax on mineral extraction, it would be fair to consider it. Then one can hope for high competition and fast development of technologies. There are few reckless people in Russia who work in our team, a handful. But we have to [go downstream], we have no other choice.

Do you discuss the necessity of differentiating mineral tax with the government?

We talk about it. But at the moment, the gap between us is too huge. There is no phone there. This is why we try to solve the problem with the help of new technologies.

Did the change in the government last year change anything? We have a new vice premier who is responsible for the Fuel and Energy Complex. Does he understand the gist of this problem?

This issue hasn’t been so far discussed in the new government.

Does it mean you are building a $2-billion supertechnological unit just because you aren’t heard at the top?

We have no choice. Neither I nor my people know what is going on at the top. We don’t know the situation across the country. It means there are some reasons. This is what we think about it. But this is a very tough task for the Ministry of Energy, Ministry of Finance, the Russian Prime Minister’s administration. In addition, one we have to agree with companies: with Rosneft, Lukoil, Tatneft, Gazprom Neft.

And we have to find a common solution anyway. Today oil price is about $70 per barrel, and the situation can change tomorrow. And nobody guarantees that we won’t go back to the 1997-1998s when a barrel of oil fell to $6-8. It will be super hard with the current imbalance in oil production, the country will be in crisis. We also should be ready for such a turn of events. And it is not just about us.

Do you have a technical capability to produce oil with another sulphur content?

Officials of Transneft claimed in the early noughties that a producer could get as good as oil as he wants.

There is, of course, another path — the HRDCC has huge capacities. Both sulphur and synthetic oil can be produced, and polymers can be processed. It includes a big number of technologies. But why deal with heavy, very heavy oil in the country, while we take light oil outside the country to our director competitors? Why give them the advantage of light oil refining? It is a competitive world market, and the country’s interests must be protected.

The parameters of the ethylene complex project at Nizhnekamskneftekhim changed several times. Why did you choose naphtha?

They changed because end products were selected: if we were going to produce only monomers or polymers, too. It is very complicated processes, this is why it took much time to choose a technology. But now we have a solution, there will be a wide range. Propylene, butadiene, divinyl — the whole range of products made of straight-run gasoline. We are going to use them to produce polypropylene, polyurethane. The solution isn’t cheap: two ethylene units with a 600,000 tonnes capacity each. I think it is a thing of the past to judge by it. One should already judge such units by polymers. Each of them will produce about 1,5m tonnes of polymers. Nizhnekamskneftekhim already got a loan for this project at less than 1% a year for 15 years.

How much is the complex going to cost?

I am under obligation to maintain secrecy. I can talk about the price of the credit only. Several big banks offered a syndicated loan of another €2,5bn, but at the moment there is no need for it.

Zapsibneftekhim is to almost double Sibur’s polymer production capacities and has already reached mechanical availability. How are you going to split the market?

The petrochemical market isn’t a farm market to come and split with Sibur: here is your half, that’s mine. If we are talking about polyethylene and polypropylene, up to 100 million tonnes of polyethylene a year is made now around the world. It is a marketable good. It can always be bought and sold — it is only a matter of price. Russia’s polyethylene needs have already nearly been met. This is why those who are geographically closer to Sibur will purchase from Sibur, and those closer to Kazanorgsintez and Nizhnekamsk will do from us. Logistics will define it. Secondly, it is the assortment and quality. Our assortment and that of Sibur are a bit different. This is why there will be no problem with sales. And, of course, a huge part will be exported, everyone will sell depending on the remoteness of the market. For instance, Europe is closer to us, though the rate is lower, of course. Eastern Asia is closer to Sibur. Perhaps, the margin will fall a bit because the majority will be exported, and logistic costs will rise.

CHPP instead of boiler

Two of your power plants — Kazan CHPP-3 and Nizhnekamsk CHPP-1 — are getting ready for modernisation…

We have already completed the first stage of modernisation of the plants. Now both CHPPs are showing one of the best performances across the country in efficiency and brake specific fuel consumption to generate thermal and electrical energy. But we have plans for further development: TAIF Group plans to increase the installed generation capacity to 3 GW in general. The key concept is to create reserves for further development of consumers, including ours. No matter it is new plants or future development of Nizhnekamsk or Kazan. Any plant is modernised with room for possible expansion of the city so that all the population, all social and cultural venues will be connected to central heating because central heating from the CHPP is the cheapest and most optimal variant to supply consumers with heating and hot water, especially considering harsh climatic conditions of our country.

For instance, Kazan. The large-scale modernisation of the city’s power plants has almost been completed now. The upgrade of the Kazan CHPP-1, CHPP-2, CHPP-3 has become its result. Electrical energy generation at the CHPP in Kazan has increased, but at the same time, heat generation capacities in the central combined cycle heating system are just 25-30% full on average. This indicator was 95% in the Soviet Union. And if there is no heat load, it means there is no electricity.

The existing heating networks should be put into order in the city. Of course, this costs money, but much less than it would take to build new CHPPs and then not load them. At the same time, we shouldn’t forget that most costs on the construction of these plants appeared because of power purchase agreements (PPA), that’s to say, at the expense of consumers, including the population.

We offered both President of the republic Mr Minnikhanov and the government to create a programme of dramatic modernisation of the central heating system of Kazan to use its full potential, to make the heating system economically profitable and efficient for both the population and industrial enterprises and investors. If this decision is made this year, we will be able to load the power plants of Kazan with joint efforts as much as possible by fully meeting the needs of the population and factories with inexpensive heat.

Do I understand correctly that Tatenergo is going to become your direct competitor in this case?

No, we don’t have competitors in this issue. It is an additional load of all Kazan CHPPs with thermal energy production, which will lead to the greatest growth of electrical energy generation.

However, a rise in the heating energy load at your CHPPs is a reduction in the heating load in someone’s facilities. If you augment production, somebody will have to reduce it.

In this respect, both we and Tatenergo are interested in creating an effective operating mechanism, as the whole possible heat production volume is in demand. Nobody has to reduce thermal energy production.

Are you ready to invest in the modernisation of heating networks in Kazan in order to get an additional market for yourself to sell heat?

We don’t want to become owners but ready to finance or give money to normal companies really operating in the market and not violating current legislation when solving these problems.

How much help might be needed?

My experience suggests that it can’t be less than 2-3 billion rubles, 10bn rubles as a maximum in Kazan. This money is needed to put everything in order and have all heating in the combined cycle, close all boilers. Otherwise, if we continue working as we do now, heating prices are going to simply become too high for the population soon. People will stop paying, start installing their own boilers in flats. And then everyone will understand there is no way, they will begin thinking and go back to central heating from the CHPP. This it will be much more expensive and longer to do it — much time will have been lost, much money will have been spent.

And how much time will such a project need?

It is necessary to carry out a full technical audit of all thermal power plants, all heating networks, all boilers across the city, to complete the heat supply scheme on this basis and make up its further development plan for the next five years. The plan must have a full list of built and modernised heating networks, closed boilers, the deadlines, money and so on. In general, legislation on heat supply considers it all now. No news. By our estimates, the whole programme in Kazan can be carried out for 5-6 years. It is just 5-6 years, and Kazan can be in a perfect state, the cheapest in terms of heat supply.

How is it going to change your financial performance?

For the CHPP-3 (TGC-16), it will be growth of revenue and economic effect, including for our colleagues from Tatenergo. Generally speaking, additional revenue from thermal and electrical energy sale will grow to 25bn rubles a year (with 2017 prices). Moreover, the majority of this sum comes from the sale of additional electrical energy volumes generated in the combined cycle.

Is it going to reduce tariffs for consumers in Kazan? Have you calculated the final effect for them in numbers ahead of time?

At least the tariffs won’t go up in price, while the population will seriously economise. In a word, the heat generated by the CHPPs is 500-600 rubles per Gcal. Its supply to final consumers isn’t more than 500 rubles in 2019 prices. In any case, heat for the final consumer won’t be more than 1,000-1,200 rubles per Gcal with the price for heat from boilers up to 2,000-3,000 per Gcal.

It is the gist of our proposal, but we can’t work on this project because of a huge workload in other areas (not only in power engineering). The most important thing for us is that our enterprises run effectively and don’t have heating and energy problems for at least 20-30 years. And we are ready to give combined cycle heat to the city. If it doesn’t work out, electrical energy generation will use this heat — we have technologies for it, while energy is always in demand in the market.

How many boilers by your calculations should close in Kazan if your plan is fulfilled? Now many people are working there now? How are they going to be employed?

It is a complicated question that can’t be brushed off. If fundamental decisions are made, this seems to be discussed in the urban and republican governments.

Albert and Alberta

Do you hope to participate in the PPA programme in further modernisation of your CHPPs?

One of the requirements of the PPA programme is to increase localisation. To choose modernisation projects, we made requests for several steam turbines. But, first of all, to load Russian factories manufacturing the equipment we can install here. And according to their petition, it is vital, we also have a little effect.

I say that a specific decision on modernisation in power engineering must strictly comply with specific requests of the consumer. We installed the 405 MW turbine [by General Electric] at the Kazan CHPP-3. At the moment, it is the most powerful turbine in Russia. At the Nizhnekamsk CHPP-1, we just modernise steam turbines made in Russia. Now they are running full load, and this is why their combustion efficiency is at the level of the best turbines. Everything must be analysed in detail each time, then there will be a good result.

Siemens participates in the existing projects of new CHPP construction…

Everything is made abroad. Without localisation. Without PPA. But here our approach is quite strict. Siemens builds a turnkey CCGT for us with borrowing with ECA as a safeguard and fixed service agreement for the next 12 years. This is why we are satisfied with the money influx and the financial performance for the whole payback period of the project, excluding the economic and ecological effect of the use of by-product gases produced in key manufacturing processes as a fuel, which are burnt in the flare stack at the moment.

All General Electric CCGT-405 turbines have proper names. Yours is called Alberta. Is it a coincidence?

My granddaughter’s name is Alberta. Mr Rice [General Electric Vice President] said when he came: “Albert, the turbine is a feminine word, let’s make up a name.” I replied: “Do what you want”. Then I heard about Alberta. I am pleased, I don’t hide.

High time

Since when have you been counting your service at TAIF?

Kazan Foreign Trade, Research and Development Production Association was created in 1990 and reorganised into TAIF Joint-Stock Company. But everything began as early as 1988 when small enterprises were permitted in the Soviet Union. We organised the Exporting Scientific Engineering Centre first, then the Foreign Trade, Research and Development Production Association. I personally wrote chapters, orders with this hand day and night in the room the size of two tables…

Aren’t you tired? You have children, grandchildren. Do you have the time for them with such a job? Are you already preparing a successor?

Yes, I have a grandson and three granddaughters. But the job I do, the team I work with — it is impossible to get rid of it because it is all so interesting and so useful, not only for me personally but for my family, our team, our homeland, everyone who lives in the country, it is on the one hand.

On the other hand, there must be a balance. I’ve thought about. At a young age, you have a working capacity but less experience. If a working capacity doesn’t reinforce the experience you have, it means there is an imbalance, and you should go. It is high time for me.

I work in a team that has plenty of good guys, specialists. I deliberately haven’t prepared a successor but held vices, directors of administration, director generals of factories accountable no less than I do myself. And I think any of them is ready to occupy my place today. They will just work better because more working capacity is needed now to use the experience we have accumulated. Yes, I can become an aide or adviser to somebody, but time makes itself known. Secondly, I really want to participate in the formation of a new TAIF team.

Do you mean even if you leave the post of director general, you will anyway stay at TAIF — in the board of directors, top management?

I think there must be a transition period, especially in the beginning. And the one who will come must learn all the experience, knowledge, methods I have because this post requires huge dedication, flexibility and patience.

Is there a specific time frame for the change of director general?

It is already clear that I won’t be the director general of TAIF JSC forever. But it doesn’t mean I won’t work in general. I really want to be useful for the company, but not to be a brake on it. And when a new person becomes the director general, TAIF will operate better, more successfully, with greater efficiency. I want to enjoy it, I am also a human.

What else do you enjoy apart from work?

I love swimming, going to the banya, going for a walk in the forest. To tell the truth, there is a constant shortage of time. Once I’ve tried to play golf, I liked it, now I want to learn to play it. And I like to go fishing.

The Volga River is said to be once a good place to go for fishing…

It is. Tatrybprom Tatar production association existed that went fishing in the Volga and Kama Rivers and processed fish. It has six sites with artificial ponds, fish traps where mirror carp, common carp, bighead carp, grass carp were bred. I worked there for five years. I know almost all the fishing spots in Tatarstan.

Reference

Albert Shigabutdinov

Born in 1952 in Pervouralsk. Graduated from Kazan Aviation Institute in Radio and Electronic Devices.

- 1979 — vice director of Narmonsky state farm;

- 1986 — head of Tatrybprom association’s MTS base. Vice director general in Construction, Supply and Sales of Tatrybkhoz Tatar Production Fishery Association;

- 1991 — director general of Kazan foreign trade association;

- 1995 by now — director general of TAIF.

TAIF JSC

Industrial holding

Shareholders (date as of 31 December 2015): Radik Shaimiyev (11,97%), AS CJSC (according to Unified State Register of Legal Entities, 8,02% belong to Shigabutdinov), Guzeliya Safina (4,5%), the other shareholders aren’t made public.

Total financial performance (2018 г.):

- revenue — 757,6bn rubles;

- EBITDA — 143,9bn rubles.

It was created in 1995 on the basis of Kazan Foreign Trade, Research and Development Association. It unites companies in oil and gas processing, chemistry and petrochemistry, investment and finance, construction. TAIF-NK, Nizhnekamskneftekhim, Kazanorgsintez, TGC-16 are among the assets. All the enterprises are closely connected from a perspective of economy, equipment, technologies and management.