Russia’s automotive market: to hurry after Europe, KAMAZ with German cab and dreams of an off-road vehicle

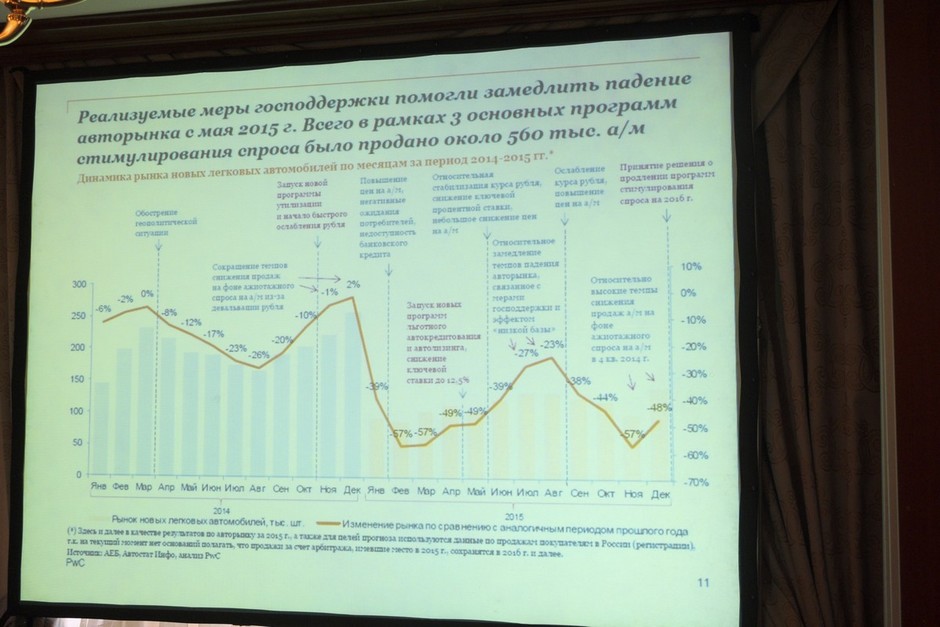

Russia's automotive market is in the doldrums: ruble crush provoked the growth of prices for cars and parts, the degree of localisation of domestic cars does not save them from the price increase, the decline in personal income makes to defer a car purchase, but the market is still attractive to automobile manufacturers. Experts presented positive and alarming trends in figures at the annual conference 'Russia's automotive market: results and outlook', organized by analytic agency Avtostat and website AutoMarketolog.ru. About 200 representatives from 80 companies attended this event. The correspondent of Realnoe Vremya listened to analysts and matched the outlooks.

Russia has fallen below Japan and Brazil

The crisis of 2008-2009 dented the market, but by 2012, car sales beat the record — 2.8 million passenger cars. Then good life of car manufacturers ended, and now for the third year, this figure has been steadily declining: only by the end of 2015, the reduction amounted to 36.2%. In absolute terms, sales reached 1.5 million cars. Russia was the 12th in the world on the number of automobiles sold, told the director of Avtostat Sergey Tselikov at the conference. In 2015, only three markets were in decline among the top-15: Japan (7.9%), Brazilian (25.6%) and Russian (36.2%).

Meanwhile, Russian automotive market remains promising, and according to European standards — almost bottomless. 280 cars accounts for a thousand of Russians, while in Europe this indicator approaches 400-500 units. Besides, the market is physically rather big: about 150 million people. Half of the Russian fleet is older than 10 years, says Avtostat.

As for brands of cars sold in the Russian market, an indisputable leadership belongs to the brand LADA — 17.5% in 2015. The closest competitor — KIA — received 10.9% of the 'pie', another Korean — Hyundai — rounds up the top-3, which is behind by only 0.2%. Russians prefer station wagons (40.6%) and sedans (39.5%), with the engine from 1.4 to 1.6 liters (51.4%) and manual transmission (51.7% against 48.3% automatic transmission). The largest revenue in Russia belongs to Toyota brand — 199.4 billion rubles. Market leaders by the number of sold cars are LADA, KIA and Hyundai — gathered 126, 146 and 135 billion rubles, respectively.

Thus, according to Sergey Tselikov, it is still profitable to buy cars: the price of cars are falling more slowly than the ruble. The experts of dealership centres also confirm that fact. They observe the decrease in the cost of cars translated into dollars or euros. Consumers buy because 'tomorrow will be more expensive', as well as because of the policy of most automobile manufacturers of artificial curbing of prices, state support, preferential loan programmes and trade-in.

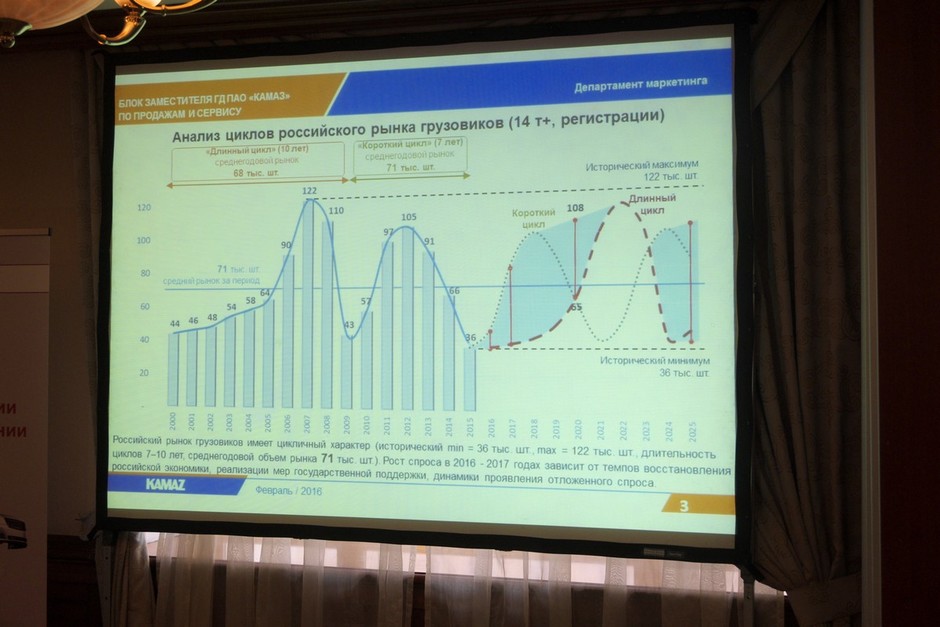

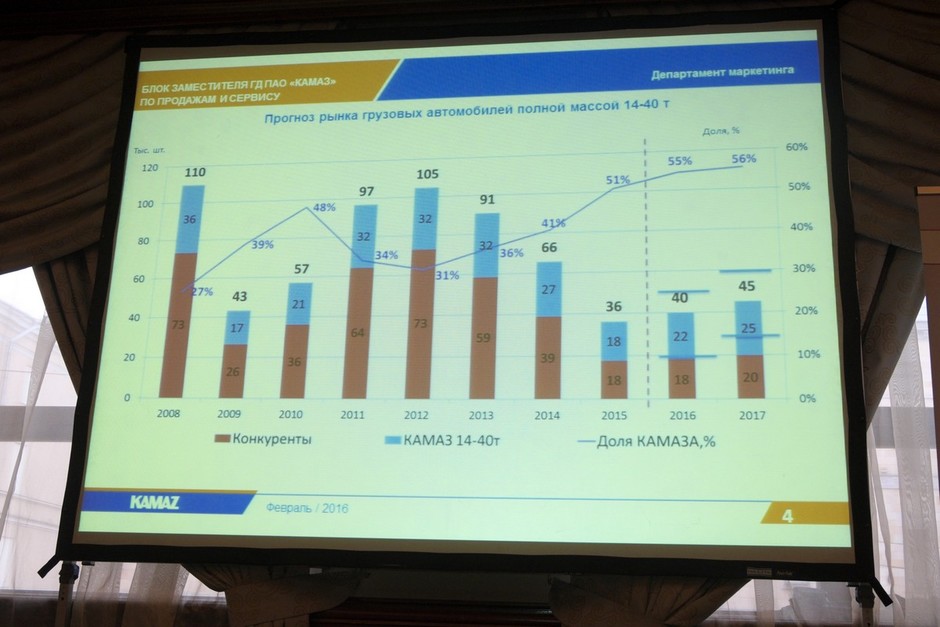

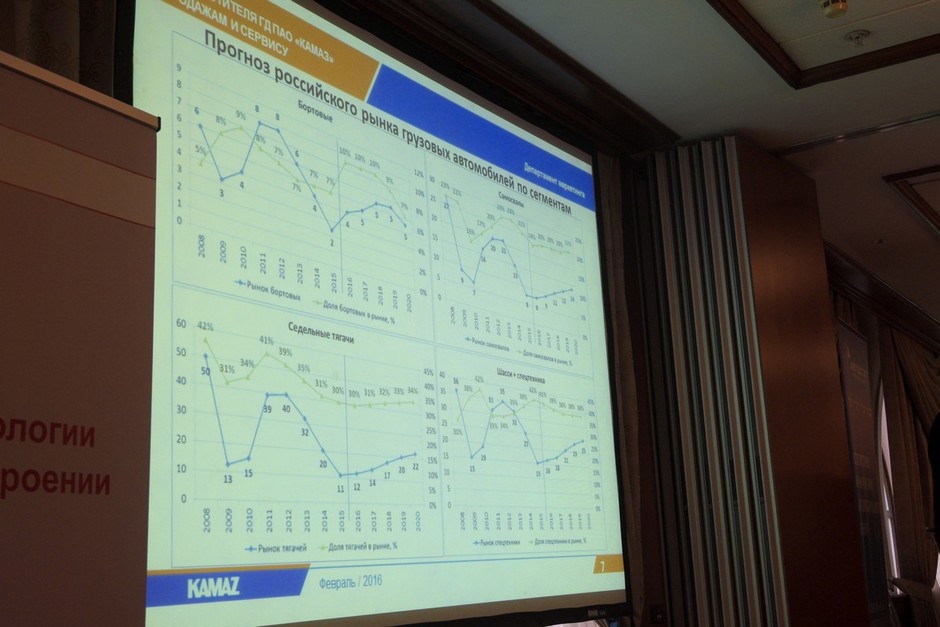

New KAMAZ with German cab will go to Peru

The situation with trucks is even more difficult than with cars. This segment of the market in 2015 fell by 42%, to 51.2 thousand units of new cars. In this context, KAMAZ has to take anti-crisis solutions. The concern is in search for new markets, said the director of marketing and advertising of KAMAZ Ashot Arutyunyan. In 2016, the company will focus on Indonesia and Iran freed from sanctions. Iran's market after the restrictions had shrunk almost 10 times, but debts of the companies still remain, and during the recovery of Iran's economy the demand for trucks must return. In 2017, it is planned to entry the market of Peru, with a new lineup.

A co-owner of KAMAZ, Daimler AG, will come to help:

'Our investment agreement means that in the future Daimler will give us a new cab. A new, completely new. Not old, which is now used, but those that will be developed,' explained Ashot Arutyunyan. 'The point is that we will enter a market with a promising lineup on the basis of technologies of Daimler.'

The creation of the tractor is the growth point for the company, belives Arutyunyan. In most segments — dump trucks, chassis for special equipment — KAMAZ historically holds the lead, taking up to 70% of the market. At the same time, among tractive units Chelny automotive giant occurs at most six times out of a hundred.

'We are going to launch a new line: drop-side truck tractor, dump truck. 65802 and 65801, all of them will be with a new cab,' told Arutyunyan. 'Why so and where is going KAMAZ? We understand that with old product range we will not exist forever.'

KAMAZ overseas interests appear for obvious reasons: Russia and the near abroad are too dependent on energy prices, and, therefore, they are unlikely to restore demand in the near future.

KAMAZ hopes for state support measures connected with the renewal of its fleet.

In general, the company expects challenges to the market for another two or three years. The strategy will be to diversify, exporting and updating of the range, said the representative of KAMAZ.

A dream car and sober reality

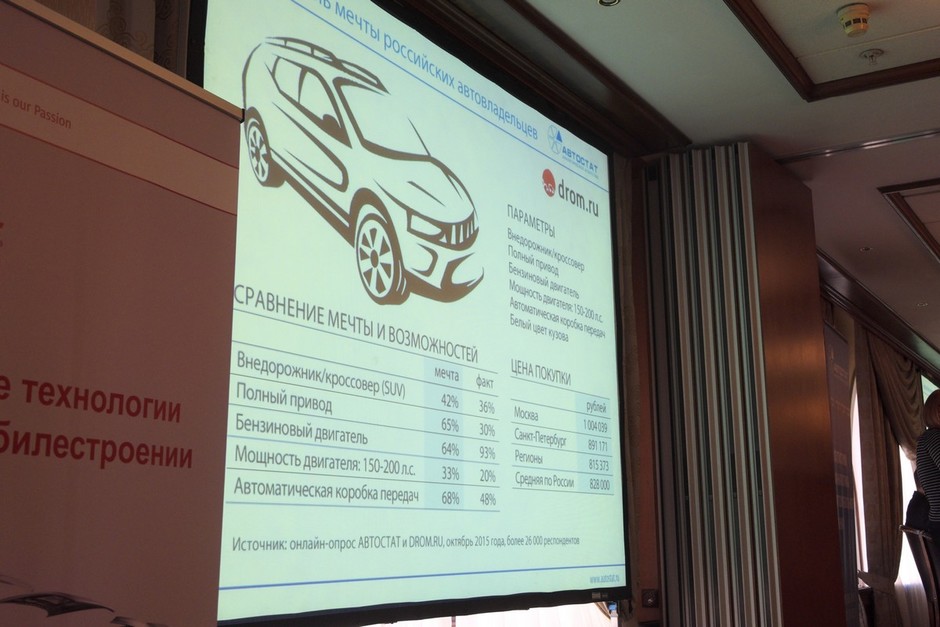

What is a dream car of the Russians? The agency Avtostat has tried to answer this question, having explored the views of users of the website drom.ru. The marketing director of the agency Tatyana Malygina announced the results:

'It is an off-road vehicle or crossover with all-wheel drive, with gasoline engine, automatic transmission, white exterior and with a capacity of 150-200 horsepower.'

But reality shatters dreams. 42% of respondents dream of an off-road vehicle, but only 36% can afford it. 65% dream of all-wheel drive and only 30% can afford it. 64% want gasoline engine but, in fact, 93% buy it. 68% would like automatic transmission, but only 48% buy it. Responds about price are different – Moscovite would like a car would cost about one million rubles, residents of St Petersburg – about 900 thousand rubles, residents of regions turned out to be more frugal – 800 thousand rubles.

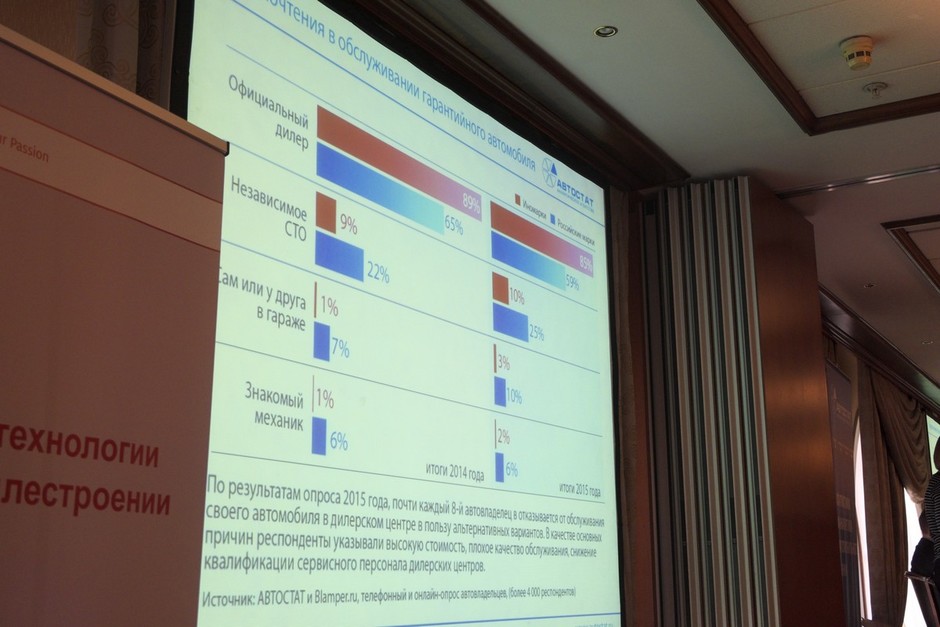

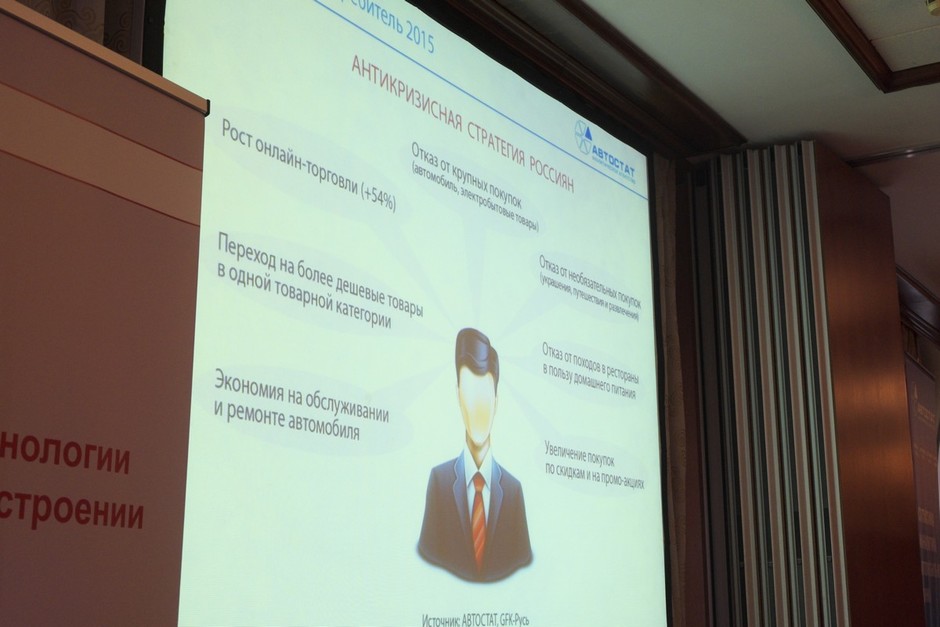

Dreams are dreams, but in 2015 most car owners started to save on their cars in compare with 2014.

Tatyana Malygina: 'The percentage of those who was going to buy a car has declined. If at the beginning of last year it was 44%, now it is 32%.'

In the first place, expenses on a car wash (76% of respondents) was subjected to family sequestration, 36% of respondents are trying to drive less, using public transport or cooperating with colleagues on the way to work. 37% refused from long trips, the same amount ceased to use paid parking lots and garages. 35% of car owners save on auto insurance (KASKO and OSAGO). 22% started to buy cheap fuel, but most respondents said that despite that the expenses has increased.

The survey was conducted in two stages — at the beginning of 2015 and at the end. According to Malygina, you can see how the year has melted the optimism of car owners:

The percentage of those who was going to buy a car has declined. If at the beginning of last year it was 44%, now it is 32%. We asked these people about their expectations for the change of the financial situation in the next six months. At the end of the year, the amount of optimists decreased.

In general, experts are pessimistic in their assessments, too. In the press release of the agency Avtostat, the experts predict a drop in sales of new passenger cars in 2016 by 20-25%.