Trend for behavioral economics: what is the difference of living people from smart machines?

Review of Barack Obama and David Cameron’s former economic adviser Richard Thaler’s book

The economic theory has become obsolete. Rational person is a too limited model to explain our decisions and actions. Professor from Chicago Richard Thaler studied emotions that rule over buyer in detail and difficulties he faces while making decisions. According to Realnoe Vremya's economic reviewer Albert Bikbov, his recently published book Misbehaving: The Making of Behavioral Economics is the most popular description of the new economic theory — behavioral economics.

What is behavioral economics?

What is the main movement of today's economic science, the so-called mainstream? First of all, it is a synthesis of the most examined and practical movements of the economic thought. Now the mainstream covers general equilibrium theory, new classical macroeconomics, Chicago macroeconomic theory, some ''remains'' of Keynesianism and neo-Keynesian economics and mainly new institutional economics and behavioral economics.

Behavioral economics is rightly one of the canons of the mainstream. It studies the influence of social, cognitive and emotional factors on making an economic decision by separate people and establishments and consequences of this influence on market variables (price, income, resource allocation). In general, scientists tried finding out the influence of human psychology on economics since ancient times. The greatest quality breakthrough in this area was made in 1979 when Daniel Kahneman and Amos Tversky's endeavour Prospect Theory: An Analysis of Decision under Risk came to light. It should be said this work was a revolution in the economic science and the second most cited economic publication in the world until 2000. Daniel Kahneman got Nobel Memorial Prize in Economic Sciences for it in 2002 (Amos Tversky died 6 years before it). The scientists proved the existence of systematic errors while estimating the risk and probability of incomes and losses. They described 11 ''cognitive illusions'' slanting the ability of rational estimation. Anchoring, fear of loss, herd behavior and risk aversion are among them.

By the way, Daniel Kahneman is one of the most famous experts in behavioral economics. His bestseller Thinking, Fast and Slow, which was translated into Russian and published by Moscow AST Publishing House in 2014, had 3,000 copies, which is a lot for this kind of books. But due to demand, the book is constantly republished, and one can see it on bookshop shelves even now. By the way, I recommend buying and reading it – it is an easily comprehensible theory about the division of human mind into two systems, fast and slow ones. ''System 1'' is usually called intuition. It works automatically, making a quick decision based on personal experience and general stereotypes. ''System 2'' is a conscious mind that analyses all possible options unhurriedly and carefully. Daniel Kahneman says that intuition suits making everyday decisions. But when the stakes are high and your well-being depends on your decision, it is better to stop and turn ''System 2'' on, mind over matter.

Kahneman's book can be hardly called a book that explains the theory of behavioral economics. The focus is only on one piece of this theory, a conceptual explanation of heuristics and biases. There are other popular books on behavioral economics in Russian. They also describe only some aspects of behavioral economics. First of all, it is a book of Massachusetts Institute of Technology professor Dan Ariely Predictably Irrational: The Hidden Forces That Shape Our Decisions and The Upside of Irrationality: The Unexpected Benefits of Defying Logic at Work and at Home, Nobel laureates Robert James Shiller and George Akerlof Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism, Irrational Exuberance, Phishing for Phools The Economics of Manipulation and Deception. But the problem is that many of these books became a rare thing. It is very difficult to find them. What is more, they are about only some parts of the behavioral economics theory. This is why any book that is translated into Russian today about behavioral economics is an event.

Richard Rahler, Obama's adviser and starting actor

Publication of Richar Thaler's book printed in 2015 Misbehaving: The Making of Behavioral Economics by Э Publishing House was a chic present for economists in 2017. The title in Russian was New Behavioral Economics. Why People Violate Traditional Economics Rules and How to Earn on It. The translation of the title is rather strange that could be shorter. But marketing is marketing, the book will be sold better if it tells ''how to earn''.

The book had many copies for this kind of literature – 2,000 copies. So one can find them not only online but in usual bookshops. It is about 600 rubles in online stores. It is easy to read all 368 pages, it doesn't have a complicated scientific slang and formulas. Reading without hurry, one can finish it within a week.

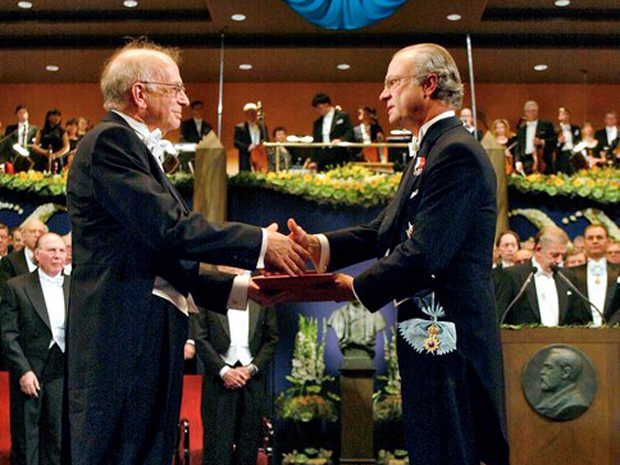

The book's author, Richard Thaler, is a University of Chicago professor. He is a legendary person for behavioral economics.

Richard Thaler is the author of the so-called Nudge theory. Almost all world leaders have paid attention to this concept in recent times. A new form of manipulation of human behaviour without bans and orders is the keynote. The basic idea of this theory is simple. People make a choice either rationally, having thought, or automatically, without thinking a lot (by the way, hello to Kahneman's ''System 1'' and ''System 2''). For this reason, one often can make a person change his or her opinion and make decisions automatic. In his interviews, Thaler calls all this sphere choice architecture and specialists — choice architects. The novelty here is that Thaler tried building a full-fledged political programme based on behavioral economics. Thaler's ideas became a tool of the state policy in all leading countries.

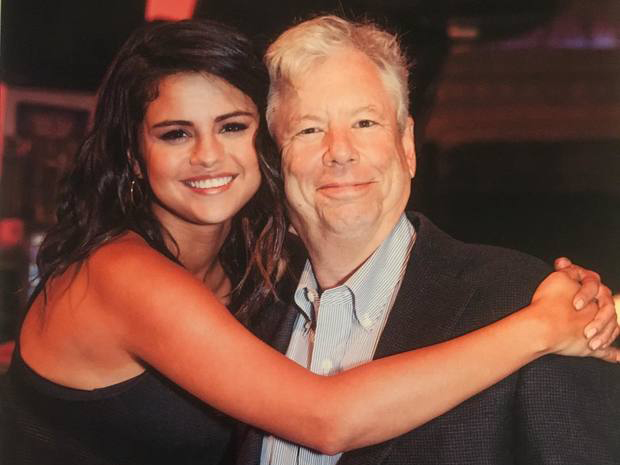

The fact that he was U.S. President Barack Obama's adviser and Great Britain Prime Minister David Cameron's adviser prove the coolness and recognition of Richard Thaler's ideas. Moreover, he was even shot in an episode of last year's notorious Hollywood film Big Short. Together with Selena Gomez, he explains a stock flurry.

What is the book about?

In brief, the usual economy is based on the axiom of rational choice. Actually, people very often behave irrationally. These irrationalities can be used. Richard Thaler builds the book like a mixture of personal scientific biography and explanation of the canons of behavioral economics.

I will add that it is impossible to include all important examples and ideas of the book in the modest size of the review. But believe me, there is a great deal of them. The book will be useful not only for economists but also marketers and entrepreneurs. The book will be mainly useful for experts because its author was asked to help in making political and economic reforms in the USA and Great Britain at the highest level. I sincerely recommend reading Richard Thaler's interesting and useful book.