Bridle for ''democratizing financial force'': should ICO be regulated?

Experts believe that the US practice of equating tokens to securities to be applicable in Russia, but first we need to determine the status of cryptocurrencies

Both sides of the ocean have become interested in regulation of the procedure ICO (Initial coin offering), a promising method to raise funds for development of start-up projects. The State Duma of Russia is discussing corresponding amendments to the legislation, and the United States Securities and Exchange Commission (SEC) has already equated ICO to issuing by the company of securities. Realnoe Vremya tells about the pros and cons of possible measures for state control of the procedure ICO and about how it already works in Russia and Tatarstan.

ICO: from ''clouds'' to zirconium dioxide

ICO is a means by which funds are raised through sale by a company of so-called tokens in the form of own cryptocurrency or existing one, with which one can pay for the services of this company. Unlike IPO, a purchaser receives no share in the company. Now this procedure is actively used by startups around the world to raise funds. Thus, according to the study of the investment bank Smith+Crowd, in January-June 2017, through ICO startups have already raised $180 million — it is more than in 2016 ($101 million). The volume of raised funds is constantly increasing.

As an example of such startup abroad it can be the secure cloud service Storj, which issues tokens in the form of their own cryptocurrency Storjcoin X. One can use these tokens to purchase storage space in this service, tokens can be reselled to another person as well.

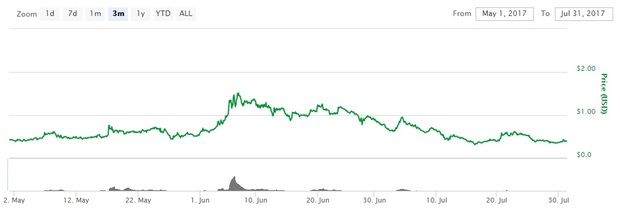

According to coinmarketcap.com, at the time of writing the material, one Storjcoin X was worth 0,39 USD, the peak price was on 6 June 2017 — then it was worth 1,38 USD. The users can also participate in mining of this cryptocurrency, that is, to contribute to its emission for reward (Realnoe Vremya wrote about the process of mining).

In Russia, the most famous project that carried out ICO is ZrCoin. It allows buying tokens of the same name, the revenue from which goes into production of synthetic zirconium dioxide — it is used in medicine as a material for dentures.

ZrCoin went on sale for $1,40, this price includes the cost of 1 kg of zirconium dioxide. By the completion of ICO, the cost will gradually increase to $1,55. As soon as the production and supply of zirconium start, tokens will be purchased from investors at the market price of the product ($2,80), thus providing the entered at the beginning of ICO investors with a double increase of investment. There is also a possibility of physical supply of zirconium for investors. In June 2017 alone, ZrCoin raised $4,5 million from 2,3 million investors.

Tatarstan has a case of conducting ICO — it is the famous cryptocurrency ITcoin backed by meat of breeding bulls. The head of the Center for business incubation of Naberezhnye Chelny (ITcoin is its resident) Yury Kolesnikov explained the scheme of its work as follows: an investor, acquiring a bull weighing 350 kg, can sell it when it will weigh 450 kg. He will make profit from the extra 100 kg. One ITcoin is equal to one ruble. If 1 kg of meat conventionally costs 350 rubles, it means that an investor already earns 3,500 rubles.

''It turns out, the increment is 3% a month, i.e. 36% per annum – it is the figure that they can guarantee. Because the meat is insured, microchipped, Halal. So the question with its sale is it not worth it — it is a liquid product. In fact, if you take bank deposits, what interest can be? 12-13% per annum, I've never seen higher. Accordingly, it is 2,5 times more interesting than deposit in a bank!'' said Kolesnikov.

''Democratizing financial force''

It is curious that until recently ICO, in fact, was outside the legal field: no country in the world has laws governing this procedure. This is due to the lack of a clear definition of the status of tokens. It was difficult to say whether they are a security, or is it just a way of crowdfunding? However, in July the US made the first and very radical step in the field of ICO regulation.

On 26 July, the United States Securities and Exchange Commission (SEC) has equated the tokens produced by the companies during the procedure of ICO to securities. SEC explained that such action is necessary to protect investors and to control their actions.

Innovative technology of these virtual transactions do not make securities and trading platforms exempt from the regulatory framework intended to protect investors and market integrity, said in the agency.

Russia has started to discuss a possibility of regulation of ICO procedure. The interagency working group under the State Duma for risk assessment of cryptocurrency turnover began to draft amendments to the legislation that will allow carrying out the ICO procedure legally. Chairman of the Duma Financial Market Committee Anatoly Aksakov also explained the need for regulation of ICO by the desire to protect investors from fraud in this area as well as the need to impose a tax on income from transactions with cryptocurrency.

According to a member of the working group, MGIMO Professor Elina Sidorenko, the regulation of ICO implies verification of contracts, identification of buyers of tokens and control over the implementation of companies' commitments to these tokens.

Meanwhile, ICO attracts exactly by the absence of any control. After introduction of state regulation, it may lose its attractiveness for start-ups. ''Cryptocurrency was invented by people who didn't much like regulators,'' notes an observer at Wired Tom Simonite. ''ICO boosters describe them as a democratizing financial force that provides capital to projects unlikely to get it from established sources such as banks or venture capitalists. The SEC's announcement means that some projects will now have to pay up for the lawyers, disclosures, and paperwork required to register with the SEC before they can solicit money from Americans.''

More radical was the comment of the founder of VKontakte and Telegram Pavel Durov. ''So the SEC just banned US companies and investors from taking part in the future of global economy,'' he twitted shortly after the SEC's announcement.

So the SEC just banned US companies and investors from taking part in the future of global economy. https://t.co/bQShbTypOB

— Pavel Durov (@durov) July 25, 2017

Meanwhile, an observer at Bloomberg Matt Levine notes that ICO tokens have all characteristics of securities, and thus, are subject for regulation.

''There is a theory that ICOs are not, or don't have to be, securities offerings. The theory goes something like this: An ICO is an offering of tokens to be used on some existing or future blockchain platform to purchase goods or services. The tokens aren't shares in a common enterprise or profit-seeking investments; the sale of the tokens is just a pre-sale of a product. You start a cloud-storage company, and people buy tokens, and you use their money to build your cloud-storage service, and then the tokens can be used to acquire cloud storage. Cloud storage is not a security, it is a product, and so is not covered by SEC regulation. In practice, though, it seems like most people are not investing in ICOs because they have a burning need for cloud storage at some indeterminate point in the future,'' believes Levine. ''They are investing in ICOs because they think that the particular project they're investing in — or the «ICO sector» generally — will take off and the tokens will become more valuable. That is, while the tokens are not stock in the traditional sense — they usually don't have the voting or ownership rights of stock — they look, financially, quite a bit like equity securities. They can be bought and sold, and their value is proportional to the value of the underlying project, which depends on the managerial efforts of the founders.''

New type of securities or new way of crowdfunding?

However, Rustam Davletbaev, head of the Center for systems distributed registry at Innopolis University, does not consider tokens to be full-fledged investment means. He sees them more as a high-tech method of crowdfunding, a system of voluntary donations to implement a project. Accordingly, it is possible to talk about the regulation of ICO only in the context of regulation of the process of crowdfunding.

''Before introducing ICO regulation, it is necessary to define the term cryptocurrency at the legislative level,'' he said to Realnoe Vremya. ''It is wrongly perceived as acompetitor to fiat currency (i.e. money which value is backed by the state — editor's note). But it's not true because bitcoin is more like digital intangible asset. Previously there were proposals to recognise the cryptocurrency as digital goods. But such tool will be limited. Cryptogoods can't be a full-fledged investment tool, whereas the main goal — to attract investments — will not be achieved.''

Davletbaev noted that regular crowdfunding platforms have existed for a long time and have not required special legislation for their regulation.

''However, the definition of crowdfunding has also a substitution of notions,'' he added. ''When we speak about the protection of an investor, it means crowdinvesting. From this point, users and consumers need a law on crowdinvesting, which would protect the rights of depositors and potential investors. For crowdfunding, explanatory works is needed, crowdfunding cannot promise a return on investment and profitability. Although an initiator of the project gives some promises, his project may carry high risks, users and consumers should understand that they take risks of the project themselves first of all, in the amount of the amount of investment.''

Member of the Advisory Council on digital economy of the State Duma of Russia Nikita Kulikov also sees in tokens a means for donations. According to him, cryptocurrency in general and tokens in particular are not stocks but by-products of the blockchain technology implementation. Hence, their conditional monetization stems from the fact that developers needed to attract somehow people involved in the process of mining of cryptocurrencies (in fact, involved in provision of efficiency of blockchain technologies by providing their computing capacity).

''Thus, token is not a payment unit,'' believes Kulikov. 'Neither a security as its value for the project is set by developers in each case individually and may imply different rights and responsibilities. Therefore, token has a function of a certain act, recording that his unnamed owner donated a sum of funds for development of a certain project, and it rather falls under the concept of crowdfunding, not securities. The problem is that crowdfunding in Russia is not really regulated at the legislative level.''

Deputy Director of the analytical department of the company Alpari Natalia Minchenko drew attention to a curious aspect of the decision of SEC for tokens. Only those tokens were recognized as securities, in which the token owner receives income directly from the issuing this token company (tokenizer). That is, these income can be equated to a dividend on the shares. The remaining tokens are not equated to securities. Thus, investors in tokens in the United States bear certain risks associated with regulatory issues of this tool.

Minchenko believes that the application of American experience in this field in Russia makes sense because for today the regulation of cryptocurrencies and their derivatives is practiced only in the United States and Japan: ''In Russia, such instruments are popular, but the legislation lags behind the needs of investors, especially because a lack of interesting investment ideas in Russia remains. The sooner Russia will begin to regulate cryptocurrencies and their derivatives, the sooner the process of reducing risks in this market will begin as well as the influx of additional capital.''

And who's to judge?

The need to regulate ICO in Russia is also due to diverse judicial practice on issues associated with cryptocurrency.

According to the review of judicial practice conducted by the company Zartsyn, Yankovsky and partners, in different cases Russian courts may recognize cryptocurrency a payment means as well as may not to.

For example, in 2015, the Arbitration court of Vologda Oblast, considering the case on bankruptcy of an individual entrepreneur, made in the bankruptcy estate cryptocurrency and with them funds to electronic purses Yandex.Money, Деньги@Mail.ru, Webmoney, QIWI. However, in Khabarovsk, considering the case of the repayment of the loan of $5 million (the defendant claimed to have returned the loan by transferring bitcoin), the court considered that the cryptocurrency is not money, and therefore an improper form of payment.

Thus, tokens along with other cryptocurrencies also find themselves in a ''grey'' area of the law. Predicting the outcome of litigation, for example, with a default on these tokens, is hardly possible.