What is the secret of paradoxical growth of industry in Tatarstan?

Only due to increased oil production in 2015 the Republic has managed to stabilize its economy

The main event in 2015 was the stabilization of oil prices at shockingly low levels. Unfortunately, over the ten years of abnormally high oil prices in Russia, it failed to build the economy, not dependent on fluctuations in the world raw materials markets. The economic observer of Realnoe Vremya Albert Bikbov reflects upon how the economy of Tatarstan has reacted to an external shock.

Economy of oil price shock

After a relatively successful first half of 2014 with an average price of around $105 per barrel, there was a twofold drop. In 2015, there were hopes to 'bounce' up, but coming long term 'new reality' discouraged even the biggest optimists. Despite a slight rebound of $60 per barrel by the summer of 2015, prices in the second half of last year fell to very low levels – to $38-39 per barrel. Now even $50-60 per barrel looks like manna from heaven. And after the crisis of 2008-2009, we have no chance to hope for such rebound.

Сonsidering the average amounts per year, in 2015 the average spot price for Brent was $52 per barrel, which is by 53% below the average in 2014 and by 49% less than the average price in 2010-2014. In fact, there was a double fall of oil prices from stable levels.

The world price of Brent oil in 2014-2015, $ per barrel

Russian oil brand Urals has the same amplitude of fluctuations. According to the Ministry of Finance of RF, the average price of Urals oil in 2015 decreased almost twofold on the previous year and amounted to $ 51.23 per barrel.

Low oil prices, remained at the same level for the whole 2015, indicate the excess supply of oil and its surpass over demand. As a result, and the oil storage tanks were overflowed for the whole year. World oil inventories increased each quarter of 2015, the net increase per day amounted to 1.72 million barrels. This was the highest level since at least 1996.

It became clear that oil prices would be low in the long term because all the time there is a technological update. The role of the countries-exporters of oil, Saudi Arabia and others on the world market fell, they can't control the world market. In fact, now the market is controlled by the idle shale oil wells in the United States. As soon as the demand rises, it immediately enters the market, the oil price starts to fall again. And then the Fed raised the discount rate, the winter was warm, the Arabian monarchy, despite the Middle East war, has increased production. And then there's Iran released from years of sanctions.

Everything is relative, but this oil shock is very close in strength to the oil shock in the mid-1980s of last century.

The world price for Brent oil in 1980-2000, $ per barrel

In the famous book by Yegor Gaidar 'Collapse of the Empire' it was convincingly demonstrated how the oil shock of the mid 80s of last century simply destroyed one of the greatest empires in human history – the Soviet Union. So you can imagine how serious is the situation now. But it is not so bad. In compare with ossified socialist economy, current market mechanisms and the country's foreign exchange reserves have greatly dampen the consequences of this strike. But whether there will be enough available margin of safety for a long term is an open question…

Tatarstan paradox

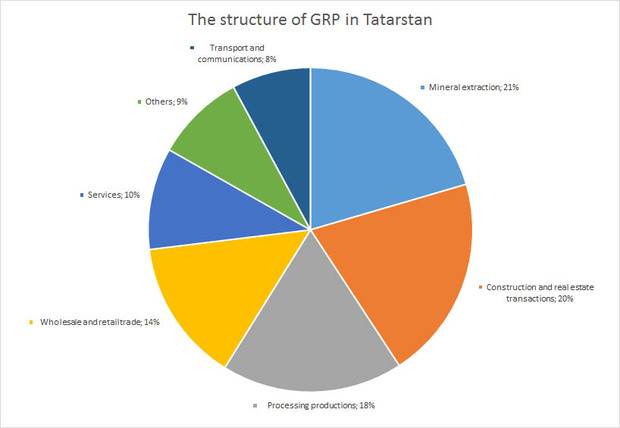

One of the surprising and paradoxical phenomena of this year – the resistance of Tatarstan economy (unlike in all Russia) to such a shocking fall in oil prices. In all Russia, it was a drop in index of industrial production by 3.4%, but in Tatarstan there was paradoxical growth – index of industrial production of the Republic has grown in 2015 by 0.4%! Logically, it should be the other way, because Tatarstan economy is even more dependent on mining, and its dependence is twice higher than in Russia on average (the share of the 'extraction…' sector is 21% in GRP of Tatartsan in compare with 9% in Russia's GDP in 2013). It would seem, they were to decrease even stronger than the Russian average.

The extended structure of GRP of Tatarstan by types of economic activity (according to 2013)

Since the beginning of 2015 – until November 2015 industrial production in RT was in the 'red zone'.

Index during 10 months was in the negative zone. Thus, we can see that after the failure in May, the index of industrial production began to 'come to life' gradually until July and then stabilized at about minus 0.6%. In October, this accumulated from the beginning of the year rate was negative (minus 0.4%). But the result of the last two months radically broke all this accumulated negative trend.

It is known that in the petroeconomy (in the sectors related to the extraction and processing of minerals), largely due to the devaluation, things are going well. Due to the fact that expenses are in rubles and export sales are in the appreciated currency, exporters have 'devaluation premium', which the Ministry of Finance of the Russian Federation wants too. Besides, domestic prices have grown due to increased netback (export alternative) – as the products of petroeconomy are competitive on the domestic and foreign markets.

World oil prices per barrel in rubles

From the chart we can see that in 2014 the ruble prices consistently fluctuated around 3 620 rubles per barrel. In 2015, till October they also stabilized at the level of 3 200 rubles per barrel. This stability gave rise to various 'budgetary calculation formulae of the ruble or the other options of 'Nemtsov's formula'. The inimitable Boris Efimovich (in loving memory!) in November of 2014 he found the principle: for the calculation of 'accounting price' of the dollar it is needed to divide the ruble oil price, from which the Russian budget is calculated, by the current oil price.

Nemtsov's formula worked well until October of 2015, but then stopped…

The mechanism of inflation targeting did its job – the economy adjusted to the fall in oil prices without the following increase rate. Now, the rate is influenced by different factors, such as decreased trade turnover, reduced levels of payment of foreign debts, and declining capital outflows. In last January-November, imports of goods to Russia decreased by 37.5% to $167.8 billion, and exports from the country – by 31.6% to $316.6 billion. In 2016, disbursements on external debts of Russia will be twofold less on 2015. A capital outflow in 2015 also decreased twofold on 2014 and will be, according to preliminary estimates, $57-58 billion. So, the exchange rates will be influenced by completely different factors…

So, from October of 2015 'devaluation premium' stopped affecting on our exporters. There is no a compensating rate of 100 rubles per dollar, now they give 76 rubles per dollar. How the exporters do to close the drop in revenue? The answer is simple – they are trying, whenever possible, to increase the physical amount of production (output). Paradoxicalgrowth of production in Tatarstan was due to the unrealistically sharp over the last decade in the history of Tatarstan increase in the rateof oil production.

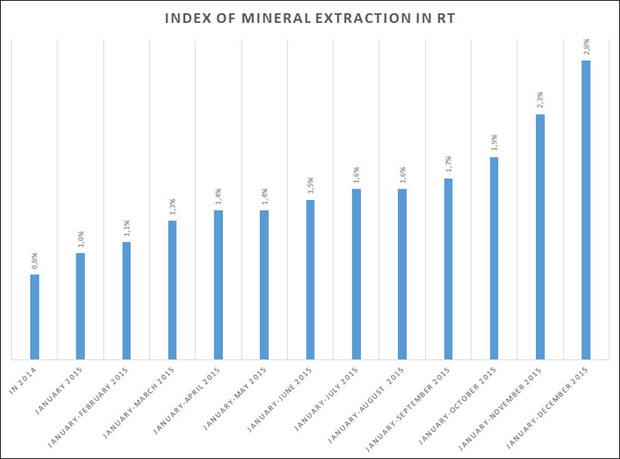

Due to increase of extraction of natural resources in 2015 by +2.8%, as well as related to the oil production sectors (in oil refining, the increase amounted to +3.7% (!), in chemical production +1.9%), we do not fall as deeply as the whole Russia, where the industrial production index fell much more than in Tatarstan (minus 3,4%).

Once again we will repeat the thesis of our past reviews: 'Oil is the saviour of Tatarstan economy', and we just note that things could be much worse if our economy would have the Russian average industrial structure.

The structure of industries in Tatarstan (according to 2013)

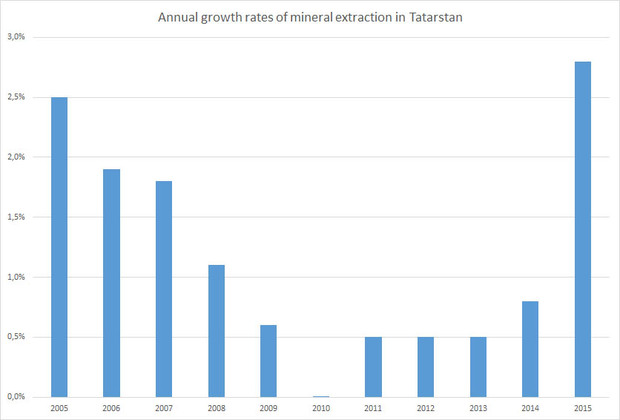

Look when was the last time oil production was so intensified!

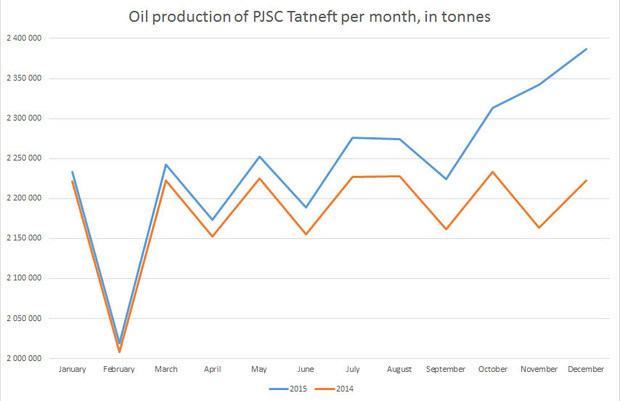

As the chart shows, the last time such a high rate of oil extracting was only in 2005, when average oil prices hung near $50 per barrel. The logic is simple – if world oil prices are falling and 'devaluation premium' is not enough to compensate the fall, the action takes an additional offsetting factor — the increase in production. The group of companies Tatneft in 2015 produced 27 518 248 tonnes (102.7 %; plus 719 348 to the level of 2014).

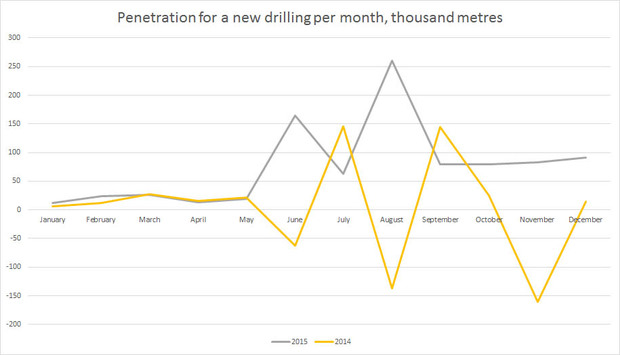

You can see that in October 2015, oil production in PJSC Tatneft dramatically increased, and how high was the company's penetration for a new drilling in 2015 (rate of penetration doubled).

Why the intensification of production is bad? Its motives, in general, are clear – who cuts or just don't increase oil production, those lose not only income, but also the market – if Saudi Arabia itself took a firm decision not to reduce production, there is no sense to play that game of reducing. Everyone is increasing, so the reasonable behavior is also to increase production, if expenses allow. Marginal costs of Tatneft on oil production at developed oilfields are very low in the third quarter of 2015, expenses of oil production amounted to 279.0 rubles per barrel, or about $4.5 per barrel (Rosneft, by the way, about $4.5 per barrel).

What was bad – the intensification of production is fraught with untimely depletion of the fields with all the ensuing consequences. In other words, our children and grandchildren could not get oil.

There's a concept of optimal field development. They just don't drill wells where there is oil, but the grid wells in the field. Some give very large debit: the oil goes fast, well, under high pressure. But in other parts – barely. But such wells give the possibility to empty the field evenly, that is, to extract the maximum oil. And here, the Soviet oil workers on unique giant fields, like Romashkinskoye, used this barbaric method: they extracted oil that came easily, and in other parts of the field they pumped up underground with water to maintain pressure. As a result of such an uneven extraction most part of oil remains underground, it is impossible to extract it. So, Tatneft is more a plumbing company now. Therefore, this forced turn in the direction of the barbaric exploitation of our oilfields is a very sad thing.

Other industries in Tatarstan

If we evaluate the state of affairs in other branches of economy in the Republic, that were lucky to be involved in petroeconomy, the picture is gloomy, but not terrible.

Indices of production (11 months in 2015 to 11 months of 2014)

Tatarstan | Russia | |

Processing productions | -1,0% | -5,4% |

Food production, including beverages and tobacco | 3,6% | 2,0% |

Textile and clothing manufacture | -49,4% | -11,7% |

The production of leather, leather products and footwear | -19,9% | -11,4% |

Processing of wood and manufacture of wood products | -10,8% | -3,4% |

Manufacture of rubber and plastic products | -3,9% | -3,7% |

Machinery and equipment production | -18,5% | -11,1% |

Production of vehicles and equipment | -10,6% | -8,5% |

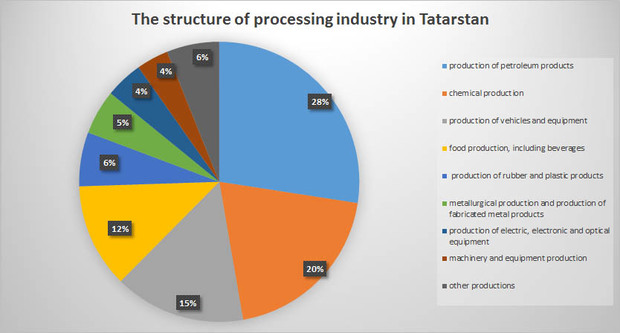

The processing industry of the Republic dropped much weaker (minus 1.0%) than the fall in Russia (minus 5.4%). And, here, (affiliated with oil) refining and petrochemicals (those in processing production) prevented falling. Look at the structure of our 'processing' – the oil refining and chemical production accounted for nearly half of all processing industries:

The structure of processing industries in Tatarstan (2015)

As for dynamics, we can state that in July-August-September the fall stopped. After this stabilization in October-November the weak, but still growth started!

In the sectors oriented to consumer demand, rather than exports, there is a drop. There is a very unpleasant picture: the higher the redistribution of industrial production, the faster its fall. If there is no demand for investment goods – production minimizes. Production minimizes — the wages fall – incomes and consumer demand fall. Consumer demand falls – industries of the consumer sector reduce their purchases of investment goods. And again the same run in all the same circles of 'recessionary spiral'.

Tatarstan | Russia | |

Production and distribution of electricity, gas and water | -3,1% | -1,6% |

Housing construction | 0,0% | -0,5% |

Agriculture | 4,7% | 3,0% |

The freight turnover of motor transport | 8,1% | -6,0% |

Retail turnover | -12,8% | -10,0% |

The thesis about a seriouscrisis in consumer demand is confirmed by the failure of retail in Tatarstan (minus 12.8%). The population decreasestheir consumption, because their real disposable incomes in January-November of 2015 in Tatarstan in relation to the same period last year fell by 5.6%while real wages dropped by 6.8%.

If to the retail figure to add consumer price index minus 13% (the price grew despite the decline in turnover). Then a drop a real physical retail becomes even worse minus 26%. This was the impact of devaluation and the inflation on the consumer market.

This 'vicious circle of poverty' will be sustained through the fall of the consumer market (in the case of stabilization of oil prices at the current period, which is very likely). The economy will 'smoulder' quietly, declining or stabilizing for a long period of time. How to break this vicious circle? We'll write about it in next article.