Down with bubble: Nabiullina to fence Russians off unbearable debts and banks – off risk

It will become less profitable to grant the population expensive loans. MFIs can win

Not to allow a new crisis of bad debts, the Central Bank decided to artificially cool down the consumer credit market: it will become unprofitable to grant the population expensive loans with a high risk for banks from autumn. Consumer credit has been dynamically recovering after the crisis since the middle of 2017 unlike the Russians and the economy's real income, in general. Experts say mainly microfinance institutions will win in the banking sector due to the restrictions. Realnoe Vremya tells the details.

It starts to concern a bit

The Bank of Russia will raise risk coefficients for unsecured consumer loans from 1 September. According to RBK, the coefficient will amount to 120% for loans at 10-15% a year, it will be 140% for a 15-20% rate; 170% will be applied to the rate from 20 to 25%, while loans at 25-30% will have the highest coefficient – 200%.

So all the coefficients will be raised by 30-60% from today's level. This means unsecured loans will become less profitable for commercial banks, as they will have to create more reserves. It was supposed the change would be by far harder: at the beginning of July, the Central Bank planned to up the scale of coefficients but corrected its decision after discussing with the banking community.

Chairwoman of the Central Bank Elvira Nabiullina has given to understand many times during this year she wants to decrease the appetite of banks for granting the population expensive and risky loans; the regulator doesn't want to allow a bubble in consumer lending and a new crisis of bad debts. In February, Nabiullina said a revival in consumer lending was good; at the same time, growth in this segment, firstly, should correspond to the growth in loans for the economy's real sector, and, secondly, be accompanied by a rise in real incomes of the population (that have been falling for 4 years in a row).

Deputy Chairman of the Central Bank Vasily Pozdyshev also commented on this topic: ''If we welcome good mortgage growth paces, high growth paces of unsecured consumer loans start to concern a bit,'' he claimed in April.

At the same time, previously the regulator permitted the banks not to reconsider the category of risk for Russian companies that were affected by US sanctions in April – the banks can grant loans on previous terms, not worsen the outlook of their financial state and not create additional reserves in this respect.

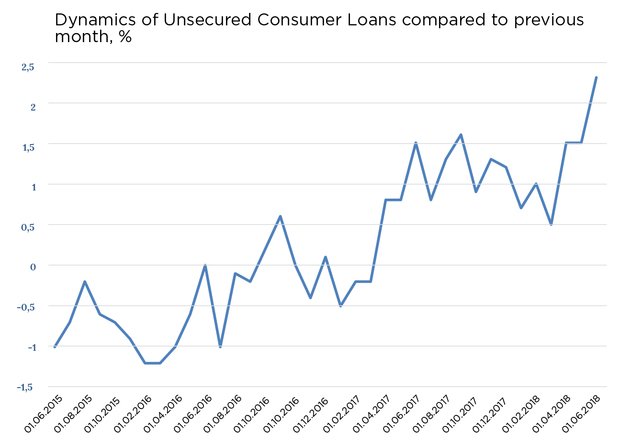

Consumer loans' banking portfolio has been severely affected during the crisis: apart from some months, its volume reduced in 2015-2016. A confident recovery began last spring: the volume of loans without collateral rose every month in 2017 since April.

According to the Central Bank, the volume of money granted to natural persons increased by 18,9% — from 11,19 to 13,3 trillion rubles last year (from 1 July 2017 to 1 July 2018). The portfolio of unsecured loans augmented by 15,6% (from June 2017 to June 2018).

Microfinancers will thank

Many experts think not banks and citizens but a third party – microfinance institutions (MFI) – will be the beneficiary of restricted loans for consumers.

''If risk coefficients are raised, banks will have to say 'no' those potential borrowers whom they would grant a loan in the past. Consequently, the latter will have to turn to microfinance institutions where interest rates are significantly higher. So this novelty will hit not only banks but also borrowers. While MFIs will benefit,'' says Director of BKF Bank's Analytic Department Maksim Osadchy.

''If risk coefficients are raised, banks will have to say 'no' those potential borrowers whom they would grant a loan in the past. Consequently, the latter will have to turn to microfinance institutions where interest rates are significantly higher. So this novelty will hit not only banks but also borrowers. While MFIs will benefit,'' says Director of BKF Bank's Analytic Department Maksim Osadchy.

He also adds the growth in unsecured consumer credit ''negatively affects the Russian economy and favours a reduction in GDP, as borrowers spend most money they receive to purchase imported goods''.

However, microfinancers haven't felt the loyalty of the Central Bank in recent time: the regulator actively cleans this market up and strictly fights against the popularity of payday loans.

It's hard to say who is right, notes Director of ACRA group of bank ratings Aleksandr Proklov: granting the population loans, banks act as quite rational economic agents; the Central Bank does its best to prevent a serious bubble from appearing. ''Banks look for those niches that are profitable for them. If they see it's more interesting for them to grant the population loans, and if the price for the risk they assume seems to them acceptable today, they will go there anyway,'' he says.

Growth in unsecured consumer credit is an impartial reality, Proklov continues. When the economy grows slowly, and real available incomes reduce or stagnate, people go to a bank to finance their needs. ''Undoubtedly, it's feasible to fence people off the debts they won't be able to pay, the load of debts of house managements must grow sustainably anyway. Another thing is that I think the dynamics of consumer credit will go ahead of the dynamics of loans granted to the real sector in any case,'' says Proklov.

Growth in unsecured consumer credit is an impartial reality, Proklov continues. When the economy grows slowly, and real available incomes reduce or stagnate, people go to a bank to finance their needs. ''Undoubtedly, it's feasible to fence people off the debts they won't be able to pay, the load of debts of house managements must grow sustainably anyway. Another thing is that I think the dynamics of consumer credit will go ahead of the dynamics of loans granted to the real sector in any case,'' says Proklov.