Marina Yakubova, Avers Bank: ''There is no sense to postpone a real estate purchase''

Annual growth in mortgage lending in Russia at the beginning of September exceeded 13%, said first deputy chairperson of the Bank of Russia Ksenia Yudaeva.

The key rate reduction has led to record low levels of mortgage rates. Reacting to the economic situation by lowering rates, banks offer their clients the freedom of choice in the form of numerous mortgage programmes. Avers Bank offers the most flexible and favourable terms. From 2 October, the bank reduced interest rates on housing loans and launched the offer Young Family, in the framework of which the spouses, or one of the spouses under the age of 35, can receive a loan on favourable terms. What one should pay attention to when taking out a mortgage loan and when it is better to do it, read in the interview of Realnoe Vremya with the head of sales department at Avers Bank PLC Marina Yakubova.

Record-low mortgage rates

Mrs Yakubova, what is the reason for lower interest rates in your bank?

In the course of this year we have noted a systematic reduction of the key rate. Of course, after the reduction of the key rate customers expect banks to reduce interest rates on loans. In September, the head of the Bank of Russia Elvira Nabiullina stated that inflation reached 4%, the key rate declined again and mortgage rates reached a record low level.

What is the current minimum rate on mortgage products in Avers Bank for young families?

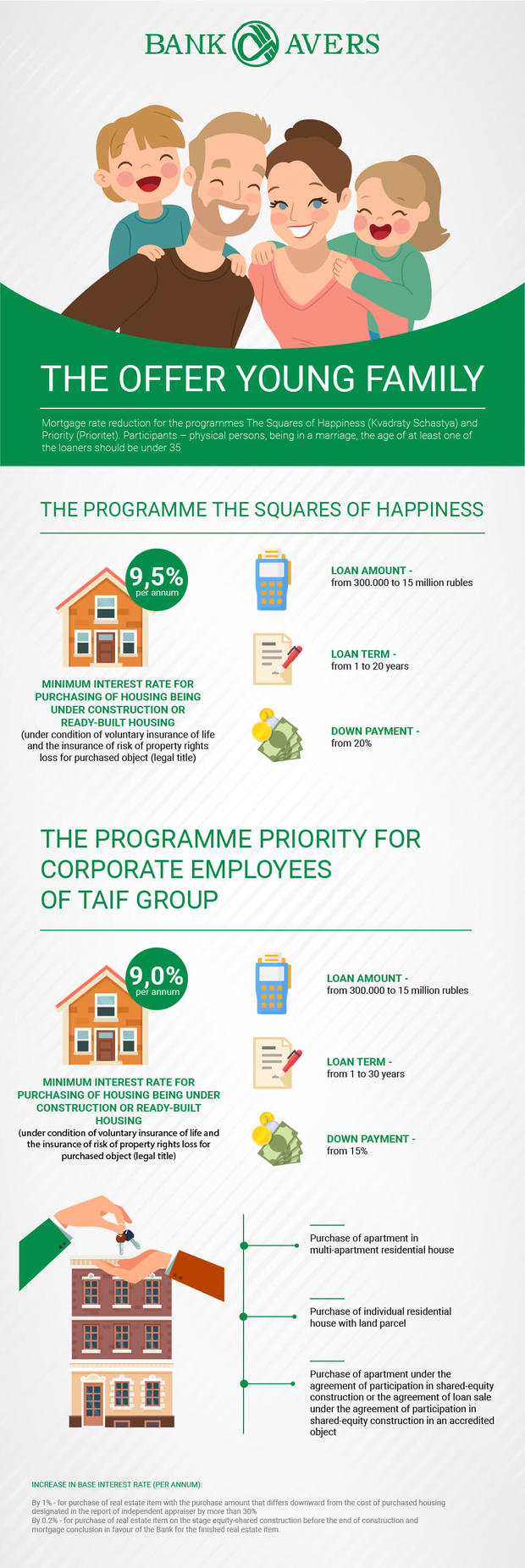

In our bank we have two main mortgage products – the programme Priority for the employees of the enterprises of TAIF Group and the programme The Squares of Happiness. Young families can take out a mortgage loan at 9% per annum in our bank. This rate is valid for the programme Priority. What is more, such a low rate is established without any subsidies from developers, additional conditions on the loan term and the initial payment. It is the bank's interest rate. The minimum mortgage rate for the programme The Squares of Happiness for the purchase of apartments in primary and secondary markets is 9.5% per annum. Interest rates have been reduced for young families where the spouses, or one of the spouses, have not attained the age of 35. The obligatory condition for obtaining a mortgage loan is the marriage between the spouses must be registered officially.

We always pay special attention to the needs of young customers and strive to offer affordable and flexible terms for banking products. Now they have the opportunity to take out a loan at lower rates for the term up to 30 years, as well as to use the maternity capital.

To what real estate items is the offer applied?

The terms of the offer Young Family is applied to the purchase of housing on the primary and secondary markets, the purchase of real estate at the construction stage or an individual house with land parcel.

What are the conditions the bank offers to other borrowers?

For them the rates start from 9.25% per annum for Priority and from 9.75% for The Squares of Happiness.

Now the housing market offer a large selection of objects, banks offer best interest rates, special offers from developers and prices for any budget.

Today we are seeing an increased demand for studio apartments with 20-35 square meters. Young families, for example, with a total income of 45,000 rubles now can easily afford the purchase of an apartment as the down payment for such apartments is small, and the monthly payment is less than the rent cost.

There is no sense to postpone the purchase of new housing. You can make a good purchase already today.

There is no sense to postpone the purchase of new housing. You can make a good purchase already today

''The loaner needs insurance not less than the bank''

What is the validity period of the offer of Avers Bank on mortgages?

The campaign period is from 2 October to 30 December, 2017.

Is the condition to take out insurance when taking on a mortgage loan obligatory?

The voluntary life insurance and insurance against the risk of loss of the right of ownership of the property will allow you to receive a minimum interest rate for the entire term of the mortgage loan (from 1 year to 30 years). In case of refusal from all types of insurance, the interest rate increases by 1% per annum and the maximum interest rate on mortgage loans in the bank can be 10.95% per annum for the purchase of housing in the construction phase and when refusing to take out insurance.

Participation in the program of life insurance allows a borrower to protect themselves in case of unforeseen life situations. Title insurance of secondary housing protects the owner from losing the right of ownership of the object. The property insurance is an obligatory condition, required by the Federal law ''On mortgage (pledge of real estate)''.

''Mortgages and refinancing — two drivers of the current credit market''

What amount can one borrow for a mortgage loan?

In the framework of the mortgage programme the loan amount can range from 300,000 rubles to 15 million rubles.

What down payment is required for a mortgage loan?

In our bank the minimum down payment is 15% for employees of TAIF Group and 20% for other categories of borrowers.

Those who compare conditions of banks when choosing a mortgage product, I always suggest to pay attention to the interest rate depending on loan term and amount of down payment. Many banks declare in advertising very low rates, but actually to get them one needs to make a large down payment.

Can the borrowers of other banks to refinance their loan in Avers Bank?

Yes, they can. Our bank continues to operate the program Reset 2.0 (Perezagruzka 2.0), the interest rate of which is reduced to 9.25% per annum for employees of TAIF Group and up to 9.5% per annum for other categories of borrowers.

In the framework of this programme it is possible to reduce the interest rate and, if desired, to change the amount of monthly payments, loan term, and the composition of borrowers.

Mortgages and refinancing — two drivers of the current credit market. Therefore, we constantly make changes to these programmes, try to simplify and make more profitable for our customers. Next year we plan to introduce electronic registration of rights of ownership of the property. Then our clients will not have to apply to the Registration Chamber.

More information in the bank offices, on the website aversbank.ruor by the phone number 8-800-700-43-21 (toll-free in Russia).

Avers Bank PLC. The License of the Bank of Russia № 415 as of 09.06.2014.