Elvira Nabiullina scared of VAT rise: softer policy postponed

Due to a threat of accelerated inflation, the Bank of Russia didn’t lower the key rate

The Bank of Russia decided not to reduce the key rate having scared of the uncertainty due to the upcoming rise in VAT – the expected increase in prices will need a bit stricter monetary conditions. In this respect, the transition to a neutral policy, which was promised to take place this year, seems to be put off. Some experts say not only the higher taxes but also risks of capital outflow could be a motive to keep the rate. Realnoe Vremya tells the details.

Russians expect prices to grow

On Friday, 27 July, the board of directors of the Central Bank decided to keep the key rate at 7,25%. Nobody was surprised at it: the absolute majority of analysts had predicted such an outcome, while many people called the meeting on 27 July boring and poor beforehand. Reuters respondents, Alfa-Bank experts, Freedom Finance, Nordea Bank, Promsvyazbank, Otkritie FC and many others unanimously told about maintaining the rate.

The last time the rate reduced in late March, previously – in February 2018 (by 0,25 percentage points in both cases) and last December (by 0,50 points). But now growing expectations of the population and rise in the key value added tax rate from 18 to 20% from next year's 1 January impede from postponing softer policy further.

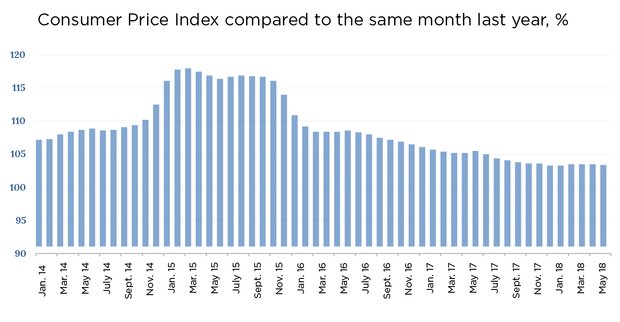

Real inflation was 2,3% from January to June year on year, that's to say, it was almost twice lower than the Central Bank's target at 4%. However, the population's inflation expectations for the next 12 months have suddenly gone up in recent time to the level they were in September-October 2017. If in April 2018 Russians expected inflation to be at 7,8%, in June, the expectations rose to 9,8% (it's average results after surveys).

Mainly a rise in oil prices by 11% since the beginning of the year provoked higher inflation expectations, thinks Felipe De La Rosa, portfolio manager for international markets at General Invest. Felipe De La Rosa also says we should consider the influence of the ruble's devaluation on import component.

In the press release after the meeting, the CB indicated the presence of pro-inflation risks: ''There is an uncertainty about the degree of influence of tax measures on inflation expectations as well as uncertainty about the development of external conditions.'' The regulator forecasts inflation will already reach 3,5-4% a year by the end of the year due to VAT, then it will go over the targeted 4% in 2019 and go back to it in early 2020. Previously, the CB's analysts predicted the rise in VAT could add 0,8-1,2% to consumer prices.

Considering how the rise in tax will affect prices, ''there will be needed some strictness of monetary conditions'' to fix inflation at about 4%, the regulator claimed. Due to this, it thinks the transition to the neutral policy in 2019 is very probable, though it previously assured the transition would be completed in 2018. At the same time, the CB thinks monetary conditions are already close to neutral and almost don't restrain the dynamics of loan, demand and inflation.

Not only VAT

The next meeting of the CB will be on 14 September, but experts are sure the decision on the rate won't be in favour of the reduction.

The CB's rhetoric changed in June already due to the decision to raise VAT. Moreover, the economy's growth at the moment corresponds to the regulator's basic forecasts. This is why this year the rate will either remain at the same level or change insignificantly, says portfolio manager for international markets at General Invest Felipe De La Rosa.

Financier and former Deputy Chairman of the Central Bank Konstantin Korischenko is sure the regulator has clearly claimed the rate won't change till 2018: ''I even don't know how it's possible to interpret it in a different way.'' Meanwhile, he thinks not only the rise in VAT can be a motive for keeping the rate. ''The risks linked with the change of taxes are important, of course, but another thing is much more important – the obvious capital outflow and departure of non-residents from the Russian public debt market. If the outflow keeps the same pace, the market can lose about $30 billion. The capital loss can weaken the ruble, while this, in turn, can aggravate inflation pressure,'' says Korischenko.

Neither will the rate rise, thinks chief economist at Alfa-Bank Natalia Orlova. A sudden change of the course would be too destabilising for the economy after a cycle of reduction. The CB's recent decision to increase risk coefficients for unsecured loans speaks about conservation: this means the regulator can locally affect the segment, which has a risk of overheating, without bothering the key rate.