Economy penetrates the Internet: average online purchase amount decreases by 10-15%

The average online purchase amount of Russians has decreased by 10-15%, while overall online sales are growing in number and money, found out Realnoe Vremya. Experts attribute this to a low paying capacity of the citizens: people are trying to save money, in the result they choose budget products. A slow-down was observed on e-commerce market at the beginning of the year, but the demand is about to recover.

More but at a less price

In the first half of 2017, the Russians continued to increase the number of online purchases, but the amount of each purchase was decreasing, retailers and experts say. Many market participants still note a sales growth, but the average amount purchase is falling.

M.Video's total online sales grew by 17% in January-June, to 13 billion rubles, including VAT. The number of online purchases increased by almost 32%. ''The average purchase amount decreased by 11%, which is primarily due to falling prices for basic product categories at the beginning of the year,'' said the press-service of the company to Realnoe Vremya.

Ulmart online retailer notices the same tendencies, ''In the first half of 2017, we recorded growth in the number of purchases, the average purchase amount was dropping due to an increase in their frequency, conversion was growing,'' said representatives of the company.

''Indeed, there is being a trend of increasing a number of purchases while the average purchase amount is falling,'' says the president of Russian Association of Internet Trade Companies (AKIT) Aleksey Fyodorov. ''First of all, it is connected with the fact that consumer activity gradually returns after the crisis, however, the incomes of Russians do not allow in most cases to make expensive purchases.''

Mikhail Perelman, Associate Professor at Trading Policy Department of the Plekhanov Russian Univercity of Economics also speaks about a fall in the amount in the range of 10-15%, although in general, he said, e-commerce is booming. ''Buyers prefer budget products and continue to adhere to the strategy of economy,'' explains the expert. According to him, at the beginning of the year, the market saw a decline in consumer activity, however, it was only temporary. Now the population has an encouraging tendency to save, so by the end of the year demand should recover. ''But the market in 2017 is still the market of price, which is the main criterion of choice of a buyer,'' concludes Perelman.

Ulmart claims that the market has started to stabilize, ''Today we can confidently say about a revival of consumer demand and reducing fears of buyers.'' It can be judged by increased sales of durable goods, according to the company.

Main toys: Apple, Samsung and PlayStation

Commodity structure of online purchases has not changed: as before, the most popular categories are smartphones and digital devices.

For example, M.Video's situation is following: in the turnover of the Internet shop the largest share is taken by smartphones as well as TVs and washing machines. ''Traditionally, the first places by sales online are taken by smartphones Apple and Samsung, Samsung TVs and the game consoles PlayStation 4,'' says the company.

Ulmart notes ''a significant increase in demand'' for durable goods — major household appliances, TVs, laptops. ''A growth for smartphones continues,'' says the company's representatives. Also in high demand are small electronics, general merchandise, home goods and repair.

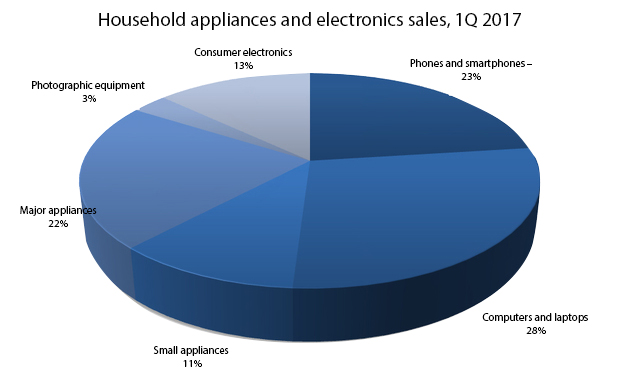

In January-March 2017, according to Gfk, the best-selling products in the segment of household appliances and electronics (household appliances account for 31-32% of the market) were computers and laptops, then smartphones and mobile phones. The first two accounted for 28%, the second two — 23%.

OZON gives an impetus to Tatarstan?

From the beginning of 2017, retailers recorded a growth of online sales in those regions that had not stood out on the map of electronic commerce before. One of these fast-growing subjects is Tatarstan. In Russia in general, online sales in January-March increased by 14% in money terms, in the republic the growth was at the level of 37%. For the first three months of the year, the local market reached a volume of 4,8 billion rubles, and the share of Tatarstan amounted to 2%.

The main volumes of sales in the network still account for the capital regions — Moscow, St-Petersburg, as well as Moscow Oblast and Leningrad Oblast. In 2016, their share accounted for more than 47% of the market, according to the report of AKIT. However, by growth rate, they lag behind non-capital entities, says Aleksey Fyodorov, ''In general, we can say that today the regions are growing faster than the CFD, which even is losing its share in the dynamics.'' According to Fyodorov, it is connected with the restoration of the purchasing power in the regions, with optimization of delivery system and overheating of the market in both capitals.

OZON.ru also notes a higher than average dynamics in Kazan and Tatarstan. In January-May, total sales of the company increased by 35%, and in Kazan — 100%. The retailer attributes this to the opening of a warehouse complex in Laishevo region in September 2016. ''In the regions where we can deliver orders the next day, for example, in Tatarstan and the Urals, the growth is much higher,'' noted the press service of OZON.ru. In Yekaterinburg, where, thanks to the same complex orders are delivered within days, sales of the company increased by 80%.

M.Video also have regions where growth was almost twice the average. Among them — St. Petersburg, Siberia and the Volga region. Their sales increased by 35%, said the press service of the retailer.

Ulmart representatives say that the top five by revenue in the first six months includes Saint Petersburg, Moscow, Krasnodar, Rostov-on-Don and Kazan. In general, the audience of registered users of Ulmart increased by 8%, the company said.

Mikhail Perelman believes that the source of a rapid growth in Tatarstan could become a single large market participant, namely OZON.ru. Moreover, the appearance of two its warehouses could change the overall picture for the industry.